| Benton County Republicans’ Private Fundraising Event, “Bent-on Boots and Bling” with Trey Taylor |

| Friday, September 5, 2025 at 5:00 pm |

| Featuring Trey Taylor Music Private Event Friday, September 5, 2025 5:00-5:30 pm VIP Reception 5:30-8:00 pm Heavy Appetizers, Auction, Concert Red: $750 VIP Reception Front Row Table Sponsor White: $500 Table Sponsor Blue: $50 per person Limited Seating. Get Yours Now!!! Support Local Dress up: Bling, Cowboy, Patriotic Benton County Republican FUNDRAISER www.BentonGOP.org Get your tickets today at: https://www.bentongop.org/event-details/benton-county-republicans-fundraiser/form About Trey: Trey is the youngest African American Man in Country Music History. The Denver Post wrote "It's impossible to miss his enthusiasm. With a fondness for cowboy boots, gaudy colors and dazzling jewelry, Trey Taylor could stand toe to toe with any of the Pop, Country or even Rap contemporaries of his generation.“ |

| Trysting Tree Golf Club, 34028 NE Electric Rd., Corvallis |

A D V E R T I S E M E N T

A D V E R T I S E M E N T

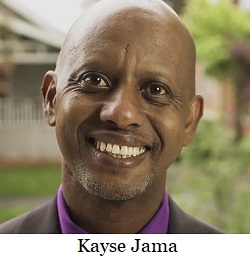

Two different bills have been introduced to grab your Kicker Income Tax Refund. Senator Lew Frederick (D-Portland) and Senator Kayse Jama (D_Portland) sponsored an amendment to the Oregon Constitution to eliminate the kicker in SJR 26 and the companion bill SB 774. They removes all references to the individual income tax kicker and leaves the corporate kicker as funding schools. These bills remove all constraints to passing new projects and programs in high revenue years that can’t be sustained in down years. That is why there is a budget shortage going into the next biennium, because federal help throughout the pandemic ended up creating new programs that now need taxpayer funding.

Two different bills have been introduced to grab your Kicker Income Tax Refund. Senator Lew Frederick (D-Portland) and Senator Kayse Jama (D_Portland) sponsored an amendment to the Oregon Constitution to eliminate the kicker in SJR 26 and the companion bill SB 774. They removes all references to the individual income tax kicker and leaves the corporate kicker as funding schools. These bills remove all constraints to passing new projects and programs in high revenue years that can’t be sustained in down years. That is why there is a budget shortage going into the next biennium, because federal help throughout the pandemic ended up creating new programs that now need taxpayer funding.

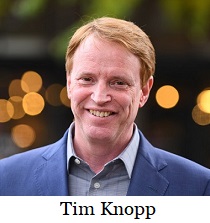

“While Oregonians still face high costs of food, fuel, child care, and rent – all of which are necessary to live, work, and raise a family – the state continues to bring in record revenue. Thanks to the Personal Kicker, Oregon taxpayers will get some of their taxes back and with it, a well-deserved break from the persisting burden of inflation and high costs.â€

“While Oregonians still face high costs of food, fuel, child care, and rent – all of which are necessary to live, work, and raise a family – the state continues to bring in record revenue. Thanks to the Personal Kicker, Oregon taxpayers will get some of their taxes back and with it, a well-deserved break from the persisting burden of inflation and high costs.â€

| Post Date: 2023-02-23 10:54:25 | Last Update: 2023-02-23 15:11:18 |