How will the Oregon legislature deal with a recession?

The average family lost $4,000 to $5,000 in real take home pay in 2022 according to the US Census, Department of Numbers. Oregon did somewhat better, losing an average of $973. That nearly $1000 taken from a medium family’s annual income doesn’t account for the inflation rate above 9% this past summer. For the year the CPI finished above 7%, which translated into the biggest annual rise in prices in four decades.

Oregon lagged behind the national average income until 2018 when family income took a whopping $2,000 jump and the national average only increased by $140. Oregon has kept that spread ever since.

Oregon Office of Economic Analysis reported at that time, the gain was a result of years in the making that turned southern Oregon around from depending on forestry to strong income gains. The growth in Bend also contributed to the 2018 gains. The rest of the state stayed on course with a slight decline in the Salem area.

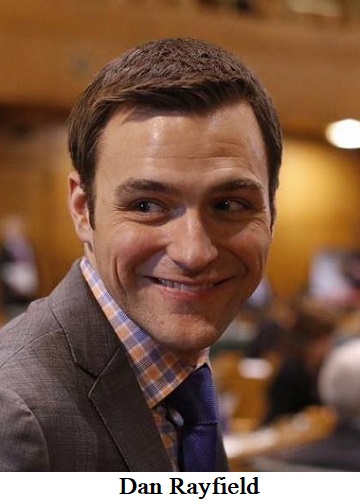

According to some observers, Oregon Democrats have focused on the fiscal health of state government at the expense of the economic health of the state. In September, Oregon House Speaker Dan Rayfield (D-Corvallis) conflated state government with the state, saying “The Oregon economy continues to be fundamentally strong. Hiring has increased, our unemployment rate is near its lowest level on record, and we hold record reserves following years of sound fiscal management by Democratic leadership. After a session in which we made critical one-time investments in all corners of the state, we’ll keep prioritizing the issues Oregonians care most about like housing, behavioral health support, abortion access and more.â€

Some experts are surprised that Portland holds on after rioters destroyed the city. Since the current administration -- state and national -- has taken office, policies for defunding police, crippling energy standards and the diversity agenda has been instigated and Portland’s real median household income has dropped $1,040 and Eugene declined by $586. Corvallis has been on a steady decline since 2019. Salem’s real median household income took the biggest hit during shutdowns declining $3,949.

Josh Lehner, Oregon Economist,

reports, “there is a difference between a strong and tight labor market and an overheating labor market. Given wage growth is clearly outstripping productivity gains, it is inflationary today. A slowing in wage growth (and an increase in business investment and productivity) is needed for underlying inflation to return to the Fed’s target as wage growth provides households their baseline ability to spend.†Oregon has typically experienced wage growth due to poaching, freeing lesser paying jobs for the unemployed. As the labor market slows down, so will wage growth that will slow inflation but likely to contribute to the feel of the coming recession.

Lehner says,

Oregon’s new data shows that the income gaps across different races and ethnicities appears to be narrowing. “Median incomes, of those for the typical Black, Indigenous, and Hispanic household still lag behind their white, and Asian peers, but the gap has narrowed in recent years. What used to be gaps of 20-40% now appear to be more like 10-20%.â€

A D V E R T I S E M E N T

A D V E R T I S E M E N T

Even with the COVID pandemic finally over and businesses are operating as usual, instead of a year of prosperity and growth, we got the opposite. Oregon’s forecast is for further decline. State economist Mark McMullen predicts Oregon losing 24,000 jobs in a 2023 recession. He said the decline will show in housing and business investments due to high interest rates causing a dip in employment, but predicts a come back in 2024. If his assumption that employers won’t be quick to let workers go when sales slow, it will help slow the recession.

Then there was the stock market selloff that vaporized some $12 trillion of savings and wealth in 2022. A

Committee to Unleash Prosperity report found that the typical 401k retirement plan lost more than $30,000. Adjusting for inflation, the Nasdaq fell by 34%, the S&P by nearly 25% and the Dow Jones by 6%, having an impact on retirements.

Next week the 2023 Oregon legislature will go on record. How will they deal with the predicted $3 billion less than they had during the current two-year budget cycle. Many Oregonians were forced to cash out capital gains in 2021 and federal stimulus checks increased the amount of state income taxes. Oregon has cash reserves of almost $1.8 billion in addition to rainy day funds. One thing is certain, a recession isn’t a time for new taxes or new programs.

--Donna Bleiler| Post Date: 2023-01-01 06:50:48 | Last Update: 2023-01-01 11:09:09 |