On this day, August 17, 2014, two people were kiled after a disabled man jumped on his mother's lap in a motorized mobilized device hitting the controls and propelling both of them into a gap between two light-rail train cars as the train left the station in Gresham.

Also on this day, August 17, 2019, Oregon police arrested at least 13 people and seized metal poles, bear spray and other weapons as Antifa rioters swarmed downtown Portland.

Post an Event

Post an Event

| Benton County Republicans’ Private Fundraising Event, “Bent-on Boots and Bling” with Trey Taylor |

| Friday, September 5, 2025 at 5:00 pm |

| Featuring Trey Taylor

Music Private Event

Friday, September 5, 2025 5:00-5:30 pm VIP Reception

5:30-8:00 pm Heavy Appetizers,

Auction, Concert

Red: $750 VIP Reception

Front Row Table Sponsor

White: $500 Table Sponsor

Blue: $50 per person

Limited Seating. Get Yours Now!!!

Support Local

Dress up: Bling, Cowboy, Patriotic Benton County Republican

FUNDRAISER

www.BentonGOP.org

Get your tickets today at:

https://www.bentongop.org/event-details/benton-county-republicans-fundraiser/form

About Trey:

Trey is the youngest African American Man in Country Music History. The Denver Post wrote

"It's impossible to miss his enthusiasm. With a fondness for cowboy boots, gaudy colors and dazzling jewelry, Trey Taylor could stand toe to toe with any of the Pop, Country or even Rap

contemporaries of his generation.“ |

| Trysting Tree Golf Club, 34028 NE Electric Rd., Corvallis |

Some bills to watch in the Revenue Committee, but not just yet

Editor's note: This is the sixth in a multipart series exploring tax measures before the Oregon Legislature during the 2021 session

"Gut and stuff" may sound like something that a hunting party does after a successful day tracking big game, but it's actually something less dramatic. It describes the process in the Legislature of amending a bill by removing all the contents of the bill and replacing them with something else. It's pretty common.

Often, legislators will introduce "placeholder" bills because the concepts behind them are still being discussed. In the 2021 session, there are several of these lurking in the House Committee on Revenue -- where all bills for raising revenue must originate.

The bills are:

- HB 2432 Directs Legislative Revenue Officer to report to Legislative Assembly on options for income tax credit reform including recommendations for legislation intended to reform current income tax credit system.

- HB 2433 Directs Legislative Revenue Officer to study state and local tax systems and report findings to interim committees of Legislative Assembly related to revenue no later than September 15, 2022.

- HB 2434 Directs Legislative Revenue Officer to report to Legislative Assembly no later than February 15, 2022, on options for revenue system reform including recommendations for legislation intended to reform current system for raising revenue.

- HB 2435 Directs Legislative Revenue Officer to report to Legislative Assembly no later than February 15, 2022, on options for tax reform including recommendations for legislation intended to reform current tax system.

- HB 2436 Directs Legislative Revenue Officer to report to Legislative Assembly no later than February 15, 2022, on options for corporate tax reform including recommendations for legislation intended to reform current corporate excise and income tax system.

- HB 2437 Directs Legislative Revenue Officer to report to Legislative Assembly no later than February 15, 2022, on options for income tax reform including recommendations for legislation intended to reform current personal income tax system.

- HB 2438 Directs Legislative Revenue Officer to study property tax reform and report findings to interim committees of Legislative Assembly related to revenue no later than September 15, 2022.

- HB 2972 Directs Legislative Revenue Officer to study land value taxation and submit report to interim legislative committees related to revenue.

Don't for a minute think that the House Revenue Committee needs to pass a law to get the Legislative Revenue Officer to prepare a report on some tax issue.

--Staff Reports| Post Date: 2021-03-27 09:48:58 | Last Update: 2021-03-20 22:29:55 |

These bills have the effect of raising taxes.

Editor's note: This is the fifth in a multipart series exploring tax measures before the Oregon Legislature during the 2021 session

As short -- less than a page -- bill,

HB 2254, requires addition, in determination of Oregon taxable income, of amount of compensation above $1 million threshold paid by taxpayer to any individual and deducted as business expense. In short, tax deductions won't apply to income over $1 million, at least for the purposes of calculating state taxes.

It's pretty clear that the spirit of the bill -- introduced by Representative Marty Wilde (D-Eugene) -- is to generate extra revenue from "the rich," but it may have the effect of punishing small businesses, because of the way they file taxes. Many small businesses file as individuals and while $1 million is a large annual income for an individual, even a very small business can generate that level of revenue.

The effective part of the bill reads.

There shall be added to federal taxable income the amount of any individual’s compensation paid by a taxpayer that is in excess of $1 million for the tax year and that has been deducted on the taxpayer’s federal return under section 162 of the Internal Revenue Code.

HB 2255, also introduced by Representative Wilde, is similar. It limits, for purposes of personal income taxation, availability of itemized deductions, using phaseout based on adjusted gross income of taxpayer.

A taxpayer’s itemized deductions are the amount of the taxpayer’s itemized deductions as defined in section 63(d) of the

Internal Revenue Codeshall be reduced by five percent for every $50,000 by which the

taxpayer’s adjusted gross income exceeds $500,000.

In a time of record revenues coupled with a recession focused on small businesses, some think that these proposals are unnecessary and even mean-spirited. Neither bill has been scheduled for a hearing in the House Committee on Revenue, but this committee is not subject to the chamber deadlines faced by other committees.

--Staff Reports| Post Date: 2021-03-26 09:39:53 | Last Update: 2021-03-20 22:09:38 |

Dude, rural counties got the munchies

Editor's note: This is the fourth in a multipart series exploring tax measures before the Oregon Legislature during the 2021 session

Marijuana taxes have become a big part of Oregon's budget, brining in a whopping $133,150,349 in fiscal year 2020. 40% of that goes to schools and 15% goes to the State Police, so over half of the revenue is offsetting general fund money that would otherwise have to be paid by Oregon income taxpayers. It's play money for the Governor and the Legislature.

Since the passage of

Ballot Measure 91 in 2014, marijuana has been seen as a cash cow, and like many other addictive products, there is incentive to turn up the spigot and generate even more revenue -- or at least change the rules for distributing the revenue.. People who are opposed in general to marijuana might support a tax increase also.

Right now, local taxes on pot are capped at 3% and have to be approved by the voters. State Representative Mark Owens (R-Crane) has a proposal,

HB 2015, which would raise that cap to 10%. Some might argue that it's a sin tax and might deter some from weed, while generating revenue for local communities.

He's also introduced

HB 2014 which changes the formula for redistributing marijuana revenue to cites -- currently based solely on population -- and bases it partly on sales.

--Staff Reports| Post Date: 2021-03-25 09:32:15 | Last Update: 2021-03-20 21:46:31 |

As business start to pay, they start to not want to pay

Editor's note: This is the third in a multipart series exploring tax measures before the Oregon Legislature during the 2021 session

The year 2019 saw an increase in Democratic numbers in the Legislature and with it, the ability to raise taxes without any support from the minority party. That brought one of the largest tax increases in the history of the State of Oregon with the Commercial Activities Tax that was created to fund the Student Success Act. Not surprisingly, a backlash has begun as targets of the tax seek to free themselves from its burdens.

HB 2259 exempts receipts from sales of prescription drugs and medical supplies or from provision of medical services from commercial activity subject to corporate activity tax.

HB 2268 exempts interest received on financial institution loans made to small business concerns from commercial activity subject to corporate activity tax.

An exemption that carries perhaps the highest price tag,

HB 2293 exempts receipts from sales of agricultural, floricultural, horticultural, viticultural or food products from commercial activity subject to corporate activity tax. It was introduced by Representative Mark Owens (R-Crane).

HB 2429 has been introduced by Representatives Nancy Nathanson (D-Eugene) and E. Werner Reschke (R-Klamath Falls) Modifies provisions of corporate activity tax, expanding exemption for grocery sales to include groceries held by consignee store operator and expanding exemption for motor vehicle dealer transactions to include all new vehicle exchanges between franchised motor vehicle dealerships.

Representative Christine Drazan (R-Canby) has introduced

HB 2633 exempts, from commercial activity subject to corporate activity tax, contractor receipts from repair or rebuilding of structure destroyed or damaged by wildfire.

HB 2753 prohibits pharmacy benefit manager from including in contract with network pharmacy term barring price increase to customer to offset estimated amount of corporate activity tax paid by pharmacy and attributable to sale of prescription drug. This has been introduced by Representative Ron Noble (R-McMinnville)

The bill has not been scheduled for a hearing.

--Staff Reports| Post Date: 2021-03-17 16:41:42 | Last Update: 2021-03-15 16:56:41 |

If projected revenues are up, why do we need new taxes?

Editor's note: This is the second in a multipart series exploring tax measures before the Oregon Legislature during the 2021 session

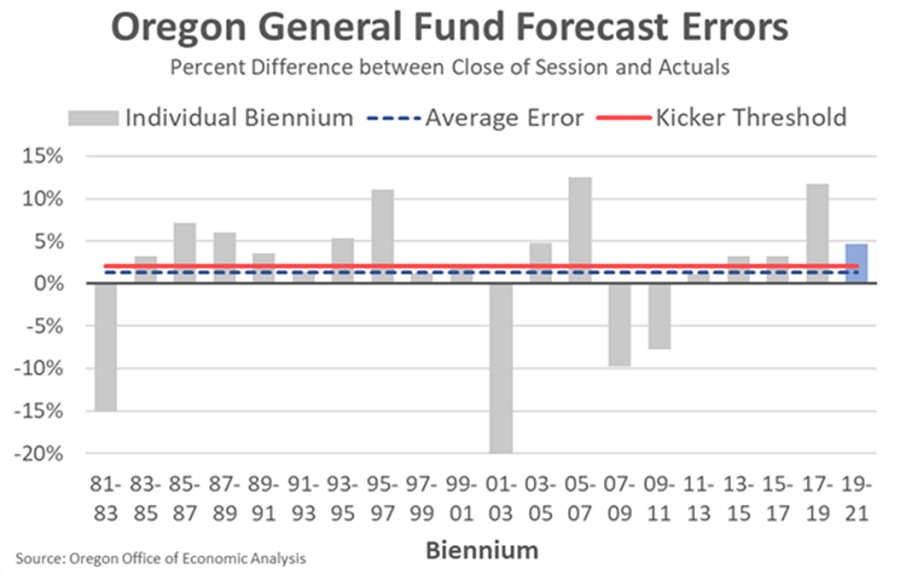

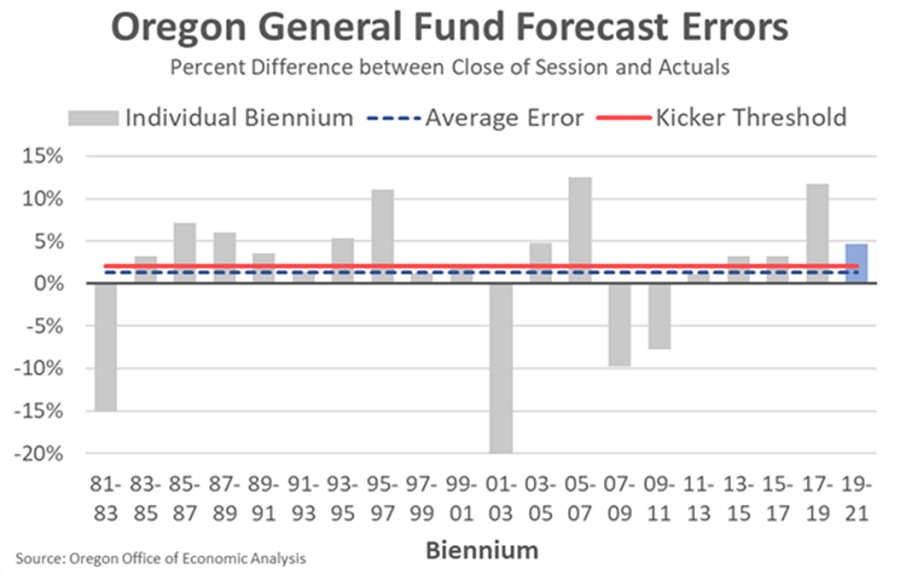

As the Oregon Office of Economic Analysis presented their

revenue forecast they said that the "Oregon March forecast puts kicker credit back in play," which is interesting because we're supposed to be in a recession and like planes lining up to land as a major airport, the revenue bills have been queuing up in the Oregon House Revenue Committee, chaired by Representative Nancy Nathanson (D-Eugene), where all bills for raising revenue must originate.

They did hedge. Saying, "kicker credit is far from a sure thing since the tax season has yet to get under way," but they are cautiously projecting a personal kicker of $571 million and a corporate kicker of $420 million, though this money doesn't kick back to corporations. It goes to K-12 education, which frees up general fund money for the Legislature to spend as they wish.

Bills for raising revenue also require a three-fifths majority vote in each chamber to pass. Because of this, as Democrats barely have the numbers in both chambers to win a tax vote, it's easier for them if they can find a way to pass a revenue increase that doesn't require the super-majority. They can do this in many ways, including changing the eligibility requirements for qualifying for a tax.

Oregon's kicker law is a part of the Oregon Constitution and can be found in Article IX, Section 14:

Section 14.

(1) As soon as is practicable after adjournment sine die of an odd-numbered year regular session of the Legislative Assembly, the Governor shall cause an estimate to be prepared of revenues that will be received by the General Fund for the biennium beginning July 1. The estimated revenues from corporate income and excise taxes shall be separately stated from the estimated revenues from other General Fund sources.

(2) As soon as is practicable after the end of the biennium, the Governor shall cause actual collections of revenues received by the General Fund for that biennium to be determined. The revenues received from corporate income and excise taxes shall be determined separately from the revenues received from other General Fund sources.

(3) If the revenues received by the General Fund from corporate income and excise taxes during the biennium exceed the amount estimated to be received from corporate income and excise taxes for the biennium, by two percent or more, the total amount of the excess shall be retained in the General Fund and used to provide additional funding for public education, kindergarten through twelfth grade.

(4) If the revenues received from General Fund revenue sources, exclusive of those described in subsection (3) of this section, during the biennium exceed the amount estimated to be received from such sources for the biennium, by two percent or more, the total amount of the excess shall be returned to personal income taxpayers.

--Staff Reports

--Staff Reports| Post Date: 2021-02-25 16:04:28 | Last Update: 2021-02-25 16:02:16 |

Big government dream: A self-increasing tax

Editor's note: This is the first in a multipart series exploring tax measures before the Oregon Legislature during the 2021 session

As one of the few states without a general sales tax, Oregon depends heavily on property tax for revenue. Real property is taxed based on its value -- know as

ad valorem taxes. As real estate prices spiked in the 1990s -- along with taxes -- citizens began to become resentful of the tax windfall enjoyed by their governments. In 1996 the citizens of Oregon passed property tax reform as Measure 47. There were some technical problems with Measure 47, so in 1997, the Legislature sent Measure 50 to the voters, which fixed the problems by repealing Measure 47, but keeping the tax cuts.

For 1997-98, the assessed value of a property was set at 90 percent of the property’s 1995-96 assessed value. After 1998 the growth in assessed value was limited to three percent annually. New properties are calculated by multiplying the ratio of assessed to real market value for similar property in the county by that property’s real market value. This means that if you have a home where the assessment has been rising only three percent in 1989 and you build a similarly valued home nearby, the tax rates would be similar.

Property values, especially with the policies in Oregon, tends to increase at a rate greater than three percent, so over the decades, most properties have seen a huge gap between the real market value -- what a home can sell for -- and the assessed value, which is capped to increase at no more than three percent annually.

State Representative Rob Nosse has introduced

HJR 13 which proposes an amendment to Oregon Constitution providing that, for purposes of

ad valorem property taxation, the ratio of maximum assessed value to real market value of property must be equal to three quarters of the market value.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

It also exempts from ad valorem property taxes lesser of first $25,000 or first 25 percent of real market value of each homestead and requires the legislature to enact laws for administration of exemption, including adjusting $25,000 for inflation.

This means that property taxes would no longer be capped at three percent annually. They are only required to lag behind market value. The legislative revenue office has not done any analysis on what dollar amount this will raise, but it has to be significant, and will grow over the years.

As with all changes to the Oregon Constitution, only the people can do that, so this bill is a referral to the 2022 ballot. This resolution has not be scheduled for a hearing.

--Staff Reports| Post Date: 2021-02-23 13:04:07 | Last Update: 2021-02-23 15:48:24 |

Read More Articles

Right now, local taxes on pot are capped at 3% and have to be approved by the voters. State Representative Mark Owens (R-Crane) has a proposal, HB 2015, which would raise that cap to 10%. Some might argue that it's a sin tax and might deter some from weed, while generating revenue for local communities.

Right now, local taxes on pot are capped at 3% and have to be approved by the voters. State Representative Mark Owens (R-Crane) has a proposal, HB 2015, which would raise that cap to 10%. Some might argue that it's a sin tax and might deter some from weed, while generating revenue for local communities.