On this day, July 12, 2013, the Oregon Fish and Wildlife commission adopted provisions of a lawsuit settlement that will make the state the only one in the West where killing wolves that attack livestock must be a last resort.

Post an Event

Post an Event

| TILLAMOOK COUNTY FAIR - 100 YEARS OF PIG N'FORD |

| Wednesday, August 6, 2025 at 10:00 am |

| The Tillamook County Fair received its recognition as one of the top ten Blue Ribbon Fairs in the nation due to its uniqueness; offering so much for fairgoers to enjoy free along with their paid admission. Fairgoers can enjoy all of the Open Class and 4-H/FFA exhibits that Tillamook County residents have prepared the year prior, free entertainment and concerts, live exotic animal displays, and a whole lot more!

FOR MORE INFORMATION

tillamookfairoffice@gmail.com

(M-F, 8 AM-5 PM) at (503) 842-2272.

Reminders:

NO OUTSIDE FOOD OR DRINK

All bags are subject to search

For the safety of all present, only trained service animals are permitted to enter Fairgrounds property. A trained service animal is any guide dog, signal dog, or other animal individually trained to do work or perform tasks for people with disabilities. |

| 4603 East 3rd Street

Tillamook, OR, 97141 |

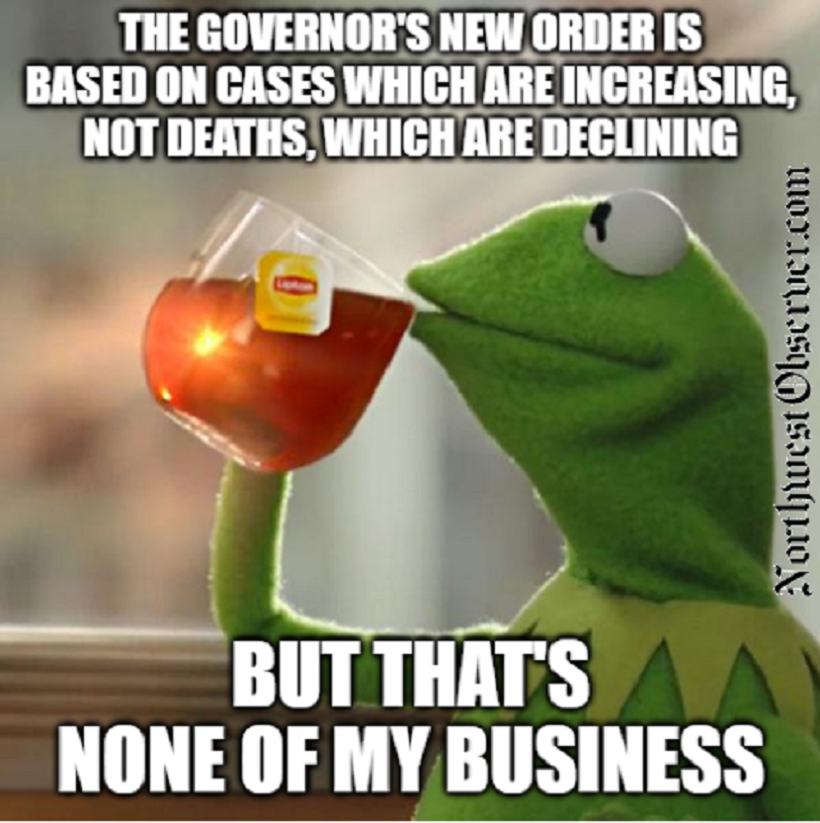

Kermit always comes through for us

--Northwest Observer Meme Team| Post Date: 2020-07-13 14:35:57 | |

“It all depends on you. Your choices determine our future."

In response to the "alarming rise in COVID-19 case counts" across Oregon over the last several weeks, Governor Kate Brown today announced new requirements for face coverings and limits on social get-togethers. Effective Wednesday, July 15, Oregon’s face covering requirement will be expanded to apply to outdoor public spaces when six feet of distance cannot be maintained. In addition, indoor social get-togethers of more than 10 people will be prohibited. Civil-libertarians noted that the decision could not have been based on the relatively few deaths --

237 in Oregon -- so far.

The gathering limit applies only to indoor social get-togethers. This new rule does not change the operation of businesses or churches at this time. This move was interpreted by some to be a defensive maneuver designed to avoid lawsuits from businesses or churches.

Governor Brown noted that failure to comply with the new requirements would lead to more outbreaks of COVID-19 and more restrictive closures with greater impact on Oregon’s economies, communities, health care systems, and families.

“We need to do absolutely everything we can to reduce transmission in ways that do not require us to close down businesses again," said Governor Brown. “The proof here will be in the numbers. Either people will adhere to this requirement and be a positive force for stopping COVID-19, or I will be forced to take more restrictive measures.â€

“It all depends on you. Your choices determine our future."

Governor Brown shared the following facts about COVID-19 in Oregon:

- Oregon reported more cases in the past week than in the entire month of May.

- The last time Oregon had less than 100 cases in a single day was more than a month ago.

- Half of all cases in Oregon are from people under the age of 40 and one third of all cases are from people under the age of 30.

- Currently, people in their 20s and 30s are the most likely group to get sick with COVID-19.

- Two Oregonians in their 30s have died from COVID-19.

Updated face covering and indoor social get-together guidance will be posted to coronavirus.oregon.gov.

--Staff Reports| Post Date: 2020-07-13 14:22:34 | |

Let’s integrate education and save some money

Editor’s note: This is the fourth in a multi-part series on the budget for the State of Oregon and where possible efficiencies can be found.

Editor’s note: This is the fourth in a multi-part series on the budget for the State of Oregon and where possible efficiencies can be found.

Although it was controversial when it happened in 2009, the state shut down the Oregon School for the Blind and allocated proceeds from the sale of assets for the benefit of Oregon's blind students. As integrated education is increasingly -- though not universally -- regarded as beneficial for both the disabled student as well as the all of the student body, closure of the Oregon School for the Deaf seems to be not only fiscally responsible, but sound instructional policy.

At the beginning of the 2018-19 school year, OSD was serving 117 students with 62, or 53%, of the students in the day program and the remaining 55 students residing on the campus during the school year. At about $19 million per biennium, that's over $81,000 per student annually. It seems like they could be both better served and more efficiently served by local school districts partnering with their local Education Service Districts.

Though the budget for the agency is over $19 million, shuttering the institution certainly wouldn't return all that money back to the general fund. These students still have extraordinary needs and that costs money -- though probably not $81,000 per year. The 52 acre campus could generate much revenue at sale.

Savings: $3 million one-time sale of assets, plus $5-10 million biennially

--Staff Reports| Post Date: 2020-07-12 08:00:00 | Last Update: 2020-07-01 21:31:10 |

Rep. Hernandez voted for the regressive tax

State Rep. Diego Hernandez voted for a cell phone tax, which passed during the first Special Session at a time when Oregon’s people and economy might not appreciate the financial investment on behalf of the government, when they are themselves are soon required to make massive and historic budget cuts due to the recent shutdown of the economy. The tax will be applied to monthly service bills.

The proceeds of the tax are dedicated to building rural broadband infrastructure. Nonetheless, many Republican legislators from rural districts voted no, as they could not see the benefits outweighing the drawback of another tax.

Senate Republicans voted against

SB 1603, describing it as a cell phone tax disguised as a rural assistance bill. “The legislative process has not only been taken away from Oregonians, but now they must absorb a new tax when they are living in an economic shutdown,†said Senate Republican Leader Fred Girod (R-Stayton). “Democrats are spending money the state doesn’t have. This is a tax, and I think Oregon deserves better.†The Emergency Board recently allocated $20 million to broad band. “You know something is wrong with a bill when senators like me that represent rural Oregonians voted no,†said Senator Lynn Findley (R-Vale). “My constituents cannot afford another tax on their livelihoods, especially when the Emergency Board just allocated $20 million in funds to broadband without any plan on what projects the money will go to.â€

Critics have also noted that many Oregonians -- including many rural Oregonians -- use their cell phone as an internet connection and has the effect of taxing an existing internet connection in order to create another one. The irony of urban Democrats voting to tax their urban constituents to create a benefit for rural areas is also apparent. The tax is seen by experts as regressive, placing a heavier burden on lower-income people who have to use a greater proportion of their income to pay the tax.

Governor Brown signed the bill into law on July 7.

--Staff Reports| Post Date: 2020-07-10 21:08:15 | Last Update: 2020-08-03 21:08:30 |

Federal court grants extension

A federal district court issued a preliminary order granting

People Not Politicians, a broad and diverse coalition to create an independent citizens commission for Oregon, relief to qualify its redistricting reform initiative for the November 2020 election. The judge’s order allows the Secretary of State to decide by 5:00pm Monday, July 13, 2020 to either accept People Not Politician’s signatures as submitted, or accept a reduced number of signatures to 58,789 and allow additional time to gather until August 17, 2020.

Judge Michael J. McShane in People Not Politicians v. Secretary of State Clarno ruled in favor of People Not Politicians which executed a no-contact statewide signature gathering campaign in order to qualify Initiative Petition 57 for the November 2020 ballot while observing Governor Kate Brown’s stay-at-home orders.

Judge McShane found that People Not Politicians exercised “reasonable diligence†in attempting to qualify for the ballot, specifically because of the hard work that the campaign did to do outreach, build a broad coalition and plan creatively to collect signatures in light of the COVID-19 pandemic.

Through direct mail to 500,000 households and grassroot volunteer efforts that included multiple methods of outreach to thousands of voters, People Not Politicians gathered signatures from over 64,000 voters who signed IP 57 and mailed it back to the campaign.

Activists in other states have successfully challenged state petition and signature laws. In Arkansas, Illinois, Nevada, Massachusetts, Michigan and Virginia, courts granted extensions of the signature submission deadline and/or reductions in the signature threshold and other relief. Building on those successes, People Not Politicians asked a federal district court in Oregon for similar relief on June 30.

Kathay Feng, Redistricting & Representation Director, Common Cause

“We filed this lawsuit asking the Court to recognize the extreme and unprecedented circumstances of a global pandemic and the burdens that the Governor’s orders placed on PNP’s First Amendment rights. Oregonians will now have a say on IP 57, giving people, not politicians, the ability to just in time for the 2021 redistricting process.â€

“People Not Politicians is fighting to enact redistricting reform before Oregon draws new maps in 2021. We forged ahead through this COVID crisis and implemented an unprecedented signature gathering program, bringing in tens of thousands of petitions from Oregonians in barely over one month,†said Norman Turrill, spokesperson for People Not Politicians.

Initiative Petition 57, filed in November 2019, would create the Oregon Citizens Redistricting Commission and put redistricting in the hands of voters, not our politicians. The commission would consist of 12 Oregonians who applied and were selected from qualified applicants – four from the first largest political party, four from the second largest political party, and four others who are third party members or non-affiliated. Major donors to political candidates or parties would not be eligible. Neither would elected-officials, political party officials or their family members. Commissioners would be selected to represent the broad diversity of Oregonians.

The initiative campaign coalition has been led by the League of Women Voters of Oregon, Common Cause Oregon, Oregon Farm Bureau, the Independent Party of Oregon, NAACP Eugene/Springfield Branch, OSPIRG, Oregon’s Progressive Party, and tens of thousands of Oregonians who supported the effort to remove conflicts of interest from drawing of voter lines.

Steve Elzinga of Sherman, Sherman, Johnnie and Hoyt represented People Not Politicians in court. Common Cause attorneys Dan Vicuna, Suzanne Almeida, Kathay Feng, and law clerks Alton Wang and Michael Guggenheim, and Kecker Van Nest attorney Adam Lauridsen contributed to the briefs.

--Staff Reports| Post Date: 2020-07-10 19:30:35 | |

Rep. Prusak voted for the regressive tax

State Rep. Rachel Prusak voted for a cell phone tax, which passed during the first Special Session at a time when Oregon’s people and economy might not appreciate the financial investment on behalf of the government, when they are themselves are soon required to make massive and historic budget cuts due to the recent shutdown of the economy. The tax will be applied to monthly service bills.

The proceeds of the tax are dedicated to building rural broadband infrastructure. Nonetheless, many Republican legislators from rural districts voted no, as they could not see the benefits outweighing the drawback of another tax.

Senate Republicans voted against

SB 1603, describing it as a cell phone tax disguised as a rural assistance bill. “The legislative process has not only been taken away from Oregonians, but now they must absorb a new tax when they are living in an economic shutdown,†said Senate Republican Leader Fred Girod (R-Stayton). “Democrats are spending money the state doesn’t have. This is a tax, and I think Oregon deserves better.†The Emergency Board recently allocated $20 million to broad band. “You know something is wrong with a bill when senators like me that represent rural Oregonians voted no,†said Senator Lynn Findley (R-Vale). “My constituents cannot afford another tax on their livelihoods, especially when the Emergency Board just allocated $20 million in funds to broadband without any plan on what projects the money will go to.â€

Critics have also noted that many Oregonians -- including many rural Oregonians -- use their cell phone as an internet connection and has the effect of taxing an existing internet connection in order to create another one. The irony of urban Democrats voting to tax their urban constituents to create a benefit for rural areas is also apparent. The tax is seen by experts as regressive, placing a heavier burden on lower-income people who have to use a greater proportion of their income to pay the tax.

Governor Brown signed the bill into law on July 7.

--Staff Reports| Post Date: 2020-07-10 19:10:16 | |

Rep. Brad Witt voted for the regressive tax

State Rep. Brad Witt (D-Clatskanie) voted for a cell phone tax, which passed during the first Special Session at a time when Oregon’s people and economy might not appreciate the financial investment on behalf of the government, when they are themselves are soon required to make massive and historic budget cuts due to the recent shutdown of the economy. The tax will be applied to monthly service bills.

The proceeds of the tax are dedicated to building rural broadband infrastructure. Nonetheless, many Republican legislators from rural districts voted no, as they could not see the benefits outweighing the drawback of another tax.

Senate Republicans voted against

SB 1603, describing it as a cell phone tax disguised as a rural assistance bill. “The legislative process has not only been taken away from Oregonians, but now they must absorb a new tax when they are living in an economic shutdown,†said Senate Republican Leader Fred Girod (R-Stayton). “Democrats are spending money the state doesn’t have. This is a tax, and I think Oregon deserves better.†The Emergency Board recently allocated $20 million to broad band. “You know something is wrong with a bill when senators like me that represent rural Oregonians voted no,†said Senator Lynn Findley (R-Vale). “My constituents cannot afford another tax on their livelihoods, especially when the Emergency Board just allocated $20 million in funds to broadband without any plan on what projects the money will go to.â€

Critics have also noted that many Oregonians -- including many rural Oregonians -- use their cell phone as an internet connection and has the effect of taxing an existing internet connection in order to create another one. The tax is seen by experts as regressive, placing a heavier burden on lower-income people who have to use a greater proportion of their income to pay the tax.

Governor Brown signed the bill into law on July 7.

--Ben Fisher| Post Date: 2020-07-10 19:10:16 | Last Update: 2020-08-03 20:13:40 |

Rep. Marty Wilde voted for the regressive tax

State Rep. Marty Wilde voted for a cell phone tax, which passed during the first Special Session at a time when Oregon’s people and economy might not appreciate the financial investment on behalf of the government, when they are themselves are soon required to make massive and historic budget cuts due to the recent shutdown of the economy. The tax will be applied to monthly service bills.

The proceeds of the tax are dedicated to building rural broadband infrastructure. Nonetheless, many Republican legislators from rural districts voted no, as they could not see the benefits outweighing the drawback of another tax.

Senate Republicans voted against

SB 1603, describing it as a cell phone tax disguised as a rural assistance bill. “The legislative process has not only been taken away from Oregonians, but now they must absorb a new tax when they are living in an economic shutdown,†said Senate Republican Leader Fred Girod (R-Stayton). “Democrats are spending money the state doesn’t have. This is a tax, and I think Oregon deserves better.†The Emergency Board recently allocated $20 million to broad band. “You know something is wrong with a bill when senators like me that represent rural Oregonians voted no,†said Senator Lynn Findley (R-Vale). “My constituents cannot afford another tax on their livelihoods, especially when the Emergency Board just allocated $20 million in funds to broadband without any plan on what projects the money will go to.â€

Critics have also noted that many Oregonians -- including many rural Oregonians -- use their cell phone as an internet connection and has the effect of taxing an existing internet connection in order to create another one. The irony of urban Democrats voting to tax their urban constituents to create a benefit for rural areas is also apparent. The tax is seen by experts as regressive, placing a heavier burden on lower-income people who have to use a greater proportion of their income to pay the tax.

Governor Brown signed the bill into law on July 7.

--Ben Fisher| Post Date: 2020-07-10 19:10:16 | Last Update: 2020-08-03 21:58:15 |

Rep. Gorsek voted for the regressive tax

State Rep. Chris Gorsek voted for a cell phone tax, which passed during the first Special Session at a time when Oregon’s people and economy might not appreciate the financial investment on behalf of the government, when they are themselves are soon required to make massive and historic budget cuts due to the recent shutdown of the economy. The tax will be applied to monthly service bills.

The proceeds of the tax are dedicated to building rural broadband infrastructure. Nonetheless, many Republican legislators from rural districts voted no, as they could not see the benefits outweighing the drawback of another tax.

Senate Republicans voted against

SB 1603, describing it as a cell phone tax disguised as a rural assistance bill. “The legislative process has not only been taken away from Oregonians, but now they must absorb a new tax when they are living in an economic shutdown,†said Senate Republican Leader Fred Girod (R-Stayton). “Democrats are spending money the state doesn’t have. This is a tax, and I think Oregon deserves better.†The Emergency Board recently allocated $20 million to broad band. “You know something is wrong with a bill when senators like me that represent rural Oregonians voted no,†said Senator Lynn Findley (R-Vale). “My constituents cannot afford another tax on their livelihoods, especially when the Emergency Board just allocated $20 million in funds to broadband without any plan on what projects the money will go to.â€

Critics have also noted that many Oregonians -- including many rural Oregonians -- use their cell phone as an internet connection and has the effect of taxing an existing internet connection in order to create another one. The tax is seen by experts as regressive, placing a heavier burden on lower-income people who have to use a greater proportion of their income to pay the tax.

Governor Brown signed the bill into law on July 7.

--Ben Fisher| Post Date: 2020-07-10 19:10:16 | |

Rep. Courtney Neron voted for the regressive tax

State Rep. Courtney Neron voted for a cell phone tax, which passed during the first Special Session at a time when Oregon’s people and economy might not appreciate the financial investment on behalf of the government, when they are themselves are soon required to make massive and historic budget cuts due to the recent shutdown of the economy. The tax will be applied to monthly service bills.

The proceeds of the tax are dedicated to building rural broadband infrastructure. Nonetheless, many Republican legislators from rural districts voted no, as they could not see the benefits outweighing the drawback of another tax.

Senate Republicans voted against

SB 1603, describing it as a cell phone tax disguised as a rural assistance bill. “The legislative process has not only been taken away from Oregonians, but now they must absorb a new tax when they are living in an economic shutdown,†said Senate Republican Leader Fred Girod (R-Stayton). “Democrats are spending money the state doesn’t have. This is a tax, and I think Oregon deserves better.†The Emergency Board recently allocated $20 million to broad band. “You know something is wrong with a bill when senators like me that represent rural Oregonians voted no,†said Senator Lynn Findley (R-Vale). “My constituents cannot afford another tax on their livelihoods, especially when the Emergency Board just allocated $20 million in funds to broadband without any plan on what projects the money will go to.â€

Critics have also noted that many Oregonians -- including many rural Oregonians -- use their cell phone as an internet connection and has the effect of taxing an existing internet connection in order to create another one. The irony of urban Democrats voting to tax their urban constituents to create a benefit for rural areas is also apparent. The tax is also seen by experts as regressive, placing a heavier burden on lower-income people who have to use a greater proportion of their income to pay the tax.

Governor Brown signed the bill into law on July 7.

--Ben Fisher| Post Date: 2020-07-10 19:10:16 | Last Update: 2020-08-03 20:12:22 |

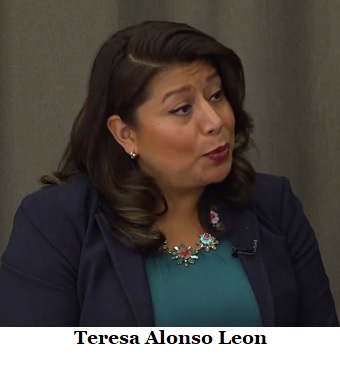

Rep. Alonso Leon voted for the regressive tax

State Rep. Teresa Alonso Leon (D-Woodburn) voted for a cell phone tax, which passed during the first Special Session at a time when Oregon’s people and economy might not appreciate the financial investment on behalf of the government, when they are themselves are soon required to make massive and historic budget cuts due to the recent shutdown of the economy. The tax will be applied to monthly service bills.

The proceeds of the tax are dedicated to building rural broadband infrastructure. Nonetheless, many Republican legislators from rural districts voted no, as they could not see the benefits outweighing the drawback of another tax.

Senate Republicans voted against

SB 1603, describing it as a cell phone tax disguised as a rural assistance bill. “The legislative process has not only been taken away from Oregonians, but now they must absorb a new tax when they are living in an economic shutdown,†said Senate Republican Leader Fred Girod (R-Stayton). “Democrats are spending money the state doesn’t have. This is a tax, and I think Oregon deserves better.†The Emergency Board recently allocated $20 million to broad band. “You know something is wrong with a bill when senators like me that represent rural Oregonians voted no,†said Senator Lynn Findley (R-Vale). “My constituents cannot afford another tax on their livelihoods, especially when the Emergency Board just allocated $20 million in funds to broadband without any plan on what projects the money will go to.â€

Critics have also noted that many Oregonians -- including many rural Oregonians -- use their cell phone as an internet connection and has the effect of taxing an existing internet connection in order to create another one. The tax is seen by experts as regressive, placing a heavier burden on lower-income people who have to use a greater proportion of their income to pay the tax.

Governor Brown signed the bill into law on July 7.

--Ben Fisher| Post Date: 2020-07-10 19:10:16 | Last Update: 2020-08-03 20:13:15 |

Rep. David Gomberg voted for the regressive tax

State Rep. David Gomberg (D-Otis) voted for a cell phone tax, which passed during the first Special Session at a time when Oregon’s people and economy might not appreciate the financial investment on behalf of the government, when they are themselves are soon required to make massive and historic budget cuts due to the recent shutdown of the economy. The tax will be applied to monthly service bills.

The proceeds of the tax are dedicated to building rural broadband infrastructure. Nonetheless, many Republican legislators from rural districts voted no, as they could not see the benefits outweighing the drawback of another tax.

Senate Republicans voted against

SB 1603, describing it as a cell phone tax disguised as a rural assistance bill. “The legislative process has not only been taken away from Oregonians, but now they must absorb a new tax when they are living in an economic shutdown,†said Senate Republican Leader Fred Girod (R-Stayton). “Democrats are spending money the state doesn’t have. This is a tax, and I think Oregon deserves better.†The Emergency Board recently allocated $20 million to broad band. “You know something is wrong with a bill when senators like me that represent rural Oregonians voted no,†said Senator Lynn Findley (R-Vale). “My constituents cannot afford another tax on their livelihoods, especially when the Emergency Board just allocated $20 million in funds to broadband without any plan on what projects the money will go to.â€

Critics have also noted that many Oregonians -- including many rural Oregonians -- use their cell phone as an internet connection and has the effect of taxing an existing internet connection in order to create another one. The tax is seen by experts as regressive, placing a heavier burden on lower-income people who have to use a greater proportion of their income to pay the tax.

Governor Brown signed the bill into law on July 7.

--Ben Fisher| Post Date: 2020-07-10 19:10:16 | Last Update: 2020-08-03 20:14:54 |

Read More Articles

Editor’s note: This is the fourth in a multi-part series on the budget for the State of Oregon and where possible efficiencies can be found.

Editor’s note: This is the fourth in a multi-part series on the budget for the State of Oregon and where possible efficiencies can be found.

“People Not Politicians is fighting to enact redistricting reform before Oregon draws new maps in 2021. We forged ahead through this COVID crisis and implemented an unprecedented signature gathering program, bringing in tens of thousands of petitions from Oregonians in barely over one month,†said Norman Turrill, spokesperson for People Not Politicians.

“People Not Politicians is fighting to enact redistricting reform before Oregon draws new maps in 2021. We forged ahead through this COVID crisis and implemented an unprecedented signature gathering program, bringing in tens of thousands of petitions from Oregonians in barely over one month,†said Norman Turrill, spokesperson for People Not Politicians.