Post an Event

Post an Event

| Benton County Republicans’ Private Fundraising Event, “Bent-on Boots and Bling” with Trey Taylor |

| Friday, September 5, 2025 at 5:00 pm |

| Featuring Trey Taylor

Music Private Event

Friday, September 5, 2025 5:00-5:30 pm VIP Reception

5:30-8:00 pm Heavy Appetizers,

Auction, Concert

Red: $750 VIP Reception

Front Row Table Sponsor

White: $500 Table Sponsor

Blue: $50 per person

Limited Seating. Get Yours Now!!!

Support Local

Dress up: Bling, Cowboy, Patriotic Benton County Republican

FUNDRAISER

www.BentonGOP.org

Get your tickets today at:

https://www.bentongop.org/event-details/benton-county-republicans-fundraiser/form

About Trey:

Trey is the youngest African American Man in Country Music History. The Denver Post wrote

"It's impossible to miss his enthusiasm. With a fondness for cowboy boots, gaudy colors and dazzling jewelry, Trey Taylor could stand toe to toe with any of the Pop, Country or even Rap

contemporaries of his generation.“ |

| Trysting Tree Golf Club, 34028 NE Electric Rd., Corvallis |

Hopeful to reduce unsheltered homeless

February 10, 2023, marked Oregon Governor Tina Kotek’s one month in office making good on her pledge to tackle the state’s housing and homelessness crisis, she signed three executive orders the first day. Governor Kotek appealed to the legislature to invest $130 million as soon as possible to reduce the number of unsheltered Oregonians by the end of the year.

February 2, Governor Kotek was handed $9.5 million in federal funding to address Portland’s housing and homelessness from the U.S. Housing and Urban Development (HUD), Northwest Regional Administrator Margaret Salazar. The Portland-Multnomah County Continuum of Care (COC) is receiving $8.3 million, and the State Balance of Care COC is receiving $1.1 million.

“Oregonians are demanding bold action to reduce homelessness and build more housing,†Governor Kotek said. “I’m urging the legislature to act now on this urgent homelessness package. But we can’t stop there. As I laid out in my recommended budget, we need to make ongoing investments to take on this crisis at the scale needed to solve it, and I will work with legislators from both parties and leaders from all over the state to get the job done.â€

Bills working their way through the legislature that could impact housing and homelessness include:

- SB 434 has a public hearing February 15 to create eviction mediation program.

- SB 131 has a work session on February 15 to extend the tax credit for affordable housing lenders.

- SB 147 has a work session on February 15 to extend tax exemptions granted by cities for certain rehabilitated or newly constructed single unit housing.

- HB 2001 has a public hearing on February 13 for Housing and Community Services Department to study housing.

- HB 2889 has a public hearing on February 16 to establish Oregon Housing Needs Analysis within Housing and Community Services Department.

- Ways and Means has not yet scheduled the budget hearing for Housing and Community Services Department.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

The three executive orders Governor Kotek signed on her first day set an ambitious state target to increase home construction; declaring a homelessness state of emergency; and directing state agencies to prioritize reducing homelessness in all areas of the state.

Executive Order No. 23-02 declares a state of emergency due to homelessness in regions of the state that have experienced an increase in unsheltered homelessness of 50% or more from 2017 to 2022.

Executive Order No. 23-03 directs state agencies to prioritize reducing both sheltered and unsheltered homelessness in all areas of the state—not solely those in which a state of emergency has been declared—using their existing statutory authorities.

Executive Order No. 23-04 establishes a statewide housing production goal of 36,000 per year and creates the Housing Production Advisory Council to develop comprehensive budget and policy recommendations to meet that goal.

Governor Kotek has since announced she is accepting applications for the statewide Housing Production Advisory Council, which will be composed of 25 members, including the Governor or her designee, bipartisan members of the Oregon House and Senate, relevant state agency directors, and a Tribal member. The largest share of members (18) will be appointed by the Governor. Oregonians interested in applying for the Council are encouraged to submit an application, found here.

Applications are due February 15, 2023. The Council will begin work in early March.

--Donna Bleiler| Post Date: 2023-02-12 08:15:13 | Last Update: 2023-02-11 19:20:21 |

$4.4 million goes to ten nurseries for seedlings

Ten tree nurseries across the state are receiving over $4.4 million this year to help them increase their ability to produce badly needed seedlings. The seedlings are needed to help reforest millions of acres deforested in recent years by wildfire, disease and pests.

The money was allocated in

House Bill 5006 to ODF after passage by the Oregon Legislature in 2021. The bill was a response to the devastating 2020 wildfires which burned a million acres of forest. In the wake of those fires, there were many barriers to reforesting, including shortages of money, labor, and for some smaller landowners appropriate tree seedlings.

ODF Small Forestland Owner Assistance Unit Manager Nate Agalzoff said, "These grants are helping nurseries make strategic investments to increase their ability to grow more seedlings, which will enable them to better support reforestation needs in the future."

Nurseries are using the funds to invest in everything from adding irrigation to building new greenhouses and seedbed space as well as storage facilities for storing seedling trees. Funds can also go toward equipment, the cost of collecting or purchasing tree seeds, or buying land on which to expand nursery facilities.

"These grants are increasing overall capacity across the state for whenever seedling demand rises," said ODF Reforestation Program Project Coordinator Astrea Strawn. "In the case of nurseries in Union and Hood River counties, the grants also ensure there will be capacity to provide geographically appropriate seedlings for those areas."

Strawn said funds must be spent before the end of this summer. "This makes us optimistic that landowners, especially smaller ones, will have better access to seedlings. When they do, they can promptly reforest after future tree losses to keep Oregon's working forests working for Oregonians."

A D V E R T I S E M E N T

A D V E R T I S E M E N T

"The funding will allow Lava Nursery, Inc. to increase seedling production for the small woodland owners, helping them to meet their reforestation needs after forest fires and/or harvest operations," said Lava's Assistant Nursery Manager Jeff Snyder. "These funds will also allow for additional freezer storage capability for long-term storage of seedlings to ensure the best quality seedlings are available at the time of planting."

To qualify for a grant, a nursery had to have experience growing high-quality commercial conifer trees for reforestation in Oregon, including Douglas-fir, grand fir, noble fir, western redcedar, ponderosa pine and others. Strawn says, "The awards were targeted to nurseries which showed interest in helping with future reforestation needs, whether from wildfires or climate change losses."

Nurseries which received funds include:

Brooks Tree Farm – Salem in Marion County $540,000

Drakes Crossing Nursery – Silverton in Marion County $540,000

PRT Growing Services – Cottage Grove and Hubbard $540,000

Trillium Gardens – Eugene in Lane County $531,000

Weyerhaeuser – Aurora and Turner in the Willamette Valley $500,000

Champoeg Nursery – Aurora in Marion County $458,000

Lava Nursery, Inc. – Parkdale in Hood County $458,000

Scholls Valley Native Nursery – Forest Grove in Washington County $367,000

The Plantworks, LLC – Cove in Union County $276,000

Kintigh Nursery – Springfield in Lane County $238,000

--Ryan Bannister

| Post Date: 2023-02-11 03:49:57 | Last Update: 2023-02-10 23:53:44 |

Two bills should concern Oregon voters

The Oregon House Committee on Rules has schedule two election bills on Valentines Day. Perhaps they thought you’d be too busy to notice. Secretary of State Shemia Fagan has requested two bills that should concern Oregon voters. However one has been removed.

HJR 4 proposes to amend the Oregon Constitution to provide for same-day voter registration, and has been removed from the hearing schedule. The amendment removes the requirement to be registered 20 days prior to an election and adds, “Registers to vote not later than 8 p.m. on the date of the election in the manner provided by law.â€

The Secretary of State website lists requirements to register to vote, which assumes someone at least glances at the documents for compliance. If a person is allowed to register at the same time as voting, there is no verification process prior to voting, and once a ballot is cast, it’s in stone and never retrieved if the registrant turns out to not qualify. To qualify, a person must have documentation that proves:

- U.S. citizenship

- Oregon resident for 6 months

- At least 16 years old, but can’t vote until 18

- Oregon driver’s license, permit or ID card or signed verification.

Constitutional amendments are referred to voters for their approval or rejection at the next regular general election. Voters are disenfranchised with government’s quest to increase the number of voters that seemingly are not informed. Voters want secure elections that guards against fraudulent votes. It is government’s job to protect our voting system, not push it off on the voters.

HB 2107 expands the automatic registration of the motor voter system in two ways. First, it extends automatic voter registration to the Oregon Health Authority when people receive care under the Oregon Health Plan. It states: “The Oregon Health Authority shall provide to the secretary electronic records, derived from information provided to the Oregon Health Plan, containing the legal name, age, residence and citizenship information for, and, if any, the electronic signature of, each person who the authority deems may be eligible to be a qualified elector.†There is some question whether this violates HIPPA laws. To approach a patient on the election process when most vulnerable and may not be thinking clearly may add to the duress of why they are seeing a doctor.

The bill further states, “the authority may not provide to the secretary any electronic records demonstrating that a person is not a citizen of the United States,†which is one of the criteria for being an eligible voter. Then the secretary is to obtain an electronic signature from the Department of Transportation if not provided by the authority. If Transportation has the signature, that should mean they have already been registered under motor voter. Is there no check for duplication?

The secretary sends the information to the county clerk and the clerk notifies each person of the process to decline registration or adopt a political party affiliation. If no response, the person is registered to vote as a qualified non-affiliated elector.

The second part of HB 2107 establishes a pilot program at Powder River Correctional Facility to require that each adult in custody be granted an updated state identification card and voter registration upon release. The facility is located in Baker City, with mixed custody housing up to 286 inmates of low- to high-risk inmates that may be serving life sentences without parole.

The Adult Custody Programs aimed towards rehabilitation include civic responsibility to re-enter society. If they take their rehabilitation seriously, voter registration or re-registration should be presented as a privilege to seek out their right to vote, not be force onto them. Once this system is set up, it makes it easier to then pass voting for prisoners.

To the heart of Valentines Day, the hearing is scheduled to include

HB 2585, sponsored by Representative Lily Morgan (R-Grants Pass), which will end automatic voter registration through Oregon Motor Voter. It reestablishes the process of registration at any office of Department of Transportation where licenses or renewal applications are distributed or received that existed prior to enactment of Oregon Motor Voter. This bill is identical to

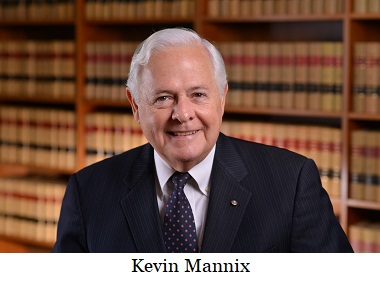

HB 2233 sponsored by Representative Kevin Mannix.

These bills remove electronic reporting to the Secretary of State of every name, age, signature, residence and citizenship information, and the process for transferring it to county clerks. Instead, DMV offices will make voter registration cards available and deliver them to the county clerk in a timely manner.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

The bills provide for the driver's license application and the state identification card application include a section to apply for voter registration, which complies with the National Voter Registration Act of 1993. Signatures may only be used for voter registration purposes, and they will not be automatically registered without their signature.

Court evidence is now available that proves that unused ballots are being fraudulently harvested, and that automatic voter registration has increased the number of ballots available for fraudulent activity.

The hearing is scheduled for February 14 at 1 PM in room HR C.

Let your voice be heard.

--Donna Bleiler| Post Date: 2023-02-10 03:21:22 | Last Update: 2023-02-11 19:49:57 |

A losing battle for the forest industry

Last October, U.S. Senators Jeff Merkley and Ron Wyden announced Oregon would receive $1,519,627 in federal grants to help support the development of habitat conservation plans to improve the management of state and private forestlands. The funding goes to the Oregon Private Forest Accord Aquatic Species Habitat Conservation Plan in the amount of $769, 627, and Western Oregon State Forests Habitat Conservation Plan received $750,000.

This was after Merkley and Wyden announced the Oregon Mass Timber Coalition was awarded $41.4 million Build Back Better grant to advance Oregon’s sustainable mass timber sector intended to grow jobs and increase wood production and manufacturing.

“Forests in Oregon support rural economies and are also home to countless species including vulnerable salmon,†said Senator Merkley. “In this era of mega-wildfires, they’re also increasingly potential hazards if not properly managed.†Merkley claims that the Memorandum of Understanding reached by the Private Forest Accord improves the management of state and private forestlands in Oregon. If true, why does the state need to do another study to develop recommendations on state forest management,

SB 90?

The age-old conflict in forest management also raises the question of the forest sector paying its fair share has risen again with the re-introduction of a severance tax. The state had a severance tax on timber harvest prior to 1991, which was dwindling leaving rural counties in the red. It was phased out by 2003 and replaced by a harvest tax. The Forest Products Harvest Tax (FPHT) applies to timber harvested from all land in Oregon, except most tribal lands. No distinction is made between timber harvested from private lands and government-owned lands.

Representative Paul Holvey (D-Eugene) and Senator Jeff Golden (D-Ashland) are proposing to replace the forest products harvest tax and restore a severance tax in

HB 3025. Similar to the harvest tax, it imposes a severance tax at harvest on timber owners of public and private forestlands. The bill adds distribution of 40 percent going to the Wildfire Management Fund and 5 percent to the Watershed Conservation Grant Fund after receiving $42.9 million federal grants. Also new is 40 percent going to the general fund of each county according to their proportion. That 85 percent is offset by reducing the State Forestry Department Account to 10 percent, reducing the Forest Research and Experiment Account to 5 percent, eliminates the Public University Fund for professional forestry education, and repeals the Oregon Forest Land Protection Fund.

Should fire suppression emergency funds be eliminated? The Oregon Forest Land Protection Fund was established as an 'insurance fund' for the purpose of equalizing emergency fire suppression costs among the various Oregon Department of Forestry protection districts. The emergency funding system is designed to operate as an insurance policy whereby all districts contribute (pay premiums) into the fund so that money will be available to any individual district to pay fire suppression costs on emergency fires.

HB 3025 describes a tiered tax by the amount of acreage owned, multiplied by pond value of timber at time of harvest. The rate is discounted if management is certified by the Forest Stewardship Council (FSC). The FSC is an international non-profit, multistakeholder organization that “promotes environmentally appropriate, socially beneficial, and economically viable management of the world's forests†via timber certification. While it may be advantageous for timber owners to join, it isn’t financially responsible for the state to promote them via a discount. The rates should be reduced for all owners without obligation.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

A tax review commissioned by the Oregon Forest & Industries Council (OFIC), reported

Tax contributions of Oregon’s Forest Industry is paying 1.5 times more in overall taxes than the average Oregon business.

One timber owner told Northwest Observer, “They want more taxes while they’re shutting down more timberland. Between the Elliott State Forest, the Western HCP impacts 2/3rds of our state forests, the new Forest Management Plan that aligns itself with the Western HCP, and the Private Forest Accord which affects over 60,000 timberland owners in Oregon by increasing unmanaged land on their private property, the only way ODF and other beneficiaries of harvest tax revenue can operate is to keep increasing taxes to offset the decrease in harvestable timberland.â€

--Donna Bleiler| Post Date: 2023-02-10 02:37:56 | Last Update: 2023-02-10 15:19:21 |

House District 1 was left vacant after former Representative David Brock Smith was appointed to Senate District 1 filling former Senator Dallas Heard's seat. The House Republicans now welcome Representative Court Boice (R- Gold Beach) as representative of House District 1.

House District 1 represents the communities of Coquille, Bandon, Myrtle Point, Winston, Port Orford, Gold Beach, and Brookings. The district includes portions of Coos, Douglas, and Curry Counties.

Representative Boice has served in several capacities throughout his career from working as an Oregon legislative staff member, to serving on the Coos Curry Douglas Business Development Corporation, to representing several counties as a part of the Association of Oregon Counties.

“I am excited to welcome State Representative Court Boice to the legislature and to the House Republican Caucus. I have full confidence that Representative Boice will serve his district well. I look forward to having his knowledge and experience in the building,†said House Republican Leader Breese-Iverson (R-Prineville).

“My family has been living, working, and serving in this area for over 60 years. I believe my career has prepared me to be a strong advocate for the issues impacting my district – from housing and homelessness, to education, to Oregon’s fishing and timber industries. I am truly honored to represent the constituents of House District 1,†said Representative Court Boice (R-Gold Beach).

--Staff Reports| Post Date: 2023-02-09 13:06:36 | Last Update: 2023-02-09 13:20:11 |

55 commodity commissioner openings

The Oregon Department of Agriculture (ODA) seeks applicants to fill 55 commissioner seats on 19 of the state's agricultural and commercial fisheries commodity commissions. The deadline to apply is March 15, 2023. For a complete list of the openings and how to apply or to learn more about the commissions,

visit ODA webpage.

Acting ODA Director Lauren Henderson appoints commissioners. Once selected, commissioners serve as public officials in three-year terms. Their duties include making decisions about funding for promotion, education, and research projects. Acting Director Henderson seeks applicants representing the diversity among Oregon's farmers, ranchers, processors, and commercial fisheries. For public members, users of the commodity who have an interest and time to serve are often the best fit.

A public member must be a U.S. citizen, an Oregon resident, and have an active interest in improving economic conditions for the commodity. A public member cannot be directly associated with producing or handling the specific commodity they seek to serve.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

--Ryan Bannister| Post Date: 2023-02-08 11:50:11 | Last Update: 2023-02-08 15:15:40 |

Identifies human remains from 1989

On March 26, 1989, the remains of a skeletonized human body were discovered by a rafting group on the Sherman County side of the John Day River. Then-Sheriff Gerald Lohrey and additional Sherman County Sheriff’s Office deputies launched a jet boat at Cottonwood Bridge, approximately 13 miles east of Wasco, and recovered the incomplete skeletal remains. In addition to many long bones that had been half-buried in silt on the riverbank, a skull was collected with dental work.

The discovery of the body made local headlines, but nothing was immediately known about the deceased. The remains were transported to the Oregon State Medical Examiner’s Office (SMEO) for examination.

An examination of the body determined that the decedent was most likely a Caucasian male, between 40 and 50 years of age at the time of death, and around 5’6†to 5’9†in living stature. Evidence of compressed lumbar vertebrae by the forensic anthropologist indicated possible arthritic changes in the bone. It was noted that several teeth in the mandible exhibited restorations. Additional searches of the area were performed over the next month that yielded additional small bones and several teeth.

Leads on the possible identification of this individual were received by the Sheriff’s Office in the following days and weeks; numerous reporting parties indicated they believed the remains to be that of David West, Jr., a man who had disappeared from Sherman County trying to cross the John Day River during a large flooding event in 1964. Mr. West, Jr. had lived on a ranch near Bridge Creek and was known to cross the John Day often. He normally went back and forth across the river to feed cattle. He and a friend had even built a makeshift cable car across the river to assist in quickly navigating the waters back and forth over the John Day. The day the John Day River flooded in 1964, Mr. West was thought to be feeding cattle near Ashwood, Oregon. A friend went to check on him and saw that the cable car had been washed away, the large tree that had held the cable was uprooted, and Mr. West’s dog was injured and agitated on the bank of the river. David West Jr. was never seen or heard from again.

In 1989, Mr. West’s dentist was consulted, but no conclusive identification was ever made.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

The remains were retained by the SMEO. In 2010, the SMEO submitted a bone sample to the University of North Texas Center for Human Identification. The sample was processed and yielded a forensic DNA profile for comparison and upload into CODIS. Unfortunately, no genetic associations to missing persons or family reference standards in the CODIS database were established.

In April 2022, the SMEO recognized the effectiveness of investigative genetic genealogy on cold unidentified remains cases and submitted an additional bone sample to Othram, a private DNA lab specializing in advanced forensic DNA testing. Othram uses an in-house whole genome sequencing technique that can provide genetic information and possible familial associations even with a low-yield sample. The analysis revealed the names of two biological relatives of David West Jr. as being genetically associated with the remains.

Both the Gilliam County Sheriff Gary Bettencourt and the Sherman County Sheriff Brad Lohrey (the son of Sheriff Gerald Lohrey) worked to contact family members; Sheriff Bettencourt collected oral swab standards from one relative, and these were submitted and tested by Othram.

The genetic association was confirmed through DNA comparison by Othram in September 2022, and the family was notified of the positive identification.

Sheriff Brad Lohrey said, “We are very excited that such an old case was able to be solved. It is amazing what our forensic teams can accomplish with modern technology. This was a case that was a mystery for generations here at the Sherman County Sheriff’s Office. I’m happy that the family of the deceased finally has closure.â€

--Donna Bleiler| Post Date: 2023-02-07 01:48:28 | Last Update: 2023-02-07 16:54:07 |

Passage would lessen inflation impact

Oregon’s Corporate Activity Tax (CAT) goes through some amount of reform every legislative session since it was passed in 2019. The CAT tax is often referred to as the gross receipts tax allowing a 35 percent subtraction for certain business expenses and applied to receipts in excess of $1 million. If a business has commercial activity over $1 million, it owes a flat $250 tax plus tax at the 0.57% tax rate for taxable commercial activity over $1 million.

The CAT is imposed on businesses for the privilege of doing business in Oregon that is allocated to a "Fund for Student Success" that is separate and distinct from the state's general fund. While Oregonians were looking for alternative funding for education, the CAT tax hasn’t materialized in helping schools to be successful in digging Oregon out of nearly the bottom ranked state in education.

Shortly after CAT was passed,

HB 4202 was passed in 2020 special session adding exemptions for foreign commercial activity that is sourced to Oregon, allowed an offset for returns and allowances, exempt agricultural and farming sells to wholesaler or broker, exempts dairies not part of coop, and added the 35 percent subtraction. Many other proposals were not considered. The Department of Revenue, however, subsequently made rules to exclude subcontracting payments, property brought into Oregon, retail sale of groceries, allowed labor cost subtractions, and resale of motor vehicles.

In 2021,

SB 164 expanded the exclusion for motor vehicle dealers that make exchanges between franchises, it expanded the exemption of wholesale and retail sales of groceries to include consignment sales, and excluded insurance companies subject to retaliatory tax

Two bills were proposed in 2022.

SB 1507 would exempt prescription drugs, feminine hygiene products, diapers and baby formula, and

HB 4094 would exempt prescription drugs and medical supplies. However, the Democrat majority blocked both bills from a floor motion to withdraw from committee to give them a vote on the floor.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

This session is no different. There are four bills that will have public hearings this week. They should all be passed to lessen the impact on inflation.

Representative Virgle Osborne (R-Roseburg) has introduced

HB 2433, which increases the exempt amount threshold for purposes of the corporate activity tax (CAT) from $1 million to $5 million.

Representative Shelly Boshart Davis (R-Albany) has introduced

HB 2142, which adds “processor†to types of entities that farming operations may exempt from CAT tax calculations. The tax has created a disincentive to sell to Oregon-based processors that sell outside of Oregon, because of their inability to obtain documentation needed to accurately calculate which portion of their crops are sold in-state v. out-of-state.

Senator Lynn Findley (R-Vale) and Representative Mark Owens (R-Crane) are co-sponsoring

SB 61 to revisit exempting receipts from sales of prescription drugs by a pharmacy from CAT taxation.

Senator Findley and Representative Owens are also co-sponsoring

SB 56, which exempts reimbursements for recipients of medical assistance under Medicare, the Public Employee's Benefit Board, the Oregon Educator's Benefit Board, the Children's Health Insurance Program, or the U.S. Department of Defense under a TRICARE contract. These programs were responsible for over $20 billion in health care spending. Overall, more than two-thirds of commercial activity related to health care is currently exempt either because the recipient is an exempt entity or because the taxpayer’s commercial activity is below the taxability threshold of $1 million in commercial activity. The bill also creates an exemption for medications administered or dispensed in a clinical setting other than a hospital.

Oregon statutes currently defines several entities that are not subject to the CAT tax, including nonprofits (e.g., 501(c) corporations), and ORS 317A.100 lists 48 excluded commercial activities. The more exclusions, the more accountable recipients of the tax should be to justify its continuation.

--Donna Bleiler| Post Date: 2023-02-06 09:00:57 | Last Update: 2023-02-07 00:28:15 |

Changes the opt-out process to opt-in

Oregon passed the nation’s first automatic voter registration law in 2015, and was in use for the 2016 elections. Representative Kevin Mannix (R-Salem) has introduced

HB 2233 ending automatic voter registration through Oregon Motor Voter. It changes the opt-out process to an opt-in procedure. The bill reestablishes the process of registration at any office of the Department of Transportation where licenses or renewal applications can be purchased or received that existed prior to the enactment of Oregon Motor Voter.

HB 2233 removes electronic reporting to the Secretary of State of every name, age, signature, residence and citizenship information for the process of transferring it to county election clerks. Instead, DMV offices will make voter registration cards available and deliver them to the county election clerk in a timely manner.

Driver's license applications and renewal forms will contain a section to register to vote while applying or renewing a license, but they will not be automatically registered without their signature. Signatures are limited to only be used for voter registration purposes.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

Janice Dysinger, Oregonians for Fair Elections, says HB2233 finally puts Oregonians in charge of their voter registration information. “Voters have been disenfranchised by allowing the government to change the information through the Automatic Motor Voter Laws. We have seen the skyrocketing of non-Affiliate voters after the Automatic Voter Registration Law passed, as voters had to respond to a postcard declaration of the political party 3 weeks after visiting a DMV or their party affiliation was recorded as NAV. Choosing a political party should have been taken care of by the voter at the time of registration.â€

HB 2233 requires procedures for voter registration applications to include a state identification card that allows an applicant to register to vote. The procedure must comply with the

National Voter Registration Act of 1993 (NVRA).

NVRA is the national motor voter law, which lays out voter registration requirement for federal offices. Section 5 of the NVRA requires that States offer voter registration opportunities at State motor vehicle agencies when transacting other business, including by mail, phone or internet.

Section 6 of the NVRA requires that States offer voter registration opportunities by mail-in application. It also requires first time voters in a federal election provide identification, which can be a current and valid photo identification, or a copy of a current utility bill, bank statement, government check, paycheck, or other government document that shows the name and address of the voter.

Section 8 of the NVRA requires states to implement procedures to maintain accurate and current voter registration lists. It prohibits removing registrants from the voter registration list solely because of a failure to vote, and restricts the timing on removals from the voter list based on a change of residence. However, if the registrant fails to respond to a notice and fails to vote in two federal general election, then the registrant can be removed from the voter registration list.

HB 2233 does not address Oregon’s lifetime retention issue, but the NVRA clearly indicates that eight years should be sufficient time for a person to affirm their civic duty. Watch for a hearing date this week.

--Donna Bleiler| Post Date: 2023-02-06 01:34:54 | Last Update: 2023-02-06 15:48:28 |

SALT deduction included in the 2017 federal Tax Cuts and Jobs Act

New updates about the Pass-Through Entity Elective (PTE-E) tax are available on the Oregon Department of Revenue website, including additional frequently asked questions, step-by-step examples of how to file PTE-E returns, and schedules that make filing easier and faster.

In July 2021, Oregon established a Pass-Through Entity Elective (PTE-E) Tax, a business alternative income tax in response to the $10,000 cap on the federal State and Local Tax (SALT) deduction included in the 2017 federal Tax Cuts and Jobs Act.

For tax years beginning on or after January 1, 2022, entities taxed as S corporations and partnerships may elect annually to be subject to the PTE-E tax at a rate of 9 percent tax on the first $250,000 of distributive proceeds and 9.9 percent tax on any amount exceeding $250,000.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

The department's latest web updates answer the most common questions from tax preparers, who are starting to file PTE-E returns as the tax filing season begins.

The department provides an Excel spreadsheet that can be used to speed up filing of the OR-21. The data on the spreadsheet will populate to the OR-21-MD and the OR-21-MD-PT forms used in PTE-E tax filing.

The updates were posted this week on the department's PTE-E web page. For PTE-E questions contact: BusinessAlternative.IncomeTax@dor.oregon.gov.

--Ritch Hanneman| Post Date: 2023-02-05 11:12:41 | Last Update: 2023-02-03 22:05:27 |

18 Members of the council to be appointed by the governor

Governor Tina Kotek is seeking a diverse membership to a statewide Housing Production Advisory Council.

The Governor is accepting applications for her newly created Housing Production Advisory Council that she established through an executive order on January 10, the Governor's first full day in office.

The order established an annual housing production goal of 36,000 additional housing units at all levels of affordability across the state to address Oregon's current housing shortage and keep pace with projected population growth. That's an ambitious target – about an 80 percent increase over current construction trends – and would set Oregon on a path to build 360,000 additional homes over the next decade.

The Housing Production Advisory Council will be responsible for proposing an action plan to meet the state's housing production goals. It will be composed of 25 members, including the Governor or her designee, bipartisan members of the Oregon House and Senate, relevant state agency directors, and a Tribal member. The largest share of members (18) will be appointed by the Governor with the goal of assembling a highly effective, diverse and representative council, ready to get to work for Oregonians.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

The Governor is looking to appoint housing developers with expertise in permanent supportive, affordable, and market rate housing, representatives of rural and coastal communities, communities of color, local government representatives, and experts in land use, fair housing, permitting, workforce development, and construction. Oregonians interested in applying for the Council are encouraged to submit an application, found here.

Applications are due February 15, 2023. Appointees will begin work on the Council in early March.

Moreover, the executive order dictates that two co-chairs be appointed, one living or working in an urban area and the other in a rural area. The Council is scheduled to provide a recommended framework for their action plan by April 1, 2023.

--Ritch Hanneman| Post Date: 2023-02-04 12:21:29 | Last Update: 2023-02-03 21:31:54 |

The future of carbon credits in question

Oregon land is about 25 percent National Forests at 16 million acres. Add to that about 7.3 million acres of private timber land. These carbon-sequestering forests purify the air, filter water, prevent soil erosion, and act as an important buffer. That is nearly 50 percent of Oregon with a mixed variety of forests, making the state a large carbon sink.

According to Pete Stewart, CEO of ResourceWise, his research led him to “

6 Predictions for 2023 Global Forest Industry,†he states, “we can likely expect the beginning of the end for carbon credits this year. Many critics often question the legitimacy of carbon credits altogether, wondering if companies merely use them as a veneer to conceal their ongoing pollution.†Forest2Market also predicts that 2023 will bring an end to carbon credits in general. “The world is coming around to the fact that carbon credits, of any kind, are just a license to pollute more.†In regards to forests, their research shows that “carbon is stored longer in the finished product, especially lumber and cross-laminated timber.â€

Despite the national trend, Senator Jeff Golden (D-Ashland) chaired the 2021-2022 Senate Interim Committee on Natural Resources and Wildfire Recovery that introduced

SB 88 to establish a state policy to increase net carbon sequestration and storage in natural and working lands. The bill requires certain agencies to monitor progress advancing state net carbon sequestration and storage policy and report their findings to the Oregon Global Warming Commission.

SB 88 directs Oregon Global Warming Commission with related agencies to develop natural and working lands net carbon sequestration and storage inventory using cap and trade methods for assessing greenhouse gas fluxes. Everything you do is now being measured to reduce carbon emissions and if reduction isn’t possible, then in increasing carbon storage.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

Companies will proudly announce their corporate aim toward reaching net zero for the benefit of clients, known as ‘greenwashing.’ Rather than reducing a company’s actual emissions, they buy credits from conserved forest land. However, Stewart’s study indicates companies have little intentions of actively reducing their carbon footprint. Instead, the push seems to be toward hitting those ‘net zero’ carbon emissions by purchasing offsets and passing the cost to consumers.

An investigation by The Guardian showed that up to 90% of the credits offered by one of the leaders in setting carbon standards were simply ‘phantom credits.’ There is no tangible substance and were not helping to offset carbon pollution beyond the numbers on a spreadsheet. That leaves the question of the purpose of carbon credits.

There needs to be a more accurate measurement for pollutants, better identification on how carbon is stored in wood beyond the forests, and improve measurements and reporting mechanisms, according to Stewart. A step in that direction may be in

SB 724, introduced by Senator Fred Girod (R-Stayton). SB 724 adds to the calculation of greenhouse gas levels to include atmospheric carbon sequestered by lands and waters in determining progress towards greenhouse gas emissions reduction goals.

No matter how you look at it, Oregon's sink is draining more than carbon.

--Donna Bleiler| Post Date: 2023-02-03 12:07:32 | Last Update: 2023-02-03 16:17:18 |

Read More Articles

To the heart of Valentines Day, the hearing is scheduled to include HB 2585, sponsored by Representative Lily Morgan (R-Grants Pass), which will end automatic voter registration through Oregon Motor Voter. It reestablishes the process of registration at any office of Department of Transportation where licenses or renewal applications are distributed or received that existed prior to enactment of Oregon Motor Voter. This bill is identical to HB 2233 sponsored by Representative Kevin Mannix.

To the heart of Valentines Day, the hearing is scheduled to include HB 2585, sponsored by Representative Lily Morgan (R-Grants Pass), which will end automatic voter registration through Oregon Motor Voter. It reestablishes the process of registration at any office of Department of Transportation where licenses or renewal applications are distributed or received that existed prior to enactment of Oregon Motor Voter. This bill is identical to HB 2233 sponsored by Representative Kevin Mannix.

Acting ODA Director Lauren Henderson appoints commissioners. Once selected, commissioners serve as public officials in three-year terms. Their duties include making decisions about funding for promotion, education, and research projects. Acting Director Henderson seeks applicants representing the diversity among Oregon's farmers, ranchers, processors, and commercial fisheries. For public members, users of the commodity who have an interest and time to serve are often the best fit.

Acting ODA Director Lauren Henderson appoints commissioners. Once selected, commissioners serve as public officials in three-year terms. Their duties include making decisions about funding for promotion, education, and research projects. Acting Director Henderson seeks applicants representing the diversity among Oregon's farmers, ranchers, processors, and commercial fisheries. For public members, users of the commodity who have an interest and time to serve are often the best fit.