Post an Event

Post an Event

| Benton County Republicans’ Private Fundraising Event, “Bent-on Boots and Bling” with Trey Taylor |

| Friday, September 5, 2025 at 5:00 pm |

| Featuring Trey Taylor

Music Private Event

Friday, September 5, 2025 5:00-5:30 pm VIP Reception

5:30-8:00 pm Heavy Appetizers,

Auction, Concert

Red: $750 VIP Reception

Front Row Table Sponsor

White: $500 Table Sponsor

Blue: $50 per person

Limited Seating. Get Yours Now!!!

Support Local

Dress up: Bling, Cowboy, Patriotic Benton County Republican

FUNDRAISER

www.BentonGOP.org

Get your tickets today at:

https://www.bentongop.org/event-details/benton-county-republicans-fundraiser/form

About Trey:

Trey is the youngest African American Man in Country Music History. The Denver Post wrote

"It's impossible to miss his enthusiasm. With a fondness for cowboy boots, gaudy colors and dazzling jewelry, Trey Taylor could stand toe to toe with any of the Pop, Country or even Rap

contemporaries of his generation.“ |

| Trysting Tree Golf Club, 34028 NE Electric Rd., Corvallis |

Identifies human remains from 1989

On March 26, 1989, the remains of a skeletonized human body were discovered by a rafting group on the Sherman County side of the John Day River. Then-Sheriff Gerald Lohrey and additional Sherman County Sheriff’s Office deputies launched a jet boat at Cottonwood Bridge, approximately 13 miles east of Wasco, and recovered the incomplete skeletal remains. In addition to many long bones that had been half-buried in silt on the riverbank, a skull was collected with dental work.

The discovery of the body made local headlines, but nothing was immediately known about the deceased. The remains were transported to the Oregon State Medical Examiner’s Office (SMEO) for examination.

An examination of the body determined that the decedent was most likely a Caucasian male, between 40 and 50 years of age at the time of death, and around 5’6†to 5’9†in living stature. Evidence of compressed lumbar vertebrae by the forensic anthropologist indicated possible arthritic changes in the bone. It was noted that several teeth in the mandible exhibited restorations. Additional searches of the area were performed over the next month that yielded additional small bones and several teeth.

Leads on the possible identification of this individual were received by the Sheriff’s Office in the following days and weeks; numerous reporting parties indicated they believed the remains to be that of David West, Jr., a man who had disappeared from Sherman County trying to cross the John Day River during a large flooding event in 1964. Mr. West, Jr. had lived on a ranch near Bridge Creek and was known to cross the John Day often. He normally went back and forth across the river to feed cattle. He and a friend had even built a makeshift cable car across the river to assist in quickly navigating the waters back and forth over the John Day. The day the John Day River flooded in 1964, Mr. West was thought to be feeding cattle near Ashwood, Oregon. A friend went to check on him and saw that the cable car had been washed away, the large tree that had held the cable was uprooted, and Mr. West’s dog was injured and agitated on the bank of the river. David West Jr. was never seen or heard from again.

In 1989, Mr. West’s dentist was consulted, but no conclusive identification was ever made.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

The remains were retained by the SMEO. In 2010, the SMEO submitted a bone sample to the University of North Texas Center for Human Identification. The sample was processed and yielded a forensic DNA profile for comparison and upload into CODIS. Unfortunately, no genetic associations to missing persons or family reference standards in the CODIS database were established.

In April 2022, the SMEO recognized the effectiveness of investigative genetic genealogy on cold unidentified remains cases and submitted an additional bone sample to Othram, a private DNA lab specializing in advanced forensic DNA testing. Othram uses an in-house whole genome sequencing technique that can provide genetic information and possible familial associations even with a low-yield sample. The analysis revealed the names of two biological relatives of David West Jr. as being genetically associated with the remains.

Both the Gilliam County Sheriff Gary Bettencourt and the Sherman County Sheriff Brad Lohrey (the son of Sheriff Gerald Lohrey) worked to contact family members; Sheriff Bettencourt collected oral swab standards from one relative, and these were submitted and tested by Othram.

The genetic association was confirmed through DNA comparison by Othram in September 2022, and the family was notified of the positive identification.

Sheriff Brad Lohrey said, “We are very excited that such an old case was able to be solved. It is amazing what our forensic teams can accomplish with modern technology. This was a case that was a mystery for generations here at the Sherman County Sheriff’s Office. I’m happy that the family of the deceased finally has closure.â€

--Donna Bleiler| Post Date: 2023-02-07 01:48:28 | Last Update: 2023-02-07 16:54:07 |

Passage would lessen inflation impact

Oregon’s Corporate Activity Tax (CAT) goes through some amount of reform every legislative session since it was passed in 2019. The CAT tax is often referred to as the gross receipts tax allowing a 35 percent subtraction for certain business expenses and applied to receipts in excess of $1 million. If a business has commercial activity over $1 million, it owes a flat $250 tax plus tax at the 0.57% tax rate for taxable commercial activity over $1 million.

The CAT is imposed on businesses for the privilege of doing business in Oregon that is allocated to a "Fund for Student Success" that is separate and distinct from the state's general fund. While Oregonians were looking for alternative funding for education, the CAT tax hasn’t materialized in helping schools to be successful in digging Oregon out of nearly the bottom ranked state in education.

Shortly after CAT was passed,

HB 4202 was passed in 2020 special session adding exemptions for foreign commercial activity that is sourced to Oregon, allowed an offset for returns and allowances, exempt agricultural and farming sells to wholesaler or broker, exempts dairies not part of coop, and added the 35 percent subtraction. Many other proposals were not considered. The Department of Revenue, however, subsequently made rules to exclude subcontracting payments, property brought into Oregon, retail sale of groceries, allowed labor cost subtractions, and resale of motor vehicles.

In 2021,

SB 164 expanded the exclusion for motor vehicle dealers that make exchanges between franchises, it expanded the exemption of wholesale and retail sales of groceries to include consignment sales, and excluded insurance companies subject to retaliatory tax

Two bills were proposed in 2022.

SB 1507 would exempt prescription drugs, feminine hygiene products, diapers and baby formula, and

HB 4094 would exempt prescription drugs and medical supplies. However, the Democrat majority blocked both bills from a floor motion to withdraw from committee to give them a vote on the floor.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

This session is no different. There are four bills that will have public hearings this week. They should all be passed to lessen the impact on inflation.

Representative Virgle Osborne (R-Roseburg) has introduced

HB 2433, which increases the exempt amount threshold for purposes of the corporate activity tax (CAT) from $1 million to $5 million.

Representative Shelly Boshart Davis (R-Albany) has introduced

HB 2142, which adds “processor†to types of entities that farming operations may exempt from CAT tax calculations. The tax has created a disincentive to sell to Oregon-based processors that sell outside of Oregon, because of their inability to obtain documentation needed to accurately calculate which portion of their crops are sold in-state v. out-of-state.

Senator Lynn Findley (R-Vale) and Representative Mark Owens (R-Crane) are co-sponsoring

SB 61 to revisit exempting receipts from sales of prescription drugs by a pharmacy from CAT taxation.

Senator Findley and Representative Owens are also co-sponsoring

SB 56, which exempts reimbursements for recipients of medical assistance under Medicare, the Public Employee's Benefit Board, the Oregon Educator's Benefit Board, the Children's Health Insurance Program, or the U.S. Department of Defense under a TRICARE contract. These programs were responsible for over $20 billion in health care spending. Overall, more than two-thirds of commercial activity related to health care is currently exempt either because the recipient is an exempt entity or because the taxpayer’s commercial activity is below the taxability threshold of $1 million in commercial activity. The bill also creates an exemption for medications administered or dispensed in a clinical setting other than a hospital.

Oregon statutes currently defines several entities that are not subject to the CAT tax, including nonprofits (e.g., 501(c) corporations), and ORS 317A.100 lists 48 excluded commercial activities. The more exclusions, the more accountable recipients of the tax should be to justify its continuation.

--Donna Bleiler| Post Date: 2023-02-06 09:00:57 | Last Update: 2023-02-07 00:28:15 |

Changes the opt-out process to opt-in

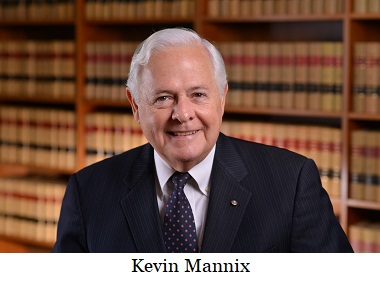

Oregon passed the nation’s first automatic voter registration law in 2015, and was in use for the 2016 elections. Representative Kevin Mannix (R-Salem) has introduced

HB 2233 ending automatic voter registration through Oregon Motor Voter. It changes the opt-out process to an opt-in procedure. The bill reestablishes the process of registration at any office of the Department of Transportation where licenses or renewal applications can be purchased or received that existed prior to the enactment of Oregon Motor Voter.

HB 2233 removes electronic reporting to the Secretary of State of every name, age, signature, residence and citizenship information for the process of transferring it to county election clerks. Instead, DMV offices will make voter registration cards available and deliver them to the county election clerk in a timely manner.

Driver's license applications and renewal forms will contain a section to register to vote while applying or renewing a license, but they will not be automatically registered without their signature. Signatures are limited to only be used for voter registration purposes.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

Janice Dysinger, Oregonians for Fair Elections, says HB2233 finally puts Oregonians in charge of their voter registration information. “Voters have been disenfranchised by allowing the government to change the information through the Automatic Motor Voter Laws. We have seen the skyrocketing of non-Affiliate voters after the Automatic Voter Registration Law passed, as voters had to respond to a postcard declaration of the political party 3 weeks after visiting a DMV or their party affiliation was recorded as NAV. Choosing a political party should have been taken care of by the voter at the time of registration.â€

HB 2233 requires procedures for voter registration applications to include a state identification card that allows an applicant to register to vote. The procedure must comply with the

National Voter Registration Act of 1993 (NVRA).

NVRA is the national motor voter law, which lays out voter registration requirement for federal offices. Section 5 of the NVRA requires that States offer voter registration opportunities at State motor vehicle agencies when transacting other business, including by mail, phone or internet.

Section 6 of the NVRA requires that States offer voter registration opportunities by mail-in application. It also requires first time voters in a federal election provide identification, which can be a current and valid photo identification, or a copy of a current utility bill, bank statement, government check, paycheck, or other government document that shows the name and address of the voter.

Section 8 of the NVRA requires states to implement procedures to maintain accurate and current voter registration lists. It prohibits removing registrants from the voter registration list solely because of a failure to vote, and restricts the timing on removals from the voter list based on a change of residence. However, if the registrant fails to respond to a notice and fails to vote in two federal general election, then the registrant can be removed from the voter registration list.

HB 2233 does not address Oregon’s lifetime retention issue, but the NVRA clearly indicates that eight years should be sufficient time for a person to affirm their civic duty. Watch for a hearing date this week.

--Donna Bleiler| Post Date: 2023-02-06 01:34:54 | Last Update: 2023-02-06 15:48:28 |

SALT deduction included in the 2017 federal Tax Cuts and Jobs Act

New updates about the Pass-Through Entity Elective (PTE-E) tax are available on the Oregon Department of Revenue website, including additional frequently asked questions, step-by-step examples of how to file PTE-E returns, and schedules that make filing easier and faster.

In July 2021, Oregon established a Pass-Through Entity Elective (PTE-E) Tax, a business alternative income tax in response to the $10,000 cap on the federal State and Local Tax (SALT) deduction included in the 2017 federal Tax Cuts and Jobs Act.

For tax years beginning on or after January 1, 2022, entities taxed as S corporations and partnerships may elect annually to be subject to the PTE-E tax at a rate of 9 percent tax on the first $250,000 of distributive proceeds and 9.9 percent tax on any amount exceeding $250,000.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

The department's latest web updates answer the most common questions from tax preparers, who are starting to file PTE-E returns as the tax filing season begins.

The department provides an Excel spreadsheet that can be used to speed up filing of the OR-21. The data on the spreadsheet will populate to the OR-21-MD and the OR-21-MD-PT forms used in PTE-E tax filing.

The updates were posted this week on the department's PTE-E web page. For PTE-E questions contact: BusinessAlternative.IncomeTax@dor.oregon.gov.

--Ritch Hanneman| Post Date: 2023-02-05 11:12:41 | Last Update: 2023-02-03 22:05:27 |

18 Members of the council to be appointed by the governor

Governor Tina Kotek is seeking a diverse membership to a statewide Housing Production Advisory Council.

The Governor is accepting applications for her newly created Housing Production Advisory Council that she established through an executive order on January 10, the Governor's first full day in office.

The order established an annual housing production goal of 36,000 additional housing units at all levels of affordability across the state to address Oregon's current housing shortage and keep pace with projected population growth. That's an ambitious target – about an 80 percent increase over current construction trends – and would set Oregon on a path to build 360,000 additional homes over the next decade.

The Housing Production Advisory Council will be responsible for proposing an action plan to meet the state's housing production goals. It will be composed of 25 members, including the Governor or her designee, bipartisan members of the Oregon House and Senate, relevant state agency directors, and a Tribal member. The largest share of members (18) will be appointed by the Governor with the goal of assembling a highly effective, diverse and representative council, ready to get to work for Oregonians.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

The Governor is looking to appoint housing developers with expertise in permanent supportive, affordable, and market rate housing, representatives of rural and coastal communities, communities of color, local government representatives, and experts in land use, fair housing, permitting, workforce development, and construction. Oregonians interested in applying for the Council are encouraged to submit an application, found here.

Applications are due February 15, 2023. Appointees will begin work on the Council in early March.

Moreover, the executive order dictates that two co-chairs be appointed, one living or working in an urban area and the other in a rural area. The Council is scheduled to provide a recommended framework for their action plan by April 1, 2023.

--Ritch Hanneman| Post Date: 2023-02-04 12:21:29 | Last Update: 2023-02-03 21:31:54 |

The future of carbon credits in question

Oregon land is about 25 percent National Forests at 16 million acres. Add to that about 7.3 million acres of private timber land. These carbon-sequestering forests purify the air, filter water, prevent soil erosion, and act as an important buffer. That is nearly 50 percent of Oregon with a mixed variety of forests, making the state a large carbon sink.

According to Pete Stewart, CEO of ResourceWise, his research led him to “

6 Predictions for 2023 Global Forest Industry,†he states, “we can likely expect the beginning of the end for carbon credits this year. Many critics often question the legitimacy of carbon credits altogether, wondering if companies merely use them as a veneer to conceal their ongoing pollution.†Forest2Market also predicts that 2023 will bring an end to carbon credits in general. “The world is coming around to the fact that carbon credits, of any kind, are just a license to pollute more.†In regards to forests, their research shows that “carbon is stored longer in the finished product, especially lumber and cross-laminated timber.â€

Despite the national trend, Senator Jeff Golden (D-Ashland) chaired the 2021-2022 Senate Interim Committee on Natural Resources and Wildfire Recovery that introduced

SB 88 to establish a state policy to increase net carbon sequestration and storage in natural and working lands. The bill requires certain agencies to monitor progress advancing state net carbon sequestration and storage policy and report their findings to the Oregon Global Warming Commission.

SB 88 directs Oregon Global Warming Commission with related agencies to develop natural and working lands net carbon sequestration and storage inventory using cap and trade methods for assessing greenhouse gas fluxes. Everything you do is now being measured to reduce carbon emissions and if reduction isn’t possible, then in increasing carbon storage.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

Companies will proudly announce their corporate aim toward reaching net zero for the benefit of clients, known as ‘greenwashing.’ Rather than reducing a company’s actual emissions, they buy credits from conserved forest land. However, Stewart’s study indicates companies have little intentions of actively reducing their carbon footprint. Instead, the push seems to be toward hitting those ‘net zero’ carbon emissions by purchasing offsets and passing the cost to consumers.

An investigation by The Guardian showed that up to 90% of the credits offered by one of the leaders in setting carbon standards were simply ‘phantom credits.’ There is no tangible substance and were not helping to offset carbon pollution beyond the numbers on a spreadsheet. That leaves the question of the purpose of carbon credits.

There needs to be a more accurate measurement for pollutants, better identification on how carbon is stored in wood beyond the forests, and improve measurements and reporting mechanisms, according to Stewart. A step in that direction may be in

SB 724, introduced by Senator Fred Girod (R-Stayton). SB 724 adds to the calculation of greenhouse gas levels to include atmospheric carbon sequestered by lands and waters in determining progress towards greenhouse gas emissions reduction goals.

No matter how you look at it, Oregon's sink is draining more than carbon.

--Donna Bleiler| Post Date: 2023-02-03 12:07:32 | Last Update: 2023-02-03 16:17:18 |

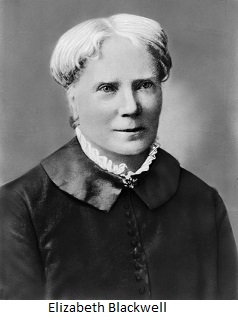

Elizabeth Blackwell celebrated as first female doctor

Today, Feb. 3, is National Women Physicians Day, and is also the birthday of Elizabeth Blackwell, born February 3, 1821. She became the first female medical doctor in the United States. The day honors the courage and accomplishments of female doctors who paved the way for so many, and who continue to set an example for younger generations. In 2017, for the first time in history, women made up more than half of all medical school students in the U.S.

Blackwell played an important role as a social awareness and moral reformer promoting education for women in medicine. She went from schoolteacher studying the anatomy to seeing the prejudice her sex endured receiving medical care, which inspired her to apply to medical school. She was only accepted by one, Geneva Medical College, where the male students voted to accept Blackwell. So, in 1847, she began her career in medicine.

Blackwell is known for her lectures to female audience on the importance of educating girls, and organized nurses during the American Civil War. Her name is still recognized on the Elizabeth Blackwell Medal, awarded annually to a woman who has made a significant contribution in medicine.

When you see a female physician, please remind her she's appreciated!

--Ritch Hanneman| Post Date: 2023-02-03 11:45:44 | Last Update: 2023-02-03 17:23:02 |

Sponsored by all 30 Senators

Oregon Representative Anna Scharf (R-Amity) joined Senate Republican Leader Tim Knopp (R-Bend) and Representative Vikki Breese Iverson (R-Prineville) as chief sponsors of

Senate Bill 853 to ban taxpayer dollars from funding out-of-state travel reimbursements for state workers. This legislation has been sponsored by all 30 Senators and has bi-partisan support in the House. The idea even received a nod from State Treasurer Read.

This policy states that “employees who work under the full-time remote work model must be reimbursed by the agency for travel to and from the central workplace.†The policy allows state workers to work remotely from states with no income tax and have their travel to Oregon reimbursed using taxpayer dollars.

While businesses have ordered their workers back, thousands of state employees still work from home, and hundreds live and work out-of-state. When workers need to be at meetings or in the office for other reasons, Oregon taxpayers cover the cost for their commute.

By September 2021, roughly 7% of people who make their living in Oregon make their home in some other state. Most of them are crossing the Columbia or Snake Rivers, but there is a growing number of teleworking employees as far away as New York, Florida and Texas since the COVID-19 pandemic. According to KGW8, Oregon has 7,691 state employees teleworking, and 500 more work remotely out-of-state and 300 of them live in distant states. They report that Oregon Department of Human Services has spent $4,000 in the first 9 months of 2022 to bring their 157 workers in from another state.

In 2020, Oregon had the fourth largest net out - adjustment for residency of any state in the U.S. Bureau of Economic Analysis’s calculation of per capita personal income (PCPI). It isn’t much of an expense as it is the policy of the state to be administered by people that choose not to live here.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

“It is wrong that my legislative staffers drive to the Capitol nearly every day from neighboring communities and cannot be reimbursed for their travel or expensive daily parking – while simultaneously, state workers living out-of-state, get paid for traveling back to Oregon for meetings or other tasks they can’t do remotely,†said Representative Scharf. “One of the House Republican Caucus’ top priorities this session is fiscal responsibility. I believe this starts by taking a close look at where our taxpayers hard-earned dollars are going.â€

This is in line with Congress’ House Oversight Committee chairman James Comer’s bill to require all federal agencies to reinstitute their telework policies as they existed on December 31, 2019, with expanded remote work only for authorized projects. It was suggested that since few people are aware that federal workers aren’t at their job, they could be dismissed and nobody would notice.

--Donna Bleiler| Post Date: 2023-02-02 20:33:57 | Last Update: 2023-02-01 21:40:52 |

Oregon Secretary of State Shemia Fagan has appointed Molly Woon to the role of Elections Director. Molly Woon has served as Interim Elections Director since December 2022.

Ms. Woon has over 15 years' experience in public service, working in the State Legislature, in city and county government, and in the Oregon Secretary of State’s Office for Secretary Fagan and former Secretary Jeanne Atkins.

In her previous role at the agency, she served as the primary liaison between the Secretary and the Oregon Association of County Clerks. Among other elections-related initiatives, Ms. Woon led the work to disburse $2 million in election modernization funds, she led several innovative projects to improve election administration, and she was responsible for day-to-day coordination between the Elections Division and the Secretary of State’s Executive Team during the November 2022 election. Ms. Woon has a B.A. in Political Science from Portland State University, where she later pursued a graduate degree in political philosophy and American Politics.

“Molly Woon is the perfect fit to lead the Elections Division,†said Secretary Fagan. “She has years of experience in public service and has served in two administrations at the Secretary of State’s Office. Her vision and leadership will allow Oregon to continue setting the gold-standard for free, fair, accessible and secure elections.â€

A D V E R T I S E M E N T

A D V E R T I S E M E N T

As Interim Director, Ms. Woon has overseen the rollout of new public education projects including campaign finance trainings for municipal candidates running in 2023 and the Oregon Republican Party. She has helped the Secretary and the Oregon Association of County Clerks develop parts of the Protect Our Democracy Agenda, which aims to improve elections administration in Oregon through targeted investments in investigations, public records, voting systems and public education.

“Molly’s energy and enthusiasm have been a great benefit to Oregon’s elections officials for the last two years,†said Derrin "Dag" Robinson, County Clerk, Harney County. “I am excited to see her take on this new role.â€

“Molly brings with her years of experience and professionalism,†said Tassi O’Neil, County Clerk, Tillamook County. “She is an excellent choice for this position, and I look forward to working with her in this new role.â€

--Staff Reports| Post Date: 2023-02-02 12:05:37 | Last Update: 2023-02-03 02:27:20 |

Lane County DA sends letter dismissing cases.

Lane County takes over where Governor Kate Brown left off. During Governor Brown's last few months in office, she granted clemency to 17 persons on Oregon's death row. She issued an order that created a path for nearly 7,000 Oregonians to seek reinstatement of their suspended driver's licenses and removes the associated fines and fees worth approximately $1.8 million. That was after she commuted 1,204 sentences who demonstrated growth in rehabilitation, and removed 47,144 convictions of possession of marijuana forgiving $14million in fines and fees.

Earlier in 2022 Brown released 953 convicted felons including 70 that committed crimes as juveniles including murder. She justified these orders as being in response to legislation such as SB 2013 (2019) that narrows the definition of aggravated murder. Has the Oregon legislature gone too far?

Now counties are feeling empowered to ignore the constitutional obligation under Article I, Section 43 (5) directing the District Attorney to provide remedy by due course of law for violation of a right. Lane County District Attorney, Patricia W. Perlow, is responding to claims saying victims have no rights.

Perlow writes, “This letter is to inform you that your case has been dismissed due to the lack of resources at the District Attorney's Office.†She sites recruitment and retention issues and backlog of cases from Covid-19. Perlow goes on to say, “As a consequence, and effective immediately, the District Attorney's Office will be dismissing and not filing criminal charges in the foreseeable future on the following offenses:

- All misdemeanor and non-prison eligible Class C property-crimes (e.g. theft 1, 2, and 3, identity theft, unauthorized use of a vehicle, burglary 2, etc);

- Driving while suspended'

- Failure to register as a sex offender;

- Disorderly conduct 1 & 2;

- All possession of a controlled substance charges;

- Delivery of controlled substances charges that are non-prison eligible;

- Criminal trespass 2; and

- Criminal mischief 2 & 3.â€

A D V E R T I S E M E N T

A D V E R T I S E M E N T

Criminal investigators are sworn police officers that give investigative and trial assistance to Oregon State prosecutors and district attorneys. District attorneys have an obligation to determine whether the case has any merit in review of relevant statutory and case law. Offenses against property are defined in Oregon Revised Statutes Chapter 164 and penalties in Chapter 161. Courts and district attorneys don't have the authority to ignore victim rights. Refusing the case does not nullify the act, but it will attract predators to their county.

Some of the bills introduced into this 2023 legislative session may aggregate the issues Lane County is experiencing. Perlow doesn't say they have a funding issue, only staffing issues. One bill that has support of the Oregon State Bar is

SB 306, which will modify statutes to allow for non-attorney associate members of the Oregon State Bar to practice law in certain scope of practice. However, the Oregon Trial Lawyers Association went on record opposing the adding of a class of legal practitioners who have not gone to law school or passed the bar. “It is modeled after a program in Washington state that was a failure and discontinued due to lack of interest.†They continue, “If the legislature decides to proceed with this program, we should make sure that Oregonians who might benefit from this type of legal service have rigorous consumer Protection…. This new type of practitioner can make a mistake as consequential as a mistake made by a lawyer... That means that harm caused by their negligence would be borne by their client. From a consumer protection perspective this makes absolutely no sense.†The bill is scheduled for a Work Session February 2.

After the Lane County DA issued her statement of no workers to develop cases, Lane County Circuit Judge Jay McAlpin submitted testimony on

SB 235 to increase the number of circuit court judges by seven, one for Lane County.

Senator James Manning Jr. (D-Eugene) introduced

SB 689, which directs the Oregon Criminal Justice Commission to create a pilot grant program funding three coalitions for the creation of nonpolice responses to minor instances of crime. The program is geared towards responding to 9-1-1 or nonemergency police calls. The bill removes the pursuit of justice from the police force putting it in the hands of nonprofit organizations and county governments. It provides authority to address the commission of crimes of theft, trespass, littering, prostitution, possession of controlled substance or illegal drugs, interfering with public transportation, and an attempt to commit a crime providing services in a proactive manner. All the bills passed in the past several legislative sessions have been to reform police aggressiveness and would not apply to this second level of enforcement.

Some other bills introduced that may help or hinder counties in work load issues:

- HB 2400 authorizes the court to issue order requiring person to appear upon failure to appear on Class E violation citation, and to issue arrest warrant upon further failure to appear.

- HB 2525 creates a crime of retail theft in the second degree as a Class B misdemeanor if value is less than $500, Class A misdemeanor if value if between $500 and $1,000, Class C felony if more than $1,000. Retailers may bring the case in any county the merchandise is sold.

- SB 311 increases statute of limitations for action for false claims from three years to five years. Work session scheduled for January 31.

- SB 618 establishes procedure for charging aggravated version of offense when defendant commits felony while wearing body armor. Public hearing scheduled January 31.

- SB 664 creates a crime of threatening to commit a terroristic act as a Class C felony.

- HB 2131 establishes process by which person may file notice of intent to pursue post-conviction relief in order to commence proceeding and, if eligible, obtain appointed attorney.

- HB 2133 requires district attorney offices to develop victims' rights form and to provide form to all victims upon initiation of prosecution.

- HB2134 directs Department of Public Safety Standards and Training to establish training program for deputy district attorneys.

- SB 697 modifies process for setting aside convictions and guilty except for insanity judgments. Eliminates requirement that person submit fingerprint card with application. Eliminates ability of district attorney to object to motion. Provides that dismissal of traffic violation citation may not be set aside. Authorizes court to waive remaining fines and fees upon entry of order.

--Donna Bleiler| Post Date: 2023-02-01 02:56:50 | Last Update: 2023-02-02 07:55:35 |

Budget is Mission Focused

Governor Tina Kotek released her

proposed budget for the 2023-2025 biennium. She calls it a “Mission Focused†budget to build more housing, reduce homelessness, increase access to mental health and addiction services, and improve education outcomes. She says it “provides a roadmap for how we are going to reach our state’s long-term goals.â€

In response, Senate Republican Leader Tim Knopp (R-Bend) stated, “According to the most recent revenue forecast, Oregon families will receive an average of $5,200 back on their taxes in the form of a surplus credit known as the “Kicker.†I’m relieved to see that the Governor’s proposed budget doesn’t pull money from the Kicker – it’s the right thing to do.â€

However, Senators Lew Frederick (D-Portland) and Kayse Jama (D-Portland) seem to be on a quest of their own. On the radar for Oregon taxpayers is

SB 774, which would allow the State to keep the tax "kicker" of overpaid taxes beyond what the State budgeted to collect, if

SJR 26 is passed by voters to amend the Constitution.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

“The Republican Majority worked to enshrine the Kicker in Oregon’s Constitution in the 1990’s and we are still committed to protecting it today,†added Senator Kim Thatcher (R-Keizer).

The House Republican Caucus said they are optimistic the Governor’s budget does not call for tax increases, but remain concerned that Governor Kotek and her agencies will raise fees on hardworking Oregonians. While the Governor’s budget does not take the Kicker, they are committed to returning these hard earned dollars back to Oregon taxpayers.

Governor Kotek’s two-year budget proposal is a $32.1 billion request, which represents a 8.76% increase over the 2021-2023 legislatively approved budget.

Oregonians are experiencing an inflation rate over eight percent and economists are predicting a mild recession over the next year. The Governor’s budget reflects the financial vulnerability individuals are feeling on a daily basis. House Republicans believe the state budget should look more after Oregon families than our state bureaucracy, and are disappointed there was no initial mention of other crises impacting our state such as transportation backlogs, a severe drought impacting our agriculture industry, public safety in our communities, or Oregon’s severe public defender crisis.

Senator Daniel Bonham (R-The Dalles) agrees, “Oregonians across the state feel the impacts of inflation and other rising costs. They deserve to spend their hard-earned money how they see fit – to plan for emergencies and spur the economy.â€

Even though both houses see value in the budget, the House Caucus wants to see reforms to the Oregon Department of Education. They also point towards the Governor’s proposed homelessness initiative as not reaching beyond the urban centers of our state. “If Governor Kotek is going to stay “Mission Focused†on being a Governor for all of Oregon, this must start now.â€

To overcome the predicted shortfall, Governor Kotek has recommended keeping the existing $2 billion of reserve funds in place, and redirect $765 million that would have been automatically added to these reserves into targeted investments aimed at better serving Oregonians in her focused areas.

The Governor's budget reflects the work of the Racial Justice Council on the development of state agency budgets as a strong, ongoing partnership in her administration. Thus, her Mission Focus, and so begins the battle for our pocketbooks.

--Donna Bleiler| Post Date: 2023-01-31 16:52:56 | Last Update: 2023-02-01 00:54:24 |

Few guarantees with life-time repayment

Representative Paul Evans (D-Independence) introduced

HB 2780, which creates the Guaranteed Opportunity Program to provide college funding by 2043. Under this bill, the State of Oregon would have 20

years to implement an in-state post-secondary education, training and workforce development loan program to qualified individuals. In exchange for the upfront payment of tuition and fees, textbooks, and housing costs by the State, a degree-seeking student would commit to repaying a set percentage of their post-education income to the program.

HB 2780 introduces a student and institutional funding system where high school graduates or resident taxpaying students attend higher education in a degree program and the state postpones the payment of costs of attendance, including tuition, housing, textbooks and fees, in exchange for payment of a set percentage of future salary. The percentage is based on the type of degree ranging from two to five percent of adjusted gross income with a payment period from three month after completing the degree to the later of age 65 or retirement.

Every two years the State Workforce and Talent Development Board will analyze the workforce and make adjustments to the percentages of future income that participants are required to pay. It places the cost of an education on the recipient and the amount of loan forgiveness at age 65 is based on the income level of the recipient. The bill allows the commission to engage a collection agency if failure to make payments occurs.

A Guaranteed Opportunity Program Implementation Fund is administered by the commission and funded by the legislature, the sale of bonds, and the repayment by participants. The cost to the state would be administration of the program and any unrepaid amounts at the participants retirement or age 65, whichever is later. The percentage of repayment is based on the level of degree obtain, not the amount of income, so repayment amounts will vary.

The Commission pointed out in testimony that the program is similar to a small pilot program proposed by the Office of Student Access and Completion 10 years ago. The complexity of this legislation requires that analysis be revisited to be able to provide information about potential program structures and costs. In addition to structures or costs, there is the question of repayment of individuals out-of-state or out-of-country, as required by the bill.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

Representative Evans states, “While 17 states have alternative student loan programs, the Guaranteed Opportunity Program is the first to have a fixed repayment agreement and term, which is desperately needed to balance the responsibility of repayment against the needs of the economy, the State and society at large. We can provide a way forward that works for everyone by implementing the Guaranteed Opportunity

Program.â€

However, the Commission suggests the bill is putting the cart before the horse. HECC recommends that, prior to convening a large public task force, or setting lifetime repayment rates and time periods in statute, that an actuarial analysis be conducted to determine potential program costs and returns based on a number of variables, including the repayment rates, enrollment projections, projected higher education costs, and wages. In particular, there may be a self-selection effect under the current payment details, where projected higher income earners do not enroll in the program, making the program more costly on a per capita basis. The bill calls for a task force to perform these functions without an actuarial analysis.

The program may not eliminate the life-time of education debt, but Evans claims the Guaranteed Opportunity Program ensures access to higher education for Oregon’s students. “We must support our economic and workforce needs while making it possible for them to buy homes and raise families." He contends it will create opportunities for non-traditional Oregonian students to access fair financing, balanced and simple repayment, and economic opportunities that are often attached to post-secondary education, training, and workforce development. This would make it possible for parents and mid-career professionals to go back to school for first time or additional academic programs.

--Donna Bleiler| Post Date: 2023-01-27 11:44:30 | Last Update: 2023-01-27 17:46:24 |

Read More Articles