Put a tax on assistance. Yeah, that will work.

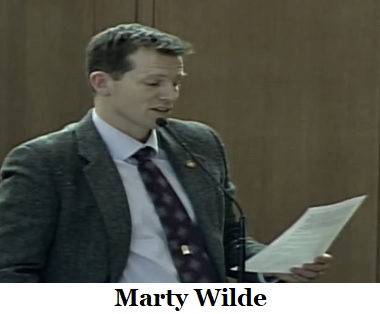

Representative Marty Wilde (D-Eugene) introduced

HB 2253 that would “surcharge†those that received forgiven loans received as a corporate excise or personal income taxpayer through Paycheck Protection Program of Coronavirus Aid, Relief, and Economic Security (CARES) Act. His proposal would apply to tax years beginning on or after January 1, 2020, and before January 1, 2021.

The Governor continues to keep Oregon closed, so businesses have resorted to alternative means to keep their businesses above the red line with the help of forgiveness loans. It has kept millions employed while unemployment has skyrocketed and many businesses have gone beyond that to keep employees in jobs. Do they get thanked? NO! They get reprimanded for making the slightest effort for survival. Those businesses not hit the hardest are expected to spread their wealth, which will ultimately put more businesses into bankrupt status.

One businessman told Northwest Observer that he was able to keep his staff and not reduce any hours even though clients cancelled. He said, “My landlord was able to collect full rent from me at the office, my utilities were able to be paid, and I was able to take what little revenue my business generated during the toughest months of the pandemic and keep my rent paid at home and my wife and baby fed and clothed.†He calculated his addition tax -- or surcharge, as it is called -- would be around $1000.

That may not sound like a lot, but another business owner said they have been in the red $4-5,000 monthly since last May, and none of the surcharge will help his business as the Governor has put her focus for relief on minority business and restaurants.

If the bill passes, any business that increased receipts by five percent over 2019 will be charged a 10% tax on moneys received under the CARES Act. How will that restore Oregon’s economy? Maybe we're

not all in this together.

--Donna Bleiler| Post Date: 2021-01-14 20:42:14 | Last Update: 2021-01-14 20:53:53 |