Is measure 118 setting Oregon up for failure?

Oregon measure 118 is far from being transparent and simple as they claim. The eye catcher is the $1,600 yearly income, which would be $6,400 for a family of four. There are very few restrictions on who would receive this windfall and will go to prisoner, drug addicts, undocumented residents, cartel traffickers, and anyone else living in Oregon. Under Measure 118, the current minimum corporation tax is replaced with a 3 percent gross receipts tax. It is being sold as a classic tax on big business, but it functions like an aggressive sales tax on consumers.

So where does all this money come from? They say big corporations need to spread their wealth back to residents of Oregon. And where do big corporations get their profits – from us, you and me. That family of four will pay approximately 12 percent more for purchases like groceries, clothes, entertainment devices, utilities, and general goods. They will also pay income tax on the added funds if they make over $40,000. Redistribution of wealth is the backbone of a socialist government, which has a history of failing. Is that where Oregon is headed?

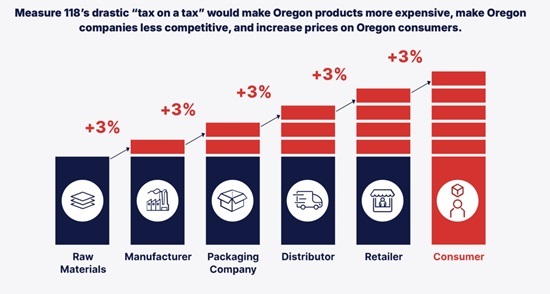

The Tax Foundation says this scheme is a hidden sales tax, which voters have rejected 10 times. They calculate that a modest corporation of $50 million in Oregon sales would generally owe taxes of $294,000 on average profit margins of 6.6 to 7.6 percent. Under measure 118, paying 3 percent on gross receipt, they would pay $1.5 million, which is 37.5 percent on profits. You might say they can afford it, but that isn’t the whole picture. Unfortunately, this sales tax isn’t just imposed at the retail level. It’s also imposed on the same product at the wholesale level, and at each stage of the manufacturing process. The tax is embedded at every level of production. That creates what is called tax pyramiding, where the final price to consumers has embedded added tax costs so that each level of production is taxed on the higher added taxed price, effectively the consumer is taxed multiple times on the same item amounting to an approximate 10.9 percent sales tax.

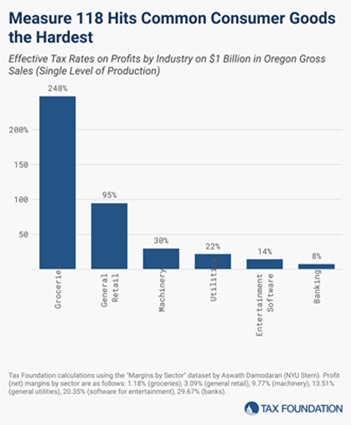

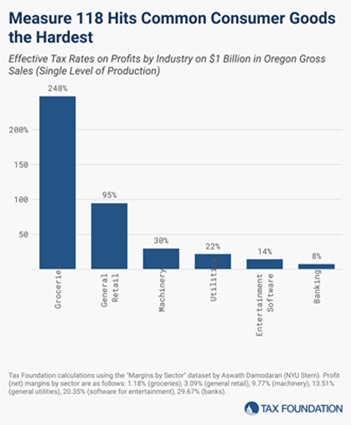

The proposed tax is also regressive, since the highest effective rates are on consumer goods (where profit margins are often slim) and the lowest effective rates are in areas like information services, where profit margins are often larger. Typically, there are far more stages of production for retail goods than for services. Groceries, which have notoriously low margins, would be hit particularly hard. The Tax Foundation charted effective rates at a single stage of production for several different industry sectors, not even taking into account how many times the tax would pyramid for the goods and services provided by these industries.

If Oregon were to see the same levels of pyramiding as Washington State has documented, consumers could expect to see about a 12 percent price increase. It may not show up on the receipt, but a 12 percent sales tax would impact Oregon’s livability negatively. According to “

Rich States, Poor States” (2024 edition), Oregon is currently ranked 42nd out of 50 states in terms of its economic outlook. This forward-looking forecast is based on the state’s standing in 15 important policy variables. A

WalletHub report (August 2024) ranked Oregon among the top 10 worst states to live in, citing factors such as high cost of living, housing affordability, restaurants per capita, and job opportunities, which would all be hit harder by measure 118.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

The pyramiding of taxes creates incentives for businesses to do as much of their production as possible outside Oregon borders, which is bad for Oregon’s economy. In 2023, Portland was fifth highest for large cities and Grants Pass was ranked 13th highest in the nation for unemployment. Increasing unemployment would put pressure on the legislature to increase the 3 percent tax, which could be done by a simple majority once the funding source (tax) is passed as law.

Will outside influencers be successful in deceiving Oregon voters that are so aversive to a sales tax?

--Donna Bleiler| Post Date: 2024-09-24 12:19:42 | Last Update: 2024-09-23 23:40:31 |