If projected revenues are up, why do we need new taxes?

Editor's note: This is the second in a multipart series exploring tax measures before the Oregon Legislature during the 2021 session

As the Oregon Office of Economic Analysis presented their

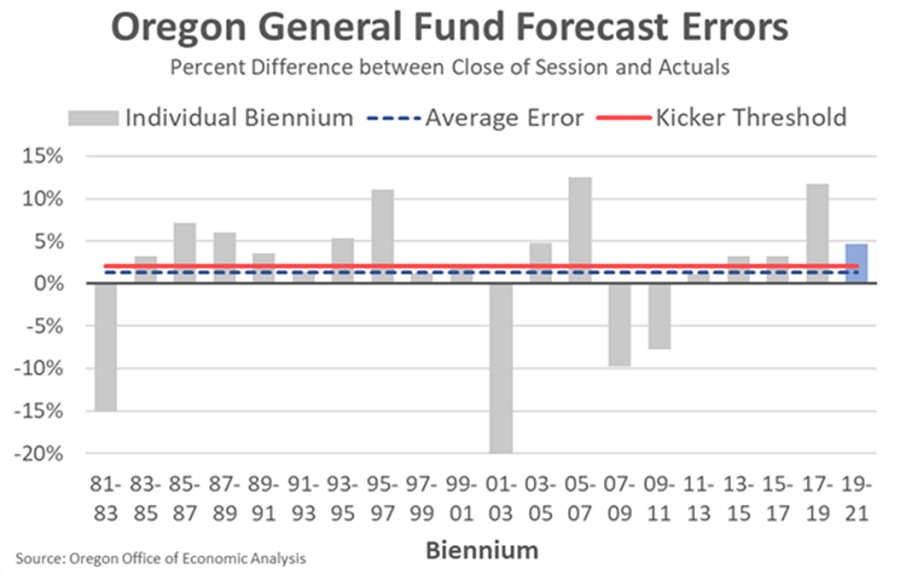

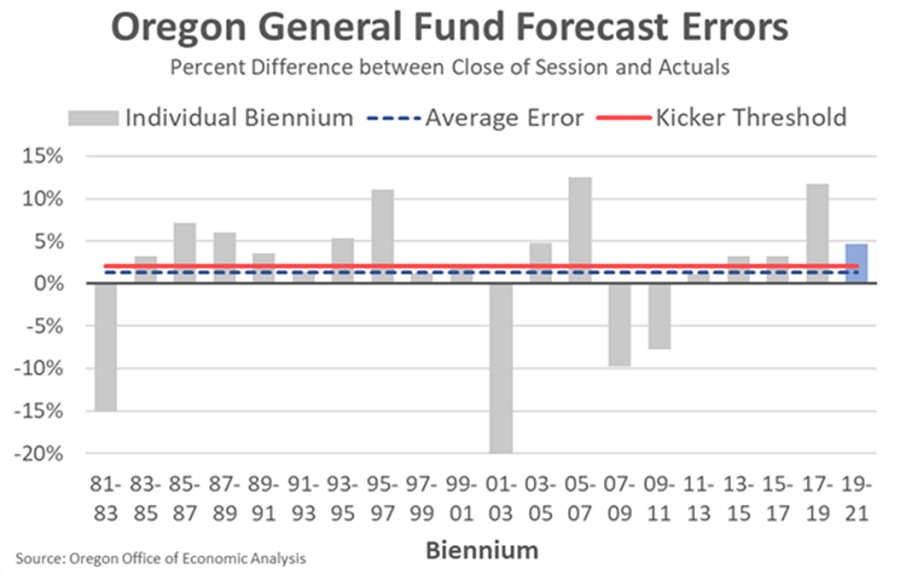

revenue forecast they said that the "Oregon March forecast puts kicker credit back in play," which is interesting because we're supposed to be in a recession and like planes lining up to land as a major airport, the revenue bills have been queuing up in the Oregon House Revenue Committee, chaired by Representative Nancy Nathanson (D-Eugene), where all bills for raising revenue must originate.

They did hedge. Saying, "kicker credit is far from a sure thing since the tax season has yet to get under way," but they are cautiously projecting a personal kicker of $571 million and a corporate kicker of $420 million, though this money doesn't kick back to corporations. It goes to K-12 education, which frees up general fund money for the Legislature to spend as they wish.

Bills for raising revenue also require a three-fifths majority vote in each chamber to pass. Because of this, as Democrats barely have the numbers in both chambers to win a tax vote, it's easier for them if they can find a way to pass a revenue increase that doesn't require the super-majority. They can do this in many ways, including changing the eligibility requirements for qualifying for a tax.

Oregon's kicker law is a part of the Oregon Constitution and can be found in Article IX, Section 14:

Section 14.

(1) As soon as is practicable after adjournment sine die of an odd-numbered year regular session of the Legislative Assembly, the Governor shall cause an estimate to be prepared of revenues that will be received by the General Fund for the biennium beginning July 1. The estimated revenues from corporate income and excise taxes shall be separately stated from the estimated revenues from other General Fund sources.

(2) As soon as is practicable after the end of the biennium, the Governor shall cause actual collections of revenues received by the General Fund for that biennium to be determined. The revenues received from corporate income and excise taxes shall be determined separately from the revenues received from other General Fund sources.

(3) If the revenues received by the General Fund from corporate income and excise taxes during the biennium exceed the amount estimated to be received from corporate income and excise taxes for the biennium, by two percent or more, the total amount of the excess shall be retained in the General Fund and used to provide additional funding for public education, kindergarten through twelfth grade.

(4) If the revenues received from General Fund revenue sources, exclusive of those described in subsection (3) of this section, during the biennium exceed the amount estimated to be received from such sources for the biennium, by two percent or more, the total amount of the excess shall be returned to personal income taxpayers.

--Staff Reports

--Staff Reports| Post Date: 2021-02-25 16:04:28 | Last Update: 2021-02-25 16:02:16 |