Post an Event

Post an Event

| Benton County Republicans’ Private Fundraising Event, “Bent-on Boots and Bling” with Trey Taylor |

| Friday, September 5, 2025 at 5:00 pm |

| Featuring Trey Taylor

Music Private Event

Friday, September 5, 2025 5:00-5:30 pm VIP Reception

5:30-8:00 pm Heavy Appetizers,

Auction, Concert

Red: $750 VIP Reception

Front Row Table Sponsor

White: $500 Table Sponsor

Blue: $50 per person

Limited Seating. Get Yours Now!!!

Support Local

Dress up: Bling, Cowboy, Patriotic Benton County Republican

FUNDRAISER

www.BentonGOP.org

Get your tickets today at:

https://www.bentongop.org/event-details/benton-county-republicans-fundraiser/form

About Trey:

Trey is the youngest African American Man in Country Music History. The Denver Post wrote

"It's impossible to miss his enthusiasm. With a fondness for cowboy boots, gaudy colors and dazzling jewelry, Trey Taylor could stand toe to toe with any of the Pop, Country or even Rap

contemporaries of his generation.“ |

| Trysting Tree Golf Club, 34028 NE Electric Rd., Corvallis |

If this were child’s play, we’d outlaw it as bullying.

Representatives Marty Wilde (D-Eugene), Paul Evans (D-Monmouth), and Karin Power (D-Milwaukie) want to remove your free speech by introducing

HB 2225. There is a lot of talk about the “underserved†in the legislature, but when it comes to rural Oregonians, they change their tune.

HB 2225 will prohibit rural areas from supporting their causes and deny them from their representation, their only means to be heard in dire situations when livelihood and their economy is at stake. It attempts to silence the “underserved.â€

HB 2225 prohibits legislators who are absent and unexcused when Legislative Assembly is in session from receiving salary, per diem or expense reimbursement, and imposes a fine of $500 per day for unexcused absence. It also prohibits political contributions from being used to pay fines or legal fees, replace salary or defray expenses.

When government establishes controls over the functions of how the citizens are represented, it no longer is a representation of the people. It becomes a controlled voice for the government’s agenda. The Majority leadership in their forecast statements voiced disparaging facts of the “underserved†among the minorities calling for more equality. But when it comes to rural Oregon and minority representation in the legislature, they change their tune.

If this were child’s play, we’d outlaw it as bullying. Bullying at the political level is no less egregious. To compound their bullying efforts

SB 261 and

SB 262 have been introduced, which also prohibits contributions to pay fines for unexcused absence, and SJR 3 prohibits re-election if not attending at least 10 floor sessions.

SJR 4 would clinch the bullying control by changing the two-thirds needed for a quorum to a simple majority.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

Democrats have super-majorities in both chambers. Apparently, this isn't enough for them to get their work done. The majority party and news media try and portray a walk-out as not showing up for work. Do we teach our students to put up their dukes and fight with bullies, or walk away? Do you walk into a burning building or save people that are being trapped?

--Donna Bleiler| Post Date: 2021-02-26 09:53:00 | Last Update: 2021-02-25 17:02:37 |

Creates a plethora of “gun-free†zones

The Senate Committee on Judiciary voted to send

SB 554, which allows local jurisdictions to decide whether to ban otherwise legally carried guns in public buildings, to the floor of the Oregon Senate for a vote.

“In light of increasing violence and threats of harm by extremists, we cannot wait any longer to pass Senate Bill 554. The growing number of firearm purchases and applications for Concealed Handgun Licenses is concerning,†said Senator Ginny Burdick (D-Portland) who introduced Senate Bill 554. “This bill will allow local entities to determine if they should allow or disallow loaded firearms in their buildings or on their property. That way, the decision is made at the local level, and local leaders can choose what’s best for their own community.â€

As was pointed out in an earlier article on

HB 3268 which would

ban guns in the Capitol the claim of "extremists" is starting to become a little threadbare as an excuse for banning guns and boarding up the Capitol building while the Legislature is in session. This is especially true in light of the fact that there are few incidents and even fewer arrests. This is no small deal either. The legislation proposes five years in prison and $125,000 in fines.

Under current Oregon law, concealed handgun license holders have an affirmative defense for the crime of possessing a firearm in airports and public buildings – including schools.

SB 554 allows school districts and local governments to criminalize the possession of firearms on their premises.

Many have noted that those who are citing safety as a reason to take away citizens' right to bear arms, were the same lawmakers who looked the other way -- or even supported -- at Portland riots. Many have also voted for legislation in special session last summer which put restrictions on police and their ability to enforce safety.

SB 554 would create a spate of "gun-free" zones, which are the very places that shooters seem to prefer, knowing that they will have prolonged access to unarmed targets.

The measure passed out of committee on a party line vote, and now moves to the Senate Floor for consideration.

--Staff Reports| Post Date: 2021-02-26 09:25:48 | Last Update: 2021-02-25 17:50:14 |

Would generate $746 million in new revenue per biennium

During the past year of Governor Brown’s endless Executive Orders and constant rule changes by State Agencies, unintended consequences may have occurred. As the Governor shut down bars and restaurants, the Oregon Liquor Control Commission began allowing liquor stores to do curbside pickup, and distillers to take remote orders and deliver. The agency also expedited the regulatory process for takeout and delivery of wine, beer and cider. Delivery was already legal, but many restaurants and bars weren't licensed to do it. In a June 17, 2020 article in the Portland Business Journal, OLCC said “835 businesses added the off-premises license to their operationsâ€. Oregon’s public alcohol consumption went behind closed doors.

The Governor’s stay at home orders placed citizens under a significant amount of stress, added to that a rapid increase in adults telecommuting with little to no oversight, many more adults unemployed altogether, and it was a cocktail for disaster.

However, Representatives Tawna Sanchez (D-Portland) and Rachel Prusak (D-West Linn) think they have a solution and in true Oregon fashion, the solution is to tax our way out of alcohol use and addiction. They have introduced the “Addiction Crisis Recovery Actâ€,

HB 3296.

HB 3296 increases the tax imposed on manufacturer or importer of malt beverages, wine or cider. The tax is not a new tax. What it is, however, is a major hike in the rate. The tax on beer and cider would rise from $2.60 to $72.60 per 31-gallon container (Keg) and for wine it would go from $0.65 to $10.65 per gallon. The tax would trickle down to the customer with an estimated increase of $2 per bottle of wine, and $0.28 per pint of beer and cider.

Almost immediately, representatives from the beer and wine industry spoke out against the pending legislation. The Oregon Beverage Alliance told Fox News that “Oregon's large beer and wine industry, is an essential part of the state's economy and is already struggling due to the pandemic. If this legislation passes, Oregon would have the highest beer, wine and spirits taxes in the nationâ€.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

In an interview with KVAL13, Deschutes Brewery President & CEO, Michael LaLonde echoed those concerns saying, "It's pretty shocking that somebody would propose, particularly at this time, an increase of that amount of money when we're already struggling to pay our billsâ€.

The sponsors of the bill, however, are hoping that the additional revenue generated by the tax increase will generate revenues for the Oregon Health Authority for the purpose of funding behavioral health and substance use programs. The bill would require revenue from the increased taxes to be set aside in a fund used at the direction of the Alcohol and Drug Policy Commission for prevention and substance use treatment. All told, the bill would generate $746 million in new revenue per biennium. It would fund 1,010 more resident treatment beds and 1,240 detox beds, in addition to thousands of outpatient openings and new jobs.

Jana McKamey, Executive Director of the Wine Growers Association told KVAL13, "Only three-and-a-half percent of exiting beer, wine and spirits revenues are dedicated to addiction recovery. So, before raising taxes on Oregon's wineries, breweries, and cideries, lawmakers really need to examine the current system and why existing dollars are not being spent on these programs."

HB3296 is at the House Speakers desk awaiting assignment to committee as of press time.

--Terese Humboldt| Post Date: 2021-02-26 09:08:26 | Last Update: 2021-02-25 21:16:33 |

Are we still following science, or are we just winging it?

As restaurants struggling to stay open and make ends meet, they have been met with fines in the tens of thousands of dollars from the Oregon Occupational Safety and Health Administration. Governor Brown has been using both Oregon OSHA and the Oregon Liquor Control Commission as enforcement agents for establishments that step out of line with her COVID-19 restrictions, though they are referred to as guidelines.

One would think that if there were several cases of COVID-19 arising from the operation of these restaurants -- either in the worker population or in the public -- that the executive branch would have made this public, so as to justify their heavy-handed actions, to discourage other restaurants and bars from also trying to open, as well as to keep the public away. However they have not, which seems to indicate that there have not been cases arising from restaurants and bars.

The Oregon Health Authority has a

wealth of data on age, gender, ethnicity and race statistics for COVID-19 cases, but very little data shown for how cases are contracted, such as from a restaurant.

When asked by the Northwest Observer if any illnesses were traced back to the Firehouse Restaurant, Aaron Corvin, public information officer for the Department of Consumer and Business Services, which is the home of the Oregon Occupational Safety and Health Administration said, "Our penalties are not based on the actual outcomes but on the risks represented by the underlying violation. In that way, for example, a machine guarding violation would carry the same penalty after all the appropriate factors were considered – whether or not it resulted in an employee injury in that particular situation.â€

Oregon OSHA's motto is "Improving workplace safety and health for all Oregon workers" which means that they do not have explicit jurisdiction over general public safety.

As an additional point, it would not be ethical to, say, have some restaurants and bars open up in order to test whether or not COVID-19 would spread due to their activity. Yet, because some establishments have skirted the guidelines, we have just such data available. It would seem that the lack of cases is strong evidence that they are not spreaders.

--Staff Reports

--Staff Reports| Post Date: 2021-02-26 07:52:40 | Last Update: 2021-02-25 15:21:37 |

“Why is this Bill being considered and why is there an emergency clause?â€

Editor's note: this is the first in a multi-part series which is a reprint of a letter from a desperate gun owner and her thoughts on the current proposals in the legislature.

I’m terrified to write this. I know this is long but I hope you take the time to read this, as I took the time to write it after a long day at work.

I never thought I would be afraid of being doxed or singled out by my own local government "officials" or neighbors, but I am afraid, and I know that I am not alone in this. The slander and violent retaliation against individuals, their families, and their livelihoods is what keeps many other Oregonians and American citizens from reaching out or sharing their concerns with local politicians. Even through that fear over 300 Oregonians came together today to testify against

SB 554 and hundreds more have expressed their opposition to this irresponsible and unconstitutional bill. I am confident many more would have come forward if they would have known about this hearing, I myself learned about it last minute.

It is not lost on me that just two days after the hearing for

SB 554 where Democrat's and special interest groups spent the day attempting to further restrict the rights of tax paying Oregonians through

SB 554 -- just two days later they are attempting to pass

SB 571 which grants additional rights to convicted felons and incarcerated individuals by allowing them the right to vote. This is clearly not about public safety, and has nothing to do with what's in the best interest of Oregonians. This is not the will of the people and appears to be nothing more than a desperate attempt by Democrats to further restrict the free will of the people while operating under the guise of "pubic safety", in an attempt to obtain as many votes as they can.

If this were about the people, why are politicians making it so hard for the people to be heard? Why was an emergency clause put on this bill? The same supporters of this bill are the same ones supporting reduced sentences for criminals and additional rights. We the people do not need or require permission to protect ourselves, but are humbly asking that you hear our pleas and put an end to the slow creep of anti second amendment legislation that is slowly eroding away at our liberties. Rushing Oregonians through testimony in an attempt to further restrict our rights, hardly seems legitimate or in the best interest of tax paying Oregonians. Many Oregonians are now contemplating moving away from our beautiful state and taking their tax funds with them.

More citizens are in opposition to this bill than proponents of it as you can tell from the testimony on Monday. It is clear to me that we would have heard even more opposition had the original hearing times been kept or extended. It is my belief and clearly the belief of a large majority of fellow Oregonians that politicians, local governments and special interest groups do not have the authority to dictate when and where we exercise our chosen self protective measures. Those who are the most unfamiliar with firearms seem to be those most opposed to them. You fear what you don't understand or know.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

I would encourage those individuals advocating for this bill to get familiar with a firearm so that they understand the true nature of this self defense tool. I also urge you to get to know just a few of the millions of Americans who carry this tool with them daily, you will understand just how out of line the anti second amendment bias truly is. The Purpose of adding the emergency clause to this bill seems like another intentional attempt to silence the voice of the people. The entire testimony process was confusing and made it difficult for individuals to effectively testify. Calling out multiple names at once was clearly confusing for those providing testimony, some of whom were testifying for the very first time.

Where does this end? This patchwork law will impact Oregonians where they live, work, recreate, do business, seek healthcare, go to school and volunteer. This Bill and others like it open the door for even more restrictive legislation until our second amendment rights have been eroded away- so much so that you simply will not be able to carry your firearms anywhere in the state of Oregon. Your firearm cannot protect you from your vehicle, this tool can only be utilized when it is on your person, that is the entire purpose of carrying a firearm. To have protection on your person at all times, in all situations.

You need to separate gun violence from responsible gun ownership, those who are apt to commit gun violence will not be those who are going to follow these radical laws if enacted. The false narrative that the only individuals that care about their second amendment rights are somehow just a bunch of right wing, conservative, racist, neo-fascist, red neck white males is absolutely absurd and embarrassing to those who push such ridiculousness. These agencies do not have the right to take away our first amendment rights in "special zones" and they should not have the ability to do so to our second amendment rights. Why is this Bill really being considered and why is there an emergency clause? This is more than just creating a "Safe Zone" -- we cannot "Safe Zone" ourselves out of reality and into further ignorance of what actually constitutes dangerous behavior. The real danger is in the passing of ill thought bills like

SB 554.

To be continued...

--A Fed Up Oregonian| Post Date: 2021-02-26 07:49:31 | Last Update: 2021-02-25 19:10:15 |

If projected revenues are up, why do we need new taxes?

Editor's note: This is the second in a multipart series exploring tax measures before the Oregon Legislature during the 2021 session

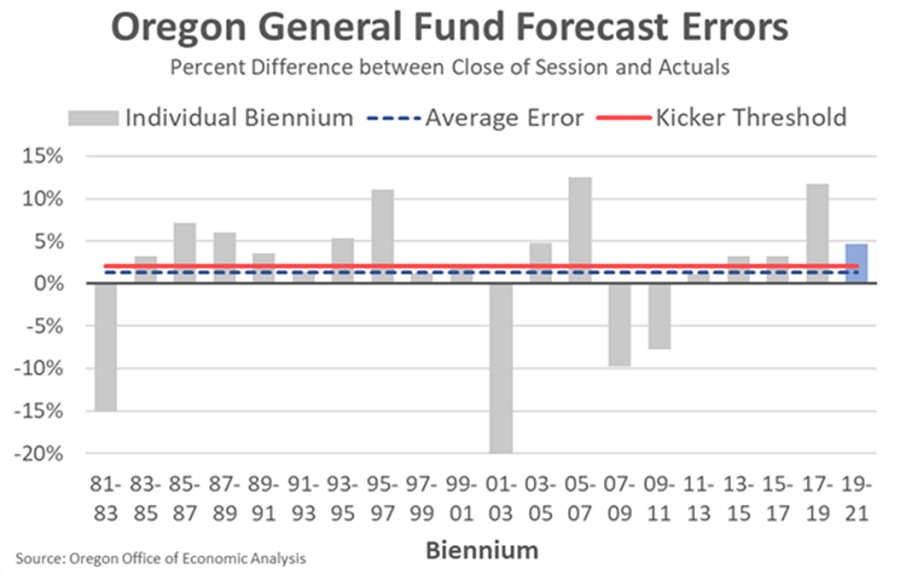

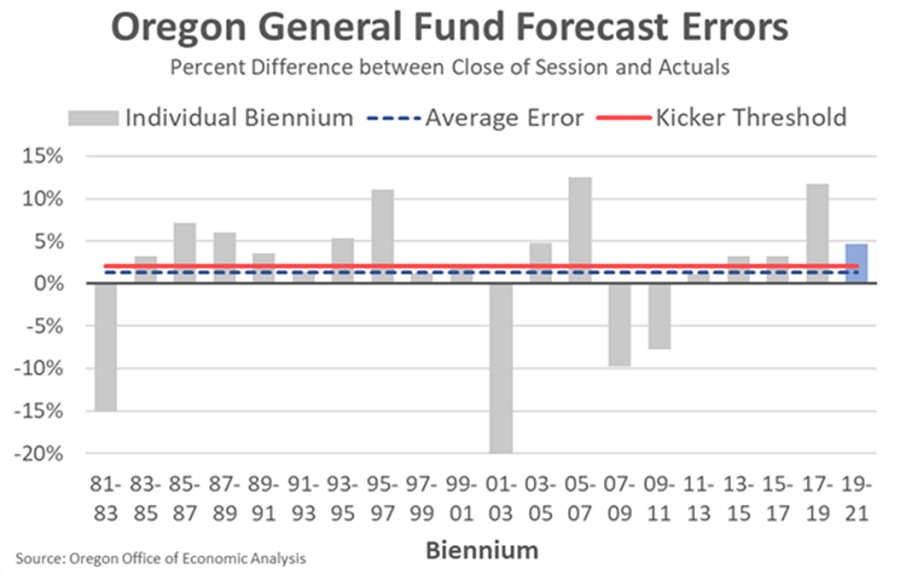

As the Oregon Office of Economic Analysis presented their

revenue forecast they said that the "Oregon March forecast puts kicker credit back in play," which is interesting because we're supposed to be in a recession and like planes lining up to land as a major airport, the revenue bills have been queuing up in the Oregon House Revenue Committee, chaired by Representative Nancy Nathanson (D-Eugene), where all bills for raising revenue must originate.

They did hedge. Saying, "kicker credit is far from a sure thing since the tax season has yet to get under way," but they are cautiously projecting a personal kicker of $571 million and a corporate kicker of $420 million, though this money doesn't kick back to corporations. It goes to K-12 education, which frees up general fund money for the Legislature to spend as they wish.

Bills for raising revenue also require a three-fifths majority vote in each chamber to pass. Because of this, as Democrats barely have the numbers in both chambers to win a tax vote, it's easier for them if they can find a way to pass a revenue increase that doesn't require the super-majority. They can do this in many ways, including changing the eligibility requirements for qualifying for a tax.

Oregon's kicker law is a part of the Oregon Constitution and can be found in Article IX, Section 14:

Section 14.

(1) As soon as is practicable after adjournment sine die of an odd-numbered year regular session of the Legislative Assembly, the Governor shall cause an estimate to be prepared of revenues that will be received by the General Fund for the biennium beginning July 1. The estimated revenues from corporate income and excise taxes shall be separately stated from the estimated revenues from other General Fund sources.

(2) As soon as is practicable after the end of the biennium, the Governor shall cause actual collections of revenues received by the General Fund for that biennium to be determined. The revenues received from corporate income and excise taxes shall be determined separately from the revenues received from other General Fund sources.

(3) If the revenues received by the General Fund from corporate income and excise taxes during the biennium exceed the amount estimated to be received from corporate income and excise taxes for the biennium, by two percent or more, the total amount of the excess shall be retained in the General Fund and used to provide additional funding for public education, kindergarten through twelfth grade.

(4) If the revenues received from General Fund revenue sources, exclusive of those described in subsection (3) of this section, during the biennium exceed the amount estimated to be received from such sources for the biennium, by two percent or more, the total amount of the excess shall be returned to personal income taxpayers.

--Staff Reports

--Staff Reports| Post Date: 2021-02-25 16:04:28 | Last Update: 2021-02-25 16:02:16 |

“This session ought to be helping Oregoniansâ€

In a press release, the Senate Republican Caucus has demanded that Democrat leaders bring an increased sense of urgency and focus to the biggest issues facing Oregonians. They appear to have denied quorum to hold floor sessions for the time being.

“Throughout the pandemic, the Legislature has abdicated too much responsibility to the Governor. We cannot sit by and watch the Governor fail to deliver on the biggest issues facing Oregonians today. It's time to take some of the responsibility and get to work on the issues that matter most to Oregonians. We are demanding legislation aimed at school re-openings, vaccine distribution, economic recovery, and government accountability be moved to the top of the priority list,†said Senate Republican Leader Fred Girod (R-Lyons).

According to Senate Leadership, students are suffering from school closures. Seniors, as well as rural Oregonians, are being failed by an abysmal vaccine rollout. Working families are struggling to make ends meet.

For these reasons, Senate Republicans say they are standing in solidarity with them by staging a protest and invoking First Amendment rights. This is their statement:

REOPEN SCHOOLS NOW

EIGHTY PERCENT of Oregon’s students last week remained out of the classroom. This flies in the face of increasing evidence. The CDC has recognized that school reopenings are safe, even if teachers aren’t vaccinated. According to the Legislative Fiscal Office, the Governor received hundreds of millions of dollars from the federal government for resources schools need to reopen. President Biden’s COVID bill would give K-12 schools another $1.2 billion, yet classrooms remain empty.

“The Governor has completely failed Oregon families and students,†Sen. Girod said. “She first promised that schools would reopen on February 15. She failed to put our kids first. Now she is moving the goalposts to the spring. Parents and kids no longer have any trust in her empty promises. We need tuly bold action. Gov. Brown is the Superintendent of Public Instruction. She needs to start acting like it and demand teachers unions immediately send their members back into the classroom.â€

Senate Republicans have an education package to give parents and kids control over their education and use budget authority to reopen schools.

EQUITABLE VACCINE DISTRIBUTION

Oregon is the 3rd worst in the country in vaccinating seniors, who are most vulnerable to COVID-19. To make matters worse, vaccines have been siphoned from rural counties and redirected to Portland, despite having one of the highest vaccination rates in the state.

This vaccine is a matter of life and death,†Girod continued. “The Governor doubled down deprioritizing seniors in the vaccine line, even when evidence suggested teachers didn’t need to be vaccinated to reopen schools. That decision almost certainly cost lives, and she tried to get away with covering up those deaths, when OHA decided they didn’t want to release the data. Its time for the Legislature to step in and hold the Governor accountable for these failures. We must use vaccines to save the most number of lives. That means seniors need to be prioritized and rural Oregon needs their fair share.â€

HELPING STRUGGLING OREGONIANS RECOVER

Oregon’s economic recovery lags behind the rest of the country. While the United States has recovered 56% of jobs lost during the pandemic, Oregon has only recovered 37%. Our unemployment rate is well above the national median. Thousand struggle to pay rent, tens of thousands are without jobs, and women are dropping out of the workforce at an alarming rate.

Despite these facts, Governor Brown extended her emergency declaration, further tightening her grip on small businesses and working Oregonians.

“Our main concern this session ought to be helping Oregonians recovery from the pandemic and its economic devastation,†Senate Republican Leader, Fred Girod said. “Yet Democrats are intent on taxing COVID relief money and increasing the cost of living for Oregonians. I urge Legislative leaders to pass Senate Republican bills aimed at giving working Oregonians relief and getting them back to work.

“Yesterday’s Revenue Forecast indicated that the state has brought $800 million is extra tax dollars. President Biden’s bailout plan will add billions of more dollars. There is no need for new taxes!â€

--Staff Reports| Post Date: 2021-02-25 13:50:46 | Last Update: 2021-02-25 13:52:40 |

Defend or settle. It

A bill that will have a huge impact on business,

HB 2205, introduced by State Representatives Marty Wilde (D-Eugene) and Barbara Smith Warner (D-Portland). Born out of the California Private Attorney General Act, PAGA, it establishes procedures for persons to bring legal action in the name of the state to recover civil penalties for violations of state laws. It provides for the distribution of civil penalties recovered. Fear of a lawsuit has always been a concern of many small-business owners, even more so during this pandemic. But the PAGA bill,

HB 2205, which had its first public hearing yesterday, would further raise the stakes for Oregon small businesses by allowing plaintiff’s attorneys to sue private businesses on behalf of the state, resulting in a no-win situation -- either settle out of court to minimize out-of-pocket costs, or even worse, try to defend the case and end up paying sizable attorney fees. It’s a simple money grab at the expense of the taxpayers.

The business community has a bill to respond to that threat,

HB 2638. It has been introduced by Representatives Christine Drazan (R-Canby) and David Gomberg (D-Lincoln City).

HB 2638 Limits liability for certain claims for damage arising out of acts or omissions taken during the COVID-19 emergency period in reasonable compliance with government guidance related to COVID-19. By contrast, HB 2638 would provide businesses with liability protection against frivolous lawsuits so long as they can demonstrate that the business was reasonably in compliance with state and federal COVID-19 rules and regulations. The concept is simple -- if business owners are following the rules, they shouldn’t have to worry about being sued.

--Tom Hammer| Post Date: 2021-02-25 13:08:15 | Last Update: 2021-02-26 17:55:12 |

“Despite declining case counts, today you extended your emergency declaration,â€

Senate Republicans have sent

a letter to Governor Brown regarding their hope that schools can be re-opened.

February 25, 2021

Governor Kate Brown

900 Court Street NE

Salem, OR 97301

Governor Brown,

We have previously called for you to immediately reopen schools because the science says it's safe. In 2011, the Legislature gave you the powers of the Superintendent of Public Instruction. You have failed to use that authority to bring forward a meaningful plan and pressure school districts to reopen. According to the Legislative Revenue Office, you have received over $600 million in unexpected money for schools from the federal government.

We request that you immediately reopen schools for full in-person instruction with proper public health measures.

Oregon is the 3rd worst in vaccinating seniors in the country. We find this unacceptable. This population is at a disproportionate risk of dying from COVID-19. This is a matter of life and death. We have previously called for you to direct vaccinations in the most equitable way possible.

That means deploying all the resources of the state government to vaccinate seniors and also ensure that rural Oregonians get their fair share of the vaccine.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

As policymakers, one of the most important goals of this session is helping Oregonians recover from your strict economic lockdown orders. Your own state economists have shown that Oregon’s economic recovery lags behind the rest of the county. Our unemployment rate is well above the national median.

Despite declining case counts, today you extended your emergency declaration, squeezing Oregonians even more. The Legislature cannot do its work to help Oregonians recover when people cannot go back to work because of orders requiring small businesses to stay closed. We ask that you immediately speed up economic reopening to give Oregonians a fighting chance of recovery.

You have shown interest in helping low-income communities, communities of color, and underserved Oregonians. These populations have been disproportionately impacted by economic lockdowns. The best way to help them is to give them their jobs back and reopen small businesses.

Our previous efforts to bring these issues to your attention have gone unacknowledged. Thus, we are protesting today’s floor session. In this show of solidarity with Oregonians who are being failed by the current direction of your policies, we hope this action conveys the importance of these issues.

Oregonians are counting on you.

Sincerely,

Fred Girod, Senate Republican Leader

Chuck Thomsen, Deputy Republican Leader

Lynn Findley, Assistant Republican Leader

Dennis Linthicum

Dick Anderson

Bill Hansell

Dallas Heard

Bill Kennemer

Tim Knopp

Art Robinson

Kim Thatcher

--Staff Reports| Post Date: 2021-02-25 11:09:59 | Last Update: 2021-02-25 13:50:20 |

Businesses have a Right to the Equal Application of the Law

Blending is a new trend for Republicans trying to survive the tide of wokeness sweeping the political landscape, which is what Representative David Brock Smith (R-Port Orford) attempts with the COVID-19 Business Equity Act.

Equity is a trigger term the leftists have imposed on the people to direct the narrative away from the equal application of the law and steer it to the practice of social justice, which is subjective and eventually devolves into authoritarianism.

However, Smith uses the word equity in

HB 3177 as an equalizer for the small businesses that the governor has been unfairly targeting with a relentless barrage of executive orders. This new proposal would impose restrictions on the governor during a state of emergency relating to the COVID-19 pandemic. It would force the governor to treat all businesses equally under the law.

HB 3177 would require that the governor treat restaurants, fitness clubs, and bars the same as the large retail outlets, and grocery stores. Any new mandate on one business would be a mandate on all of them equally.

The law would not stop the governor from forcing social distancing, mask-wearing, or requiring barriers or partitions, but it is a way to make sure the government spreads the regulations more evenly. It might also deter the overuse of executive orders because those mandates would affect a larger swath of businesses.

--Rob Taylor| Post Date: 2021-02-25 10:59:13 | Last Update: 2021-02-25 11:09:59 |

This bill takes two steps backward

Cloaked in a

HB 2868 on accelerated college credit program, Representative Paul Evans (D-Monmouth) buried a hit on virtual schools and homeschooling.

High schools offer accelerated courses to give students the opportunity to earn college credit in an “accelerated learning†program. Accelerated learning courses are typically taught on a high school campus by a high school teacher. These programs are categorized as either:

- Dual Credit: In Dual Credit courses, the high school teacher is determined qualified by their partnering post-secondary institution’s content departments to act as a proxy faculty member.

- Sponsored Dual Credit: In Sponsored Dual Credit courses, a high school teacher partners with a sponsoring faculty member at a college or university to offer the course.

- Assessment Based Learning Credit: In Assessment Based Learning, students are provided an opportunity to earn college credit by demonstrating they have achieved a course’s learning outcomes.

HB 2868 exempts the dual credit programs and career and technical education courses, so it is focused on Assessment Based Learning Credit. Completing the course doesn’t automatically give a student college credits. The student must pass a college level exam.

Oregon College Board offers testing both in-school and at-home.

HB 2868 requires teachers of accelerated college credit program to complete or have equivalent of a minimum of 27 quarter hours of graduate level course work relevant to the course. It applies to teachers of courses that are provided to:

(A) Students of the school district, including students of public charter schools; and

(B) Students who otherwise are taught by a parent, legal guardian or private teacher as provided in

ORS 339.030.

Besides prohibiting homeschooled students from receiving Accelerated Credits, it is unclear whether it prohibits students from challenging Advanced Placement tests for college credits. If it doesn’t affect AP testing, the bill has no purpose.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

The 2017-19 Oregon Accelerated College Credit

Program Grant provided funding to Oregon public school districts, Oregon Education Service Districts (ESDs), regional consortiums, and/or Oregon public postsecondary institutions to encourage, support, and facilitate accelerated learning options in regions of Oregon with the highest need. Preference is given to those regions with high poverty rates and large underrepresented student populations, and which include schools that received less than a $350,000 allocation for the High School College and Career Readiness Act of 2016.

This bill takes two steps backward discouraging students with initiative and natural aptitude to advance themselves, especially through homeschooling or virtual schools.

--Staff Reports| Post Date: 2021-02-25 10:44:19 | |

The ghost of Mitch Greenlick haunts the Legislature

In 2005, the Late Representative Mitch Greenlick (D-Portland) along with a community coalition, filed a petition for the “Hope for Oregon Families†ballot initiative. Although it failed to make the ballot it did spark a movement to provide healthcare for all in Oregon which is still being considered today.

Before coming to the Legislature in 2003 as the Representative for HD 33 – NW Portland and parts of Multnomah and Washington Counties, he enjoyed a career in the healthcare field. He earned his B.S. in Pharmacy from Wayne State University in 1957, his M.S. in Pharmacy Administration at Wayne State University in 1960 and his Ph.D. in Medical Care Organization from the University of Michigan in 1967. His professional experience included being a Professor Emeritus at the Oregon Health and Sciences University, a VP of Research at Kaiser Foundation Hospital, and the Director/Founder of the Kaiser Permanent Center for Health Research Foundation Hospitals.

While in office Representative Greenlick used his background in healthcare to educate his colleagues and champion the movement of providing affordable healthcare to all Oregonians. He was determined to not let the failed ballot attempt stop him from his dream. He sponsored many resolutions in attempts to get the issue in front of Oregon voters. Despite his party having control of the Senate, the House and the Governor’s office, during most of his time in office, he was still unable to move the resolutions to the voters.

- 2007 HJR 18 – It moved out of committee on a party line vote and passed the House floor on a party line vote. It was in the Joint Rules committee upon adjournment.

- 2008 HJR 100 – It moved out of committee on a party line vote and passed the House floor on a party line vote. It was in the Joint Rules Committee upon adjournment.

- 2015 HJR 4 – This bill received no committee hearings.

- 2018 HJR 203 – It moved out of committee on a party line vote and passed the House floor on a party line vote. It was assigned to the Senate Healthcare Committee where it received one hearing and was in committee upon adjournment.

- 2020 HJR 202 – It moved out of committee on a party line vote, but never received a vote on the House floor due to the Republican walkout.

Now the 2021 Legislature is looking to move Representative Greenlick’s concept across the finish line with the introduction of SJR 12 by Senator Elizabeth Steiner-Hayward (D–Portland) and Representative Rob Nosse (D-Portland). Again,

2020 HJR 12 proposes an amendment to the Oregon Constitution establishing an obligation of The State to ensure every resident of state access to cost-effective, clinically appropriate, and affordable health care. Requires The State to balance its obligations against the public interest in funding public schools and other essential public services.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

However, as has been each time the concept has been brought forward, there is an inability to assess what the cost of providing “affordable healthcare†would be to the state budget. The Legislative Fiscal Offices (LFO) which reviews the cost to the state budget to implement bills as well as estimates any revenue that may be generated by legislation. For each one of the resolutions, LFO has issued the same statement. With respect to revenue, they have reported “it has NO impact on state or local revenuesâ€. On the state budget impact side, however, they have stated “Costs related to the measure are indeterminate at this timeâ€. This has long been the concern of opponents to this legislation. Healthcare is not free and if it is to be provided to everyone in Oregon by the state, how will the state pay for it and how will it impact the ability to fund other portions of the state budget.

2020 HJR 12 received a hearing on February 24th in the Senate Committee on Healthcare. A work session has not been scheduled as of press time.

--Terese Humboldt| Post Date: 2021-02-25 10:19:05 | Last Update: 2021-02-25 10:44:19 |

Read More Articles