On this day, September 6, 2020 a fire started outside a police precinct on Portland's north side resulting in about 15 arrests during protests into the morning.

“These dashboards make it easy for people to view injury and fatality data”

The Oregon Health Authority (OHA)

has now announced that they are unveiling another interactive data dashboard to help people more easily track state, county and demographic trends in deaths and hospital visits related to a range of transportation-related injuries.

The

Oregon Transportation Safety Dashboard, developed by the Injury and Violence Prevention Program at the OHA Public Health Division, improves access to the data among the public, state and local agencies, and community organizations that work to reduce incidence of transportation-related injuries and deaths.

“These dashboards make it easy for people to view injury and fatality data,” said Dagan Wright, Ph.D., M.S.P.H., senior injury epidemiologist and informaticist at the Public Health Division. “The transportation dashboard will help people understand transportation-related injury trends over time, characteristics of who is getting injured and by what types of transportation.”

A D V E R T I S E M E N T

A D V E R T I S E M E N T

The dashboard includes mortality, emergency department discharge and hospital discharge data in nine transportation categories, such as motorcycle, motor vehicle occupant, pedal cyclist and pedestrian. Data are aggregated for annual statewide trends, as well as a four-year average for county-level and demographic trends.

The new dashboard affirms trends that have made headlines in recent months:

Overall, fatalities for transportation are increasing, specifically for motorcycles, pedal cyclists and pedestrians.

OHA says that an increased focus on emerging transportation modes that cause injury is necessary in order to get a full picture of changing trends. The dashboard includes a “pedestrian-involving wheeled device” category to capture popular new transportation modes like e-scooters.

“What we have seen in both non-fatal transportation injuries and deaths needs attention from our communities, especially for more vulnerable users,” Wright said. “Data dashboards like these help us monitor trends and better anticipate where to direct resources so we can reduce the burden of these injuries on individuals, communities and agencies.”

--Ben Fisher| Post Date: 2023-10-11 13:49:46 | Last Update: 2023-10-11 14:09:54 |

Tax-hungry Democrats have been proposing to divert kicker funds away from taxpayers

Imagine if you went to your favorite fast food restaurant and ordered the cheeseburger combo with fries and a drink for $12.99 and handed the cashier a $20 bill. Suppose, instead of handing you back $7.01 in change, they added items to your order to use up the $20, figuring you needed a larger drink, some chicken nuggets, or a piece of pie for desert. You'd be puzzled, if not outraged.

Oregon's kicker law keeps state government from doing the equivalent -- except instead of a $20 bill, we're talking millions or even billions of dollars.

The 2% surplus kicker gives taxpayers an income tax credit if actual revenues for the biennium are more than 2% higher than forecast at the time the budget was adopted. When the law was first enacted, the Oregon Department of Revenue sent kicker checks to taxpayers. In 2011, the Oregon Legislature

changed the law so that the kicker refund appeared as a credit on the next year's taxes. It is estimated that the distribution via check cost the taxpayers an

additional $1M per kicker year.

| Personal Income Kicker History |

| Biennium | Tax

Year | Surplus

in $M | Percent | Mean

Distribution |

| 1979-81 | 1981 | -$141 | None | - |

| 1981-83 | 1983 | -$115 | None | - |

| 1983-85 | 1985 | $89 | 7.70% | $80 |

| 1985-87 | 1987 | $221 | 16.60% | $190 |

| 1987-89 | 1989 | $175 | 9.80% | $130 |

| 1989-91 | 1991 | $186 | Suspended | - |

| 1991-93 | 1993 | $60 | None | - |

| 1993-95 | 1994/5 | $163 | 6.27% | $110 |

| 1995-97 | 1996/7 | $432 | 14.37% | $290 |

| 1997-99 | 1998/9 | $167 | 4.57% | $100 |

| 1999-01 | 2000/1 | $254 | 6.02% | $160 |

| 2001-03 | 2002/3 | -$1,249 | None | - |

| 2003-05 | 2004/5 | -$401 | None | - |

| 2005-07 | 2006/7 | $1,071 | 18.60% | $610 |

| 2007-09 | 2008 | -$1,113 | None | - |

| 2009-11 | 2010 | -$1,050 | None | - |

| 2011-13 | 2012 | $124 | None | - |

| 2013-15 | 2014 | $402 | 5.60% | $210 |

| 2015-17 | 2016 | $464 | 5.60% | $250 |

| 2017-19 | 2018 | $1,688 | 17.17% | $910 |

| 2019-21 | 2020 | $1,898 | 17.34% | $990 |

| 2021-23 | 2022 | $5,619 | 44.28% | |

The kicker law divides all General Fund money into two pots: (1) corporate taxes; and (2) personal income taxes plus all other revenues. At the end of each biennium, if the actual collections in either of these two pots are more than 2% higher than was forecast at the close of the regular session, then a refund or credit must be paid. If a kicker is triggered in a pot, then all the money in that pot in excess of the close of session forecast, including the 2%, is returned to taxpayers.

In 1990 the legislature suspended the potential $246 million kicker because of budget problems arising from the implementation of Ballot Measure 5's property tax reform.

In 2012, voters changed the kicker law so that surpluses in the corporate pot fund a K through 12 public education. Most experts agree that this has the practical effect of diverting the money into the general fund, as this money displaces what were formerly general fund allocations to education.

The amount refunded in the case of the individual taxpayers or allocated to the general fund for public education is an identical proportion of each taxpayer’s personal income tax liability for the prior year. For example, if the kicker refund is 5% and the taxpayer had a liability of $1,000, he or she would receive a refund of $50. The estimate upon which the kicker calculation is based can be increased, thereby reducing or eliminating the kicker refund/credit, on a one-time basis if an emergency is declared and approved by a 2/3 vote in each chamber of the Legislative Assembly.

Over the years, tax-hungry Democrats have been proposing to divert kicker funds away from the taxpayers who paid them. In the 2023 session, Senator Jeff Golden (D-Ashland) propsosed

changing the kicker distribution from a payment proportional to the amount paid by the taxpayer to an equal distribution to all personal income taxpayers. The bill found little support and died in the Senate Committee on Finance and Revenue. This proposal echoed nearly identical proposals by Representative Phil Barnhart (D-Eugene) in

2016 and

2017

Senator James Manning, Jr. (D-Eugene) proposed an

amendment to the Oregon Constitution in 2017 and 2019 which would have diverted the individual kicker into education.

The "Kicker" law can be found in the Oregon Constitution:

Article IX, Section 14. Revenue estimate; retention of excess corporate tax revenue in General Fund for public education funding; return of other excess revenue to taxpayers; legislative increase in estimate. (1) As soon as is practicable after adjournment sine die of an odd-numbered year regular session of the Legislative Assembly, the Governor shall cause an estimate to be prepared of revenues that will be received by the General Fund for the biennium beginning July 1. The estimated revenues from corporate income and excise taxes shall be separately stated from the estimated revenues from other General Fund sources.

(2) As soon as is practicable after the end of the biennium, the Governor shall cause actual collections of revenues received by the General Fund for that biennium to be determined. The revenues received from corporate income and excise taxes shall be determined separately from the revenues received from other General Fund sources.

(3) If the revenues received by the General Fund from corporate income and excise taxes during the biennium exceed the amount estimated to be received from corporate income and excise taxes for the biennium, by two percent or more, the total amount of the excess shall be retained in the General Fund and used to provide additional funding for public education, kindergarten through twelfth grade.

(4) If the revenues received from General Fund revenue sources, exclusive of those described in subsection (3) of this section, during the biennium exceed the amount estimated to be received from such sources for the biennium, by two percent or more, the total amount of the excess shall be returned to personal income taxpayers.

(5) The Legislative Assembly may enact laws:

(a) Establishing a tax credit, refund payment or other mechanism by which the excess revenues are returned to taxpayers, and establishing administrative procedures connected therewith.

(b) Allowing the excess revenues to be reduced by administrative costs associated with returning the excess revenues.

(c) Permitting a taxpayer's share of the excess revenues not to be returned to the taxpayer if the taxpayer's share is less than a de minimis amount identified by the Legislative Assembly.

(d) Permitting a taxpayer's share of excess revenues to be offset by any liability of the taxpayer for which the state is authorized to undertake collection efforts.

(6)(a) Prior to the close of a biennium for which an estimate described in subsection (1) of this section has been made, the Legislative Assembly, by a two-thirds majority vote of all members elected to each House, may enact legislation declaring an emergency and increasing the amount of the estimate prepared pursuant to subsection (1) of this section.

(b) The prohibition against declaring an emergency in an act regulating taxation or exemption in section 1a, Article IX of this Constitution, does not apply to legislation enacted pursuant to this subsection.

(7) This section does not apply:

(a) If, for a biennium or any portion of a biennium, a state tax is not imposed on or measured by the income of individuals.

(b) To revenues derived from any minimum tax imposed on corporations for the privilege of carrying on or doing business in this state that is imposed as a fixed amount and that is nonapportioned (except for changes of accounting periods).

(c) To biennia beginning before July 1, 2001. [Created through H.J.R. 17, 1999, and adopted by the people Nov. 7, 2000; Amendment proposed by S.J.R. 41, 2010, and adopted by the people Nov. 2, 2010; Amendment proposed by initiative petition filed Dec. 7, 2011, and adopted by the people Nov. 6, 2012]

Editor's note: We gratefully acknowledge documents produced by the Legislative Revenue Office and the Oregon Department of Revenue for their contributions to this article

--Staff Reports| Post Date: 2023-10-11 09:40:02 | Last Update: 2023-10-11 09:44:55 |

“We mourn the tragic loss of hundreds of innocent civilian lives”

In recognition of the thousands wounded and held hostage, and more

than 1,100 innocent lives lost to Hamas terrorist attacks in Israel, Oregon House Republican

Leader Jeff Helfrich (R-Hood River) is asking Oregon Governor Kotek to immediately order all

flags to fly at half-staff.

“We cannot ignore the atrocities that have been committed against the Israeli people and

the Jewish community at large," stated Helfrich. "Blood thirsty Hamas terrorists have murdered more than

1,100 innocent men, women, and children, and held hostage hundreds of others –

including Americans. All statements dismissing these atrocities are disgraceful.

“As a military veteran who has served overseas, it is clear that this war has worldwide

impacts. Now is the time to recognize the evil in front of us and denounce Hamas, a

terrorist organization whose intention is to eradicate the State of Israel and Jewish people

around the world."

“There must be no doubt that the State of Oregon stands firm with Israel and Oregon’s

Jewish communities in their time of need."

A D V E R T I S E M E N T

A D V E R T I S E M E N T

Senate Democratic Leader Kate Lieber and Senate Republican Leader Tim Knopp

released the following joint statement:

“We unequivocally stand with our ally Israel and affirm their right to defend themselves from the

brutal terrorist acts perpetrated by Iranian-backed Hamas. We mourn the tragic loss of

hundreds of innocent civilian lives."

“This violence and chaos must end. The terrorists responsible for the heinous attack must face

severe consequences, and we call on Hamas to release all hostages immediately.”

--Ben Fisher| Post Date: 2023-10-10 14:37:50 | Last Update: 2023-10-10 16:45:08 |

“Now is the time to repeal Measure 110”

Oregon State Representative E. Werner Reschke

has now urged Governor Tina Kotek to call a special session of the Oregon Legislature for the sole purpose of repealing Measure 110.

Representative Reschke, who is a Republican representing Oregon's House District 55, cited the worsening addiction crisis, which recently saw a mass overdose event in the streets of Portland, as well as public opinion polling showing Oregonians want the measure repealed in urging the governor to take action.

“Every day Ballot Measure 110 remains in place, more addicts are created and more people die", said Reschke. "The evidence is clearly seen by the explosion of homelessness and despair throughout the state. It’s obvious to most that Measure 110 has been an abject policy failure."

He continued, “With due respect to my legislative colleagues, we cannot wait until February for a new committee to deliberate and decide. Oregonians want to see immediate action, that’s why a special session, now, is imperative. Every day that goes by, more of our neighbors succumb to addiction, and recovery takes time, is expensive and difficult. Now, not in several months, is the time to repeal Measure 110.”

Representative Reschke went on to point out that Ballot Measure 110 took state funding dedicated to schools, police, cities, and counties and shifted it to the Oregon Health Authority to set up addiction recovery services. At the same time, the measure decriminalized all street drugs.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

During the 2023 Legislative session several bills were introduced by Republican legislators to wind back the harmful effects Measure 110. All were rejected by the majority of Democrat legislators.

“Just a week ago, we saw a mass overdose event involving young adults in Portland," Reschke stated. "It’s such a tragedy — even our kids aren’t safe from this deadly policy. Each day we wait, more harm is done; Measure 110 has cost people their lives; it has failed. Oregonians recognize it, too, with a majority of them supporting outright repeal. By delaying any further, the state’s enabling of addiction is cruel and immoral. We have the power to take action now, to make things right and repeal Measure 110. At the same time, I reaffirm my commitment to ensuring the Oregonians who need help recovering from addiction get the help they need. We must hold state agencies accountable for their failures to deliver promised services and put a real plan of action in place to assist those who are struggling. However, I firmly reject the idea that we must embrace decriminalization to deliver effective addiction recovery services. We’ve already seen that model play-out, and the consequences have been deadly.”

--Ben Fisher| Post Date: 2023-10-09 14:13:59 | Last Update: 2023-10-09 14:58:57 |

Taxpayers will receive record kicker credit on returns next year

The Oregon Office of Economic Analysis has confirmed a more than $5.61 billion revenue surplus in the 2021-2023 biennium, triggering a tax surplus credit, or “kicker,” for the 2023 tax year.

The surplus -- the largest in state history -- will be returned to taxpayers through a credit on their 2023 state personal income tax returns filed in 2024. The credit is based on tax liability for the 2022 tax year. Taxpayers who have not yet filed a 2022 tax return, should file now so they can claim their kicker credit when they file their 2023 tax return.

The surplus leaves some asking, "Why are we

still raising taxes and

proposing removing the cap on property taxes when we have such lopsided surpluses?"

To calculate the amount of their credit, taxpayers can multiply their 2022 tax liability before any credits -- line 22 on the 2022 Form OR-40 -- by 44.28 percent. This percentage is determined and certified by OEA. Taxpayers who claimed a credit for tax paid to another state would need to subtract the credit amount from their liability before calculating the credit.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

Personal income taxpayers can also determine the amount of their kicker using a

What’s My Kicker? Calculator available on Revenue Online. To use the calculator, taxpayers will need to enter their name, Social Security Number, and filing status for 2022 and 2023.

| Personal Income Kicker History |

| Biennium | Tax

Year | Surplus

in $M | Percent | Mean

Distribution |

| 1979-81 | 1981 | -$141 | None | - |

| 1981-83 | 1983 | -$115 | None | - |

| 1983-85 | 1985 | $89 | 7.70% | $80 |

| 1985-87 | 1987 | $221 | 16.60% | $190 |

| 1987-89 | 1989 | $175 | 9.80% | $130 |

| 1989-91 | 1991 | $186 | Suspended | - |

| 1991-93 | 1993 | $60 | None | - |

| 1993-95 | 1994/5 | $163 | 6.27% | $110 |

| 1995-97 | 1996/7 | $432 | 14.37% | $290 |

| 1997-99 | 1998/9 | $167 | 4.57% | $100 |

| 1999-01 | 2000/1 | $254 | 6.02% | $160 |

| 2001-03 | 2002/3 | -$1,249 | None | - |

| 2003-05 | 2004/5 | -$401 | None | - |

| 2005-07 | 2006/7 | $1,071 | 18.60% | $610 |

| 2007-09 | 2008 | -$1,113 | None | - |

| 2009-11 | 2010 | -$1,050 | None | - |

| 2011-13 | 2012 | $124 | None | - |

| 2013-15 | 2014 | $402 | 5.60% | $210 |

| 2015-17 | 2016 | $464 | 5.60% | $250 |

| 2017-19 | 2018 | $1,688 | 17.17% | $910 |

| 2019-21 | 2020 | $1,898 | 17.34% | $990 |

| 2021-23 | 2022 | $5,619 | 44.28% | |

Taxpayers are eligible to claim the kicker if they filed a 2022 tax return and had tax due before credits. Even taxpayers who don't have a filing obligation for 2023, still must file a 2023 tax return to claim their credit. The 2023 Oregon personal income tax return instructions will include detailed information on how to claim the credit on Form OR-40 for full-year Oregon residents, Form OR-40-P for part-year residents, and Form OR-40-N for nonresidents. Composite and fiduciary-income tax return filers are also eligible.

Taxpayers should keep in mind that the state may use all or part of their kicker to pay any state debt they owe, such as tax due for other years, child support, court fines, or school loans.

Taxpayers can donate their kicker with a checkbox on their tax return to the Oregon State School Fund for K-12 public education, but they must donate the entire amount. The donation is permanent and cannot be taken back.

Taxpayers also have the option of donating part or all of their refund to any or all of the 29 charities approved by the Charitable Checkoff Commission. Taxpayers use Form OR-DONATE to designate any amount or all of their refund to donate to charity.

Free tax preparation services are available for both federal and Oregon tax returns. Some software companies offer free software use and e-filing for eligible taxpayers. Visit the

Department of Revenue website to take advantage of the software and free offers and get more information about free tax preparation services.

For more information, go to the

Oregon surplus “kicker” credit page of the Department of Revenue website.

--Staff Reports| Post Date: 2023-10-09 11:23:57 | Last Update: 2023-10-09 14:07:08 |

Fire and rescue crews encouraged the changes for public safety

The Oregon State Parks and Recreation Commission -- chaired by Jennifer Allen -- voted to allow beach driving to continue in fall, winter, and spring at one access point in Lincoln City and to prohibit it year-round at the other starting Oct. 1 due to ongoing safety issues.

The new rules were adopted September 20 in cooperation with Lincoln City Council, which voted earlier to support the proposal based on its staff recommendations. Fire and rescue crews encouraged the city and Oregon Parks and Recreation Department to make the changes for public safety.

“I’m grateful for our partners in Lincoln City and around Oregon who voiced their concerns and helped find a solution that balances the needs of our visitors at the Oregon Coast. This rule change provides a safer experience at the beach access points in Lincoln City,” said Central Coast District Manager Preson Phillips.

Motor vehicles will be allowed to access the ocean shore at NW 15th Street, and drive 150 feet in either direction from Oct. 1 to April 30. Motor vehicles are prohibited at all other times except for emergency vehicles.

Motor vehicles will be prohibited year-round from driving on the ocean shore at NW 34th Street in Lincoln City. Safety concerns included crowding, a lack of separation of pedestrians and vehicles and the risk of injury to visitors playing in the stream directly below the access point.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

OPRD will install signs that communicate the rule changes to the public. It will also work to improve signage and communication around both access locations regarding where individuals with disabilities can access the ocean shore.

--Staff Reports| Post Date: 2023-10-09 10:33:10 | Last Update: 2023-10-09 11:40:47 |

Applications are due by Friday, October 13th

Umpqua National Forest is

seeking applicants to fill 15 positions on the Rogue-Umpqua Resource Advisory Committee (RAC). As reauthorized under the Secure Rural Schools and Community Self-Determination Act in Public Law 115-141, RAC members participate in collaborative decision making and recommend distribution of Title II funding for projects to improve forest health, watersheds, roads and facilities on, or adjacent to, the Umpqua and Rogue River-Siskiyou National Forests.

The Rogue-Umpqua RAC represents Lane, Douglas, Jackson, and Klamath counties and includes the Umpqua and Rogue River-Siskiyou national forests. RAC members must be a resident of Oregon and reside in one of these four counties. Applications are due to the Supervisor's Office in Roseburg by Friday, October 13, 2023. More information and application forms can be found

on the website.

Past projects include noxious weed control, road realignment, trail construction and improvement, timber sale preparation, and the restoration of fish passages to restore native species.

The volunteer positions are unpaid; however, travel costs may be covered by the agency. The committee typically has one full day meeting each year in Roseburg.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

RAC committee members will be officially appointed by the Secretary of Agriculture for a term of up to four years. RAC committees are to be balanced and diverse with equal representation from industry, environmental groups, recreation groups, elected officials, and local residents.

Applicants will be evaluated based on their training and experience working in the interest group they represent, their demonstrated commitment to collaborative decision-making, and their contribution to the balance and diversity of the RAC.

Each nominee is required to submit an application to Misti-Kae Bucich, RAC Coordinator, by Friday, October 13, 2023. If you are interested in serving on the Rogue-Umpqua RAC, please visit the

Umpqua National Forest website or you can

email Misti-Kae Bucich, Partnership/RAC/Volunteer Coordinator for the Umpqua National Forest.

--Ben Fisher| Post Date: 2023-10-08 11:29:15 | Last Update: 2023-10-08 16:29:58 |

“We face the need to manage spending more conservatively”

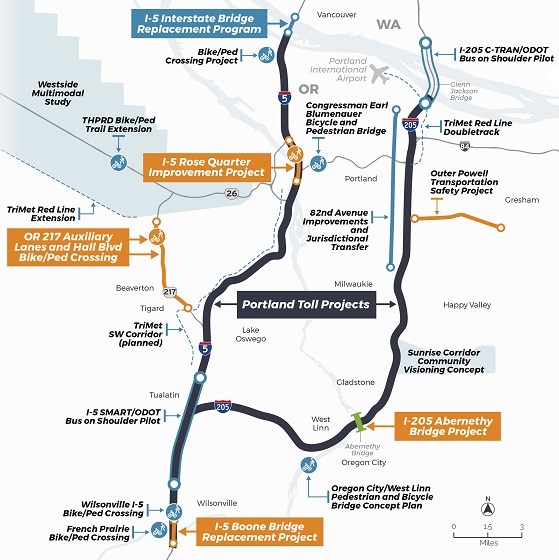

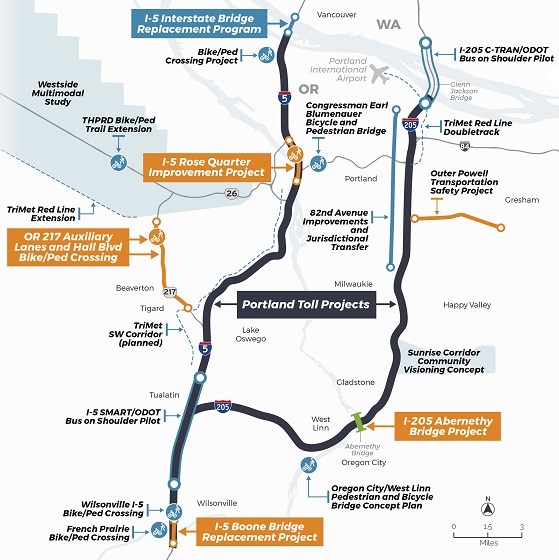

Amidst declining gas tax revenues, the Oregon Transportation Commission -- the policy setting board for the Oregon Department of Transportation -- has decided to scale back several projects in its Urban Mobility Plan, including tolling on parts of I-205 and I-5. ODOT still plans to toll the section of the Abernathy Bridge, located where I-205 crosses the Willamette River, when that part of the project is complete.

In 2017, then Governor Kate Brown signed

HB 2017, known as Keep Oregon Moving. The new law directed the Oregon Transportation Commission to establish a congestion relief program, to seek federal approval to implement value pricing and to implement pricing on specific facilities. These provisions and others, including amendments made in 2021 by

HB 3055, reside at

Chapter 383 of Oregon Revised Statutes. Since 2017, ODOT has taken steps to establish a tolling program and to prepare to implement tolling on Interstates 5 and 205, as prescribed by statute. In January, 2023, the OTC adopted an amendment to Oregon Highway Plan Goal 6 Tolling and Pricing to modernize policy.

Urban Mobility Strategy Projects include:

In late June, the Oregon Transportation Commission held a special meeting to discuss their draft finance plan for major Portland region projects such as the I-5 Rose Quarter Improvement Project, I-205 Improvements Project and the Oregon Toll Program. The commission approved the plan and the agency sent this plan to Governor Kotek for her review.

This finance plan was requested by Gov. Tina Kotek , she directed to delay toll collection until 2026, recognizing that projects that were meant to be funded by toll revenue would be impacted by this delay.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

The Transportation Commission says that tolling was always a central component of paying for these projects. They state that With tolling revenue now delayed, they face the need to manage spending more conservatively.

The Commission has said that there is still commitment to the I-5 Rose Quarter Improvement Project and the Historic Albina community. The commission advised ODOT staff to move forward with the baseline which will provide roughly $40 million in further funding to bring the project to a higher level of design, making it more competitive for future funding opportunities.

I-205 Improvements Project includes proposed two options regarding the I-205 Improvements Project. The baseline includes indefinitely postponing the second phase of construction, which includes adding a missing third lane and seismic upgrades to a total of eight bridges. Construction on the Abernethy Bridge would continue, and tolls would begin in 2026 to repay the costs of the bridge. The alternative option envisions doing the above but would also include additional funding to replace the Tualatin River Bridge to make it earthquake ready.

The commission advised ODOT staff to move forward with the baseline option of finishing construction on the Abernethy Bridge, tolling at the bridge to repay the cost of construction, and indefinitely postponing phase two of the project.

“This is how we’re going to move forward for the time being unless given different direction. If the direction is that we’re not going to toll at all, then we’re going to have to pivot hard and make really difficult decisions,” Chair Julie Brown shared.

--Staff Reports| Post Date: 2023-10-07 17:05:36 | Last Update: 2023-10-07 19:17:46 |

FBI seized 25 guns and nine kilos of cocaine

Five people were arrested in the Portland metro area on Wednesday in a large-scale drug and gun bust throughout three states.

During the operation – which involved over 150 officers, agents and personnel from federal, state and local agencies – law enforcement seized nearly nine kilos of cocaine, 25 firearms (11 from one location), nearly $50,000 in cash and thousands of suspected fentanyl pills.

“The amount of suspected fentanyl alone that we seized in this operation will make a difference in our communities. 25 guns now off the streets, kilos of drugs out of circulation, that’s an impact,” said Kieran L. Ramsey, Special Agent in Charge of the FBI Portland Field Office. “In a coordinated effort across three states the FBI and our partners, worked seamlessly to cut into the capabilities of these criminal enterprises and we are working hard to put the most violent offenders and facilitators behind bars for as long as we possibly can.”

The five people arrested were on a complaint of conspiracy to distribute controlled substances. A complaint is merely an allegation of criminal conduct, not evidence. All defendants are presumed innocent until proven guilty in a court of law. Additional charges could follow.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

The Federal Bureau of Investigation’s Portland Field Office and the Portland Police Bureau conducted the operation with the assistance of the FBI Seattle, FBI Los Angeles, HSI, IRS, Multnomah County Sheriff’s Office, Gresham Police Department, Vancouver Police Department, Oregon State Police, Washington State Department of Corrections, Port of Portland, Los Angeles Police Department, Los Angeles County Sheriff’s Department and the United States Marshals Service.

--Donna Bleiler| Post Date: 2023-10-06 19:17:43 | Last Update: 2023-10-06 20:32:55 |

You can take your DMV knowledge test anywhere that has reliable internet

The Oregon Department of Transportation

has now announced that customers can take their DMV knowledge test anywhere that has reliable internet. There is now no need to go into a local DMV office to take those tests. You can test online instead with a computer that has a webcam, keyboard and mouse.

Online knowledge testing is now part of DMV’s expanding menu of online services at

DMV2U. By going online, customers can take their test at a time that works best for them. No waiting in line at the office, or for appointments to become available.

“We hope customers embrace this new way to take their knowledge test,” said DMV Administrator Amy Joyce. “It is an easy and convenient option that we are proud to offer to Oregonians.”

The online test closely mirrors the testing screens shown in a DMV field office, so customers can expect a similar experience. There is no cost difference to use online testing.

Teens under 18, DMV’s largest group of testing customers, need an adult 21 years or older to supervise their test as they take it.

The Class C (regular driver) knowledge test and motorcycle endorsement test are available online in English and Spanish. DMV plans to add additional languages in the future to serve even more customers.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

“Testing online allows customers the chance to know that they have passed their exam before coming into the DMV office. This can save some people multiple trips into the office if they don’t pass the first time,” said Joyce. “You don’t need an appointment to come in once you pass online, but do come prepared with all the documentation you need to make sure it is a smooth visit.”

After customers pass their test online, they will need to come into the office with their identity documents, and pass a vision screening. Then they will be issued a permit or be eligible to schedule a drive test, depending on their age.

DMV partnered with an expert in the online testing industry, Intellectual Technologies Inc., to develop the new service. Their online testing platform is already used in other states. Proven identity verification and anti-cheating features protect the safety purpose of the knowledge test.

Learn more about online testing at the

DMV2U Online Service Center website.

--Ben Fisher| Post Date: 2023-10-04 13:46:16 | Last Update: 2023-10-04 14:37:37 |

“It will wallop struggling wildlife populations, causing new declines.”

What could be the

largest lithium deposit in the world may pit one camp of environmentalists against others environmentalists as the element used to make batteries for electric cars is being mined just outside the Oregon border in Nevada.

The Thacker Pass Project is located within an extinct 25 by 19 mile supervolcano named McDermitt Caldera that sits on the Oregon-Nevada border -- though the mine pit will be only in Nevada. The caldera was formed approximately 16.3 million years ago as part of a hotspot currently underneath the Yellowstone Plateau.

Following an initial eruption and concurrent collapse of the McDermitt Caldera, a large lake formed in the caldera basin. This lake water was extremely enriched in lithium and resulted in the accumulation of lithium-rich clays. Late volcanic activity uplifted the caldera, draining the lake and bringing the lithium-rich moat sediments to the surface resulting in the near-surface lithium deposit called Thacker Pass.

According to the mine owner

Lithium Americas, the open pit mine will cost $2.2 billion to develop and will produce 80,000 tons of lithium per year over its 40-year life.

“The Montana Mountains landscape has long been identified as a key area for biodiversity protection in Nevada,” said Katie Fite, Public Lands Director for Wildlands Defense. “Along with adjacent Oregon wild lands, it constitutes one of the last big blocks of the sagebrush sea free of development. Pygmy rabbits, migratory birds and other wildlife suffered a major blow from wildfire a decade ago and habitat has not yet recovered. Now this mega-mine will obliterate vital remaining sagebrush. The mine’s regional disturbance footprint will wallop struggling wildlife populations, causing new declines.”

The Nevada Department of Environmental Protection sees it differently. According to its

website, "Approval for these permits comes after an extensive application review and revision process, as well as months of public engagement with the Orovada community and the Fort McDermitt Paiute and Shoshone Tribes. All three permits, which are required for Lithium Nevada to start construction and operate the mine, come after NDEP determined the project can operate in a way that protects public health and the environment.

The Trump administration provided

federal approval near the end of his term and the 9th Circuit Court of Appeals declined to vacate that approval, meaning that the mining activity can proceed.

The world is currently

not producing enough of it to keep up with demand produced by the sale of electric vehicles. This could be a major bottleneck this decade.

--Staff Reports| Post Date: 2023-10-02 11:14:14 | Last Update: 2023-10-02 12:16:45 |

“Darin Harbick is a committed pro-life candidate”

Oregon Right to Life, a PAC that focuses on electing pro-life officials in the state of Oregon,

has now announced their endorsement of Darin Harbick. Harbick is challenging the incumbent, Representative Charlie Conrad (R-Dexter), in the 2024 Republican primary election for House District 12.

“Darin Harbick is a committed pro-life candidate,” said ORTL executive director Lois Anderson. “He has deep roots in the district, years of community involvement and business experience that will provide what he needs to be an excellent representative. I’m confident Darin Harbick will represent the values of the citizens of HD 12, and I’m proud to express my support.”

Earlier this year, ORTL PAC announced a campaign to defeat Representative Conrad due to his support for what ORTL says was dangerous abortion and assisted suicide legislation. Representative Conrad voted to pass

House Bill 2002 and

House Bill 2279 in the 2023 Oregon state legislative session.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

ORTL points out that as introduced, HB 2002 was a dramatic expansion of abortion in Oregon, going as far as making it illegal to notify parents if an abortion is performed on their child unless the child provides explicit written permission. Although the most extreme aspects of HB 2002 were removed following the Republican Senate walkout protest negotiations, ORTL says the bill that Conrad voted for and helped pass still weakens the parent-child relationship and creates virtual immunity for abortion providers who violate the laws of other states.

HB 2279 repealed the residency requirement for physician-assisted suicide in Oregon, making lethal prescriptions available regardless of where a person lives.

“Charlie Conrad’s votes on these bills are dangerous to vulnerable Oregonians,” continued Anderson. “A vote for Darin Harbick is a vote to protect the most vulnerable members of our society—unborn children and those who are pressured to end their own lives.”

According to

Harbick's campaign website, he has successfully built, purchased, and founded several businesses located in the Upper McKenzie Valley. While managing his businesses and he served 14 years on the McKenzie School board, the Lane County Tourism board, and coached high school and college women’s basketball.

--Ben Fisher| Post Date: 2023-09-30 08:38:09 | Last Update: 2023-09-30 09:53:34 |

Read More Articles

The amount refunded in the case of the individual taxpayers or allocated to the general fund for public education is an identical proportion of each taxpayer’s personal income tax liability for the prior year. For example, if the kicker refund is 5% and the taxpayer had a liability of $1,000, he or she would receive a refund of $50. The estimate upon which the kicker calculation is based can be increased, thereby reducing or eliminating the kicker refund/credit, on a one-time basis if an emergency is declared and approved by a 2/3 vote in each chamber of the Legislative Assembly.

The amount refunded in the case of the individual taxpayers or allocated to the general fund for public education is an identical proportion of each taxpayer’s personal income tax liability for the prior year. For example, if the kicker refund is 5% and the taxpayer had a liability of $1,000, he or she would receive a refund of $50. The estimate upon which the kicker calculation is based can be increased, thereby reducing or eliminating the kicker refund/credit, on a one-time basis if an emergency is declared and approved by a 2/3 vote in each chamber of the Legislative Assembly.

I-205 Improvements Project includes proposed two options regarding the I-205 Improvements Project. The baseline includes indefinitely postponing the second phase of construction, which includes adding a missing third lane and seismic upgrades to a total of eight bridges. Construction on the Abernethy Bridge would continue, and tolls would begin in 2026 to repay the costs of the bridge. The alternative option envisions doing the above but would also include additional funding to replace the Tualatin River Bridge to make it earthquake ready.

I-205 Improvements Project includes proposed two options regarding the I-205 Improvements Project. The baseline includes indefinitely postponing the second phase of construction, which includes adding a missing third lane and seismic upgrades to a total of eight bridges. Construction on the Abernethy Bridge would continue, and tolls would begin in 2026 to repay the costs of the bridge. The alternative option envisions doing the above but would also include additional funding to replace the Tualatin River Bridge to make it earthquake ready.

“The Montana Mountains landscape has long been identified as a key area for biodiversity protection in Nevada,” said Katie Fite, Public Lands Director for Wildlands Defense. “Along with adjacent Oregon wild lands, it constitutes one of the last big blocks of the sagebrush sea free of development. Pygmy rabbits, migratory birds and other wildlife suffered a major blow from wildfire a decade ago and habitat has not yet recovered. Now this mega-mine will obliterate vital remaining sagebrush. The mine’s regional disturbance footprint will wallop struggling wildlife populations, causing new declines.”

“The Montana Mountains landscape has long been identified as a key area for biodiversity protection in Nevada,” said Katie Fite, Public Lands Director for Wildlands Defense. “Along with adjacent Oregon wild lands, it constitutes one of the last big blocks of the sagebrush sea free of development. Pygmy rabbits, migratory birds and other wildlife suffered a major blow from wildfire a decade ago and habitat has not yet recovered. Now this mega-mine will obliterate vital remaining sagebrush. The mine’s regional disturbance footprint will wallop struggling wildlife populations, causing new declines.”