On this day, August 27, 2019, jet-car speed racer 30-year-old Jessi Combs, known by fans as the "fastest woman on four wheels," died in a crash in the Alvord Desert in Southeastern Oregon while trying to break a speed record.

Post an Event

Post an Event

| Benton County Republicans’ Private Fundraising Event, “Bent-on Boots and Bling” with Trey Taylor |

| Friday, September 5, 2025 at 5:00 pm |

| Featuring Trey Taylor

Music Private Event

Friday, September 5, 2025 5:00-5:30 pm VIP Reception

5:30-8:00 pm Heavy Appetizers,

Auction, Concert

Red: $750 VIP Reception

Front Row Table Sponsor

White: $500 Table Sponsor

Blue: $50 per person

Limited Seating. Get Yours Now!!!

Support Local

Dress up: Bling, Cowboy, Patriotic Benton County Republican

FUNDRAISER

www.BentonGOP.org

Get your tickets today at:

https://www.bentongop.org/event-details/benton-county-republicans-fundraiser/form

About Trey:

Trey is the youngest African American Man in Country Music History. The Denver Post wrote

"It's impossible to miss his enthusiasm. With a fondness for cowboy boots, gaudy colors and dazzling jewelry, Trey Taylor could stand toe to toe with any of the Pop, Country or even Rap

contemporaries of his generation.“ |

| Trysting Tree Golf Club, 34028 NE Electric Rd., Corvallis |

Senate Republicans seek to preserve tax relief

Secretary of State Shemia Fagan has released an

audit of Oregon’s mortgage interest deduction. The document blames the deduction, that allows Oregonians to keep more of their own money, for many of Oregon’s housing woes.

“This ‘audit’ reads more like a

political messaging memo than any real research,†said Deputy Senate Republican Leader Chuck Thomsen (R-Hood River). “The Secretary is politicizing the Audits Division for her own partisan ends of shifting blame away from her party’s decades of housing policy failures onto a tool that hundreds of thousands of working-class families use to make ends meet.â€

“Democrats continue to double down on failed housing policies that drive up the cost of housing while trying to run away from

responsibility,†said Senate Republican Leader Tim Knopp (R-Bend). “In the middle of all this economic uncertainty, it's unclear why

the Secretary is attacking the one tax benefit that is available to working-class Oregonians.

“If Democrats want to eliminate the mortgage interest deduction, they will be voting to raise taxes on hundreds of thousands of Oregonians across the state. Increasing taxes on Oregonians won’t make housing more affordable. Republicans will fight any effort to curb this vital tax relief.â€

A D V E R T I S E M E N T

A D V E R T I S E M E N T

Democrats have consistently opposed Republican-led efforts to make structural reforms to decrease the cost of housing. Last session, Democrats blocked a Republican effort to make the impact of housing regulation on the cost of housing more transparent by voting down

SB 1537. Democrats also blocked

HB 4118 which would have cleared roadblocks to the development of workforce housing.

--Staff Reports| Post Date: 2022-03-17 13:57:50 | Last Update: 2022-03-17 13:50:15 |

Using public office to promote socialism?

In an

audit that insiders decried as political, Oregon Secretary of State Shemia Fagan (D-Portland) said that the "home mortgage interest deduction as a deeply inequitable and regressive tax policy." One former legislator described her comment on her audit as "using public office to promote socialism." The mortgage interest deduction allows some, but not all, homeowners to reduce their taxable income by the amount of interest paid on mortgages up to $750,000.

Fagan continued, "While houselessness and the lack of affordable housing impact communities all over the state, auditors found the state’s largest housing subsidy mostly benefits wealthy and white Oregonians in urban counties. Fagan, herself, is a white Oregonian from an urban county. Additionally, the mortgage interest deduction receives no state-level evaluation as to whether it is meeting its purpose, limiting accountability for its inequitable outcomes."

“The affordable housing crisis is squeezing families across Oregon while the state’s largest spending on housing primarily flows to wealthy homeowners in the metro area. That is indefensible,†said Secretary of State Shemia Fagan. “Every dollar spent keeping seniors and working families in their homes or helping renters stay housed has been scrutinized and debated by lawmakers. Meanwhile billions of dollars just walk out the backdoor with no questions asked. I can’t think of a worse example of waste and systemic inequality than that.â€

The mortgage interest deduction has been law in Oregon since 1923. This biennium alone, the deduction is expected to save taxpayers over $1.1 billion. Auditors analyzed the benefits of the mortgage interest deduction by income, geography, and race and found a disproportionate share of the benefits flow to the wealthiest taxpayers.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

Despite record revenue growth in state tax revenue in recent years, auditors recommend the Legislature identify a clear purpose for the mortgage interest deduction in statute and determine if changes are necessary to ensure the purpose is met. Auditors also recommend the Legislature identify a state agency to be responsible for regularly evaluating the policy.

While the Department of Revenue is responsible for administering Oregon tax law, changing this policy would require legislative action.

--Staff Reports| Post Date: 2022-03-16 19:46:07 | Last Update: 2022-03-16 19:57:50 |

It’s not the King of Rock. It’s the Electronic Valuation Information System

Editor's note: This is the fifth of a multipart series on HB 5202, the budget bill for the 2022 Legislative Session.

A somewhat confusing part of the budget is the Article XI-Q bond program, which was passed by voters in 2010. It is used to acquire, construct, remodel, repair, equip or furnish real or personal property that is owned or operated by the State of Oregon. In order to keep the State’s cost of financing as low as possible, the bonds are primarily issued on a taxâ€exempt basis under the IRS federal tax code saving interest cost over the prior method of Certificate of Participation. Upon project completion, the unspent proceeds remaining are usually used to pay debt service or to be transferred to a different legislatively approved project.

ORS 286A.824 allows an agency to request financing for real or personal property projects that may be financed with Article XI-Q bond proceeds. Bond funds are not included in the agency’s budget, but in separate policy packages. But they need authorization to obligate taxpayers for the indebtedness through legislative budget bills.

SB 5701 increases bond authorizations for the 2021-23 biennium approving $156.07 million. This measure increases the general Fund support debt by $54.06 million in Article XI-Q general obligation bond authority reflected in

HB 5202.

Within that authority is a decrease of $435,000 to the Department of Revenue that resulted from previously approved Article XI-Q bonds for the Electronic Valuation Information System (ELVIS). This reduction to cover the taxable portion of the project frees up $400,000 from project costs and $35,000 from costs of issuing bonds. This project total is $3,810,000 Article XI-Q bond authority remains for the 2021-23 biennium.

The Oregon Judicial Department requested an increase for the Crook County Courthouse. Approved were an additional $4,445,000 Article XI-Q bonds to finance $4,416,705 of project costs and $28,295 for costs of issuing the bonds. The authorization results in total 2021-23 Article XI-Q bond authority of $16,330,000 for the construction of a new facility to replace the Crook County Courthouse.

State Capitol Accessibility, Maintenance, and Safety Phase III, approved $19,865,000 Article XI-Q bonds to finance $19,630,000 of project costs and $235,000 for costs of issuing the bonds. The project is for capital improvements to the State Capitol Building, including upgrades to the 1938 building for improved functionality, fire protection systems, seismic retrofits, roof repairs, security upgrades, IT and media modernization, and upgrades to remaining mechanical, electrical, and plumbing equipment not addressed in Phases I and II.

New amounts are also directed to public universities in the amount of $30 million for Higher Education Coordinating Commission grants. Approved was $5.1 million to Oregon Department of Emergency Management, Resiliency Grant Fund. Lottery Bond authorization for 2021-23 are also increased in SB 5701 by $23.07 million to support three projects.

Details for bonds can be found in

SB 5701 Measure Summary. Bonds are often dismissed because it isn’t a direct draw from the General Fund. But it is like charging a credit card and sooner or later the debt has to be paid by taxpayers.

--Donna Bleiler| Post Date: 2022-03-16 06:46:10 | Last Update: 2022-03-14 11:09:50 |

“Millions of Americans have now been vaccinated, and strict ongoing safety checks have revealed no concerns.â€

The Oregon Health Authority website states, “Vaccines are safe and effective†and then delves into the requirements from the FDA to have a vaccine undergo “rigorous safety testing†before being granted an “Emergency Use Authorizationâ€. The last sentence in the “Safety†message box says: “Millions of Americans have now been vaccinated, and strict ongoing safety checks have revealed no concerns.â€

However, on the FDA website, under the approval for granting the Emergency Use Authorization (EUA) of the Pfizer BioNTech vaccine, one of the stipulations is for Pfizer to “evaluate the occurrence of myocarditis and pericarditis following administration of COMIRNATY [Pfizer’s proprietary name for their Covid vaccine].†Pfizer is to submit their final evaluation report by Oct 31, 2025. With the multibillion-dollar vaccine business at stake one must wonder what their final evaluation report will say about myocarditis and pericarditis?

The New York Press News ran a news story on March 10, 2022, titled:

“Pfizer vaccine side effects: New documents uncover a shocking 158,000 adverse eventsâ€. The information received from Pfizer because of a FOIA request indicated there were over 25,000 nervous system disorders reported, as well as 17,000 musculoskeletal and connective tissue disorders and 14,000 gastrointestinal disorders. These effects were known before Pfizer applied for the EUA from the FDA. OHA says strict ongoing safety checks reveal no concerns.

The OpenVAERS (Vaccine Adverse Event Reporting System) database shows 24,156 reported cases of Myocarditis and Pericarditis in 2021, and 11,921 reported cases in 2022. OHA says strict ongoing safety checks reveal no concerns.

Of course, Oregon Health Authority -- which never issued any guidance or information that took into account natural immunity -- will be acting in lockstep with Governor Brown, the CDC, NIH, and the Biden Administration. They claim to “follow the scienceâ€. The question though is, are we really following the science, or engaged in a political shell game?

--Steve Howard| Post Date: 2022-03-15 18:17:52 | Last Update: 2022-03-15 19:51:01 |

$15 million for the Oregon Clean Vehicle Rebate Program

Editor's note: This is the fourth of a multipart series on HB 5202, the budget bill for the 2022 Legislative Session.

Gas prices has everyone concerned, but when the Whitehouse spokesperson was asked about the gas shortage, she responded with a grin, “we are obviously all in on meeting the President’s goals to get to 100 percent clean energy by 2035 and net zero carbons by 2050, and if you drive an electric car this would not be affecting you.†This statement comes after Elon Musk said that leaders of some countries have asked him to shut down satellite-based internet service and twitter inundated him to turn off all Tesla cars in Russia -- he refused. You may say that wouldn’t happen here, but we’ve already been

warned of rolling blackouts when

HB 2021 was passed during the 2021 Session. Can you imagine the control government would have if we all had electric vehicles? We already have smart meters on our homes.

As part of an overall statewide investment in climate, the budget adjustment bill,

HB 5202, includes two separate one-time General Fund appropriations of $15 million to be deposited into dedicated funds for programs at the Department of Environmental Quality, directed by Richard Whitman. The first $15 million was deposited into the Zero-Emission Incentive Fund to provide additional funding for the electric vehicle rebate program known as the Oregon Clean Vehicle Rebate Program. This program was established in

HB 2017 which passed during the 2017 Session and is funded from privilege tax revenue of approximately $12 million per year. With increased growth in the electric vehicle sector in recent years, the program is anticipated to be oversubscribed.

The second $15 million was deposited into the Medium and Heavy-Duty Electrification Fund, established in

HB 4139 passed in 2022, sponsored by Representative Dan Rayfield (D-Corvallis), as a new grant program supporting medium and heavy-duty zero-emission vehicle charging and fueling infrastructure projects. This one-time funding is intended to support grants to public or private entities for capital improvements and technical assistance to support the installation of charging infrastructure for zero-emission medium and heavy-duty vehicles. Projects will be awarded through a competitive request with priority given to projects located in communities disproportionately impacted by diesel pollution or are connected to proposed or existing transportation corridor projects, and projects that demonstrate available matching funds.

A corresponding $15 million of Other Funds expenditure limitation was provided to expend the monies in the fund. Included in this amount are anticipated costs for administrating the grant program, including $373,329 in the 2021-23 biennium for one position and potential contracting costs.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

The DEQ and the Oregon Department of Transportation are directed to report back to the Joint Committee on Transportation by December 1, 2022, with an analysis of existing incentives available to support the transition to zero emission medium and heavy-duty transportation fleets. The agencies are further directed to research incentives offered in other states and to provide recommendations on expanding or creating incentives to support businesses in the transition to zero emission medium and heavy-duty vehicles. This effort should include analyses on incentives for both vehicles and electric charging or other fuel infrastructure.

Additionally, the DEQ was approved $517,000 General Fund to support laboratory operations across all three major program areas of Air Quality, Water Quality, and Land Quality. Also approved was $484,553 General Fund for information technology costs.

That’s $5.5 million dedicated in the short session to convince you to buy an electric vehicle and put your transportation needs in the hands of government.

--Donna Bleiler| Post Date: 2022-03-15 06:42:23 | Last Update: 2022-03-14 11:04:06 |

Over $289 million paid to more than 40,000 households

In what some are taking as a sign that COVID-driven, government grip is being loosened, Oregon Housing and Community Services will close the Oregon Emergency Rental Assistance Program Portal and stop accepting new applications after 11:59 p.m. March 14, 2022. The portal reopened on Jan. 26, 2022, for a limited time after the Oregon Legislature allocated $100 million to support renters facing eviction. The state had paused accepting new applications on Dec. 1, 2021, due to dwindling federal funds. Andrea Ball is the Executive Director of Oregon Housing and Community Services.

Upon review, applications will be approved for payment or denied. This decision will be made based upon the highest need, not on a first-come, first-served basis. If a tenant has an incomplete application in the portal, they have until March 21 to complete it. As a reminder, tenants who submit new applications can access protections from eviction for nonpayment of rent while their application is being reviewed and processed.

During this historic crisis, the agency served as a national leader in providing rental assistance to more than 40,500 households, which means an estimated 104,600 people have been able to stay safely and affordably housed during the pandemic. Only two other states have provided a higher percentage of assistance, according to the National Low Income Housing Coalition. Oregon ranks third in the nation in the percentage of emergency rental assistance funds paid out and obligated. More than $289 million has been paid in the past nine months.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

If a tenant has an incomplete application in the portal, they have until March 21 to complete it. This extension applies for applications that are incomplete at the time of closure. New applications will not be accepted after March 14. If an application is started today, tenants have one week to complete it.

Applicants can continue to log on to the OERAP portal to complete their application or check the status of their finished application. They will be alerted by email as their application advances. Tenants at immediate risk of eviction should apply for rental assistance right away to access safe harbor eviction protections and contact a legal organization.

--Staff Reports| Post Date: 2022-03-14 10:31:31 | Last Update: 2022-03-14 10:34:49 |

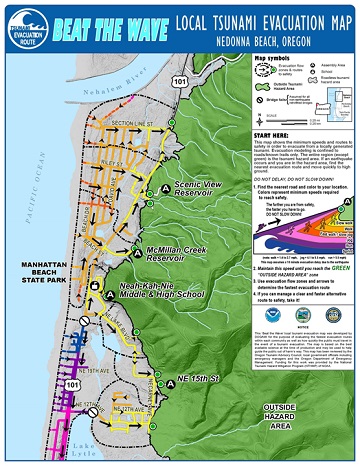

March 11 marks the anniversary of the 2011 TÅhoku earthquake and tsunami in Japan

T

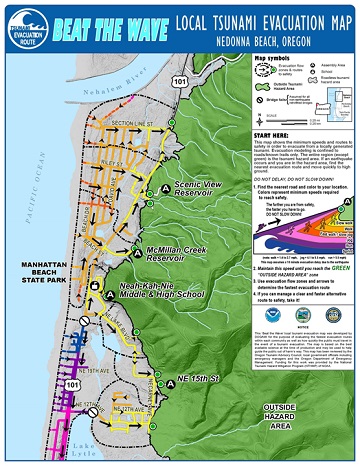

The Oregon Department of Geology and Mineral Industries has released two new Tsunami evacuation modeling reports covering Astoria, Cannon Beach, Arch Cape, and Falcon Cove in coastal Clatsop County. The reports are part of the Beat the Wave series of publications and complete the evacuation modeling for Clatsop County.

Beat the Wave reports provide information about tsunami wave arrival times, evacuation routes, and minimum evacuation speeds that pedestrians must use to reach safety in the event of a Cascadia Subduction Zone earthquake.

A tsunami caused by an earthquake along the Cascadia Subduction Zone could impact coastal communities in as little as 10 - 20 minutes, so moving to higher ground quickly is essential. In some cases, the only warning that a tsunami is imminent will be the shaking caused by the earthquake. The shaking may damage roads, bridges, and other routes residents and visitors might use to get to safety so the best way to evacuate will be on foot.

“Knowing about and practicing evacuation for locations in the tsunami zone where you live, work or play are critical for keeping you and your loved ones safe in a Cascadia event,†says Laura Gabel, Coastal Geologist with DOGAMI. “These reports and ‘Beat the Wave’ evacuation brochures are of great importance for assisting emergency managers, community leaders and the public prepare for Cascadiaâ€.

In coastal towns like Astoria and Cannon Beach, many homes, businesses, and tourist attractions are located in tsunami inundation zones, making it very important for community members and visitors to familiarize themselves with evacuation routes. With the lifting of pandemic-related restrictions, tourism on the Oregon coast will likely increase in the coming months and it is important to ensure that visitors and residents have the information they need to prepare for a possible tsunami.

--Staff Reports| Post Date: 2022-03-13 14:01:02 | Last Update: 2022-03-13 16:31:31 |

Elections Related Bills Have a Cost

Editor's note: This is the third of a multipart series on HB 5202, the budget bill for the 2022 Legislative Session.

Oregon’s short session passed two major bills that could impact election results.

SB 1527, introduced by the Senate Committee on Rules and Executive Appointments, chaired by Senator Rob Wagner, reduces the number of electors who must be registered as member of a minor political party in order for that minor political party to retain political party status from one-half of one percent to one-quarter of one percent of total number of registered electors in state. It also authorizes the Secretary of State as the only one that certifies elections, sets election rules and audits for recount.

HB 4133 requires the Oregon Centralized Voter Registration (OCVR) system to enable an individual to register to vote entering only their final four digits of their Social Security number and to electronically submit image of their signature. Implementation is to be no later than January 1, 2026.

HB 4133 was not sent to Ways and Means for funding waiting to the next biennium. However, the Elections Division has selected a vendor that recently completed similar project to OCVR in Arizona and Washington. They requested $5,300,000 Federal Funds expenditure limitation increase to pay costs associated with the OCVR system project and it was approved. This project is part of a modernization effort involving the state’s centralized voter registration and elections management software.

The federal Help America Vote Act (HAVA), which passed in 2002, provided limited federal funding to be used by states to defray the cost of required changes to elections systems and processes made by the law. The state’s remaining HAVA funds are being used to pay the one-time OCVR replacement project costs

A D V E R T I S E M E N T

A D V E R T I S E M E N T

HB 5202 provides $327,112 General Funds to support positions in the Elections Division, which changed position support funding from Help America Vote Act federal funding to the General Fund.

A good example of waste when the legislature gets ahead of the process is

HB 5006, passed in 2021, which appropriated $2,000,000 General Fund to the Secretary of State for “grants to counties to address county elections offices equipment and technology needs.†At the time of passage, no formal plan for these grants had been developed. A new elections improvement plan passed that includes $120,000 grants for each county, along with new postal barcode scanners for a total cost of $1,160,000. Another $370,000 was approved for the Secretary of State to procure statewide elections services such as search engine optimization, and statewide ballot tracking, which are cheaper for the state to provide centrally rather than having each county attempt to procure their own equivalent services individually. Also approved was $470,000 to be held back as contingency funds for potential emerging elections needs. Any contingency monies remaining would be distributed equally among counties at the end of the biennium

The OCVR and passing

SB 1527 giving the Secretary of State power over local elections is a primary concern of Janice Dysinger, Oregonians for Fair Elections. She believes this is a set up to adopt same-day-voting, which allows registration at the same time you vote. There are two other bills she thinks will return, lower the voting age to 15 and allowing prisoners to vote. Regardless of the number in opposition to all the election bills, the Oregon voting system continues to erode.

--Staff Reports| Post Date: 2022-03-13 06:50:03 | Last Update: 2022-03-11 10:58:01 |

Oregon Redefines Sanctuary State

Sanctuary State has new meaning after Senator Kate Lieber (D-Beaverton), co-sponsor, carried

SB 1543 for the Senate floor vote that established the Universal Representation Fund. The fund is to provide a statewide, integrated, universal navigation and representation system for immigration matters.

“Unlike in criminal court, immigrants facing deportation and immigration court are not entitled to a lawyer. This will bring Oregonian residents before our immigration courts in equal treatment to those before criminal court systems by granting each person access to legal representation, regardless of their financial resources,†said Representative Teresa Alonso Leon (D-Woodburn), a co-chief sponsor of the bill whose family came to Oregon from San Jeronimo Purenchecuaro, Michoacan, Mexico.

The Universal Representation Fund is a statewide program that will embed qualified community-based organizations to act as navigators that would guide Oregonians at risk of deportation into the program, supported by a statewide call center. Attorney fellows would be embedded at community-based organizations throughout the state, providing legal services to community members at culturally accessible locations including affirmative services such as DACA renewals, naturalization and legalization services.

“As a member of the Latinx community, I have seen the struggles and strain that deportation has placed on immigrant and refugee communities across the state,†said Representative Andrea Salinas (D-Lake Oswego), a co-chief sponsor of the bill. “My personal history was at the forefront of my policy-making lens when I worked with several other legislators and organizations to bring this policy forward last session.â€

A D V E R T I S E M E N T

A D V E R T I S E M E N T

The budget allotted

SB 1543 $10.5 million to the newly created Universal Representation Fund, and $4.5 million for the Oregon State Bar’s Legal Services Program to provide legal services to individuals on immigration matters. The State Bar program will work with Oregon’s immigration legal services providers and provide fiscal and regulatory oversight of legal services to individuals on immigration and related matters throughout the state.

This will not be a one-time allotment. This program is projected to be made permanent, increasing the state budget every biennium. It has the potential to explode. Neither

SB 1543 nor

the report behind the program limit the services to those residing in Oregon. “Individuals are ineligible if (a) earn more than 200% FPG, (b) have no connection with Oregon, (c) are eligible for service through other similar program (e.g., trafficking victims).†If all it takes is a lawyer to avoid deportation, it’s only fair to require assimilation and recognize that taxpayers are providing the legal services and other benefits.

--Donna Bleiler| Post Date: 2022-03-12 07:45:17 | Last Update: 2022-03-12 07:50:29 |

How the Lottery Impacts the State School Fund

Editor's note: This is the second of a multipart series on HB 5202, the budget bill for the 2022 Legislative Session.

Digging through the 100-page

HB 5202 omnibus budget bill from the Joint Committee on Ways and Means -- co-Chaired by Representative Dan Rayfield -- and the changes to the 2021-23 legislatively adopted budget, one thing stood out. State School Fund shows a negative $97,592,219 of General Funds.

Adjustments to the State School Fund is offset to align with

SB 5703, the lottery revenue forecast for 2021-23. Oregon State Lottery funds are projected for the biennium and SB 5703 adjusts lottery accounts with a 5.3% increase. That amounts to an increase of $60,982,219 Lottery funds for the State School Fund.

Other Funds make up the difference of $36,610,000. They come from adjustments in the most recent forecast of the Corporate Activities Tax, and Marijuana related revenue. Taken together, the State School Fund is unchanged for the 2021-23 biennium. This shifting of funds uses the remaining available Lottery Funds.

The biggest impact is the sale of Elliott State Forest, authorized by, which establishes the Elliott State Research Forest removing it from the Common School Fund. The Common School Fund consist of state-owned unclaimed properties and the Elliot Forest, and resources are to be used to the benefit of schools.

HB 5202 appropriates a one-time General Fund payment of $121,000,000 for the Elliott Forest. It is intended to satisfy the financial obligations to the Common School Fund appraised in 2016 at a value of $221 million. In 2019, $100 million was paid to the Common School Fund from the proceeds of certificates of participation that were authorized for issuance. Based on this appraisal, decoupling the Forest from the Common School Fund is estimated to cost $121 million. Once separated, the Elliot State Forest will transfer oversight to the newly established Elliott State Research Forest Authority as provided in

HB 1546.

Satisfying the financial obligations to the Common School Fund is one of the tasks that must be completed prior to that HB 1546 becoming operative on January 1, 2024. The Common School Fund was projected to produce $133,059,086 for biennium 2021-23. It’s hard to visualize how $221 million investment will return over 50% in interest.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

OSU currently estimates that they will need an initial investment of approximately $23 million for 2024-2026 for research equipment and the operational costs associated with starting up the research and operations programs. Federal funds are targeted for these costs, but if federal funds aren’t received, it is not known what entity would pay these costs. Additionally, OSU requests $17 million in capital costs for research and administrative facilities.

Up front, the Elliott State Research Forest has all the makings of another money guzzling department that will cost taxpayers a lot more than continuing it under the Common School Fund. It remains to be seen if OSU can make it productive, and whether the school fund investment will turn a profit.

--Donna Bleiler| Post Date: 2022-03-12 06:37:07 | Last Update: 2022-03-14 10:42:23 |

The letter shows a clear need to formally investigate the agencies for willful misconduct

Two Oregon state senators, representing American citizens with professional expertise in medicine, law, statistics and death certificate reporting, jointly filed a

formal petition for a federal grand jury investigation into the CDC’s and FDA’s reporting on COVID deaths. The petition alleges that the CDC and FDA violated federal law by inflating COVID death data. According to some analysts, this inflation of death certificate reporting started a landslide of data degradation and destructive public health policies.

State Senators Kim Thatcher (R-Keizer) and Dennis Linthicum (R-Klamath Falls) jointly filed a formal petition for a federal grand jury investigation into both the Centers for Disease Control and Prevention and U.S. Food and Drug Administration on Aug. 16 in the city of Medford. They have spoken in an exclusive briefing to Stand For Health Freedom about their letter and the petition calling for a thorough investigation. The project has been a months-in-the-making combined effort between scientific, legal and public policy experts. Their official letter shows a clear need to formally investigate the agencies for willful misconduct.

According to a

paper published in the journal

Science, Public Health Policy, and The Law, the CDC abruptly changed how death certificates were recorded for only one type of death—COVID-19—and circumvented multiple federal laws to do so.

Senator Linthicum said, “Plain and simple: the CDC acted illegally in March of 2020, which has led to these current ‘medical’ mandates stemming from the original lynchpin of corrupted data for COVID death certificates. Our health and the health of our children is our responsibility, not the government’s, yet the CDC, through pure data manipulation, has promulgated government overreach through incredulous policies in unimaginable ways through this wrongful slight-of-hand, creating a falsified reality that has no place in a free society.â€

“Federal agencies like the CDC have committed atrocities in the name of ‘public health,’ resulting in extensive collateral damage that transformed society in ways that we are still grappling to understand,†said Senator Thatcher. “The CDC’s unlawful and questionable changes to death certificates related to COVID, the use of false-positive PCR tests and their callous indifference to individual rights—or science, for that matter—led to fraudulent data that was used to justify sweeping policy changes, not only in Oregon, but across the country. I refuse to stand by and watch as our constitutional rights and liberties are endangered by oppressive agencies, which is why I have chosen to take part in this effort to bring forth a petition for a grand jury investigation. Equal protection under the Constitution is still the right of every American.â€

--Carla Dimmick| Post Date: 2022-03-11 13:48:43 | Last Update: 2022-03-11 12:01:02 |

You might need drugs for this.

Editor's note: This is the first of a multipart series on HB 5202, the budget bill for the 2022 Legislative Session.

To the average Oregonian, there just isn’t enough time to scour through a 100-page bill and decipher if your interests are being protected.

HB 5202 was the Emergency Board and budget reconciliation bill for the 2022 short session. The 100-page omnibus bill -- from the Joint Committee on Ways and Means, co-Chaired by Elizabeth Steiner Hayward -- makes changes to the 2021-23 legislatively adopted budget and implements 2022 budgetary decisions. The bill contains an 81 page summary of adjustments and rebalancing of agency budgets.

Overall,

HB 5202 includes additional spending of $1.4 billion General Funds, $82.1 million Lottery Funds, $2.1 billion Other Funds, and $2.2 billion Federal Funds for a total of $5.8 billion. The bill makes various appropriations, dis-appropriations, and expenditure limitations. It also appropriates General Funds to the Emergency Board for six new special purpose appropriations and adjusts 12 previously approved special purpose appropriations in the amount of $419,778,807.

The state seems to be flush with money, but citizens aren’t feeling it and inflation is having an additional impact. While the increase in salaries for legislators stalled out, the emergency special purpose appropriations for state employees released $198.8 million to cover the union negotiated increase of 6.95% for 2021-22 biennium.

How flush the state is evident by approximately 164 projects funded with one-time payments from General Funds. But maybe what is more concerning are the programs that received additional funding that will increase the annual budget at a higher level.

A D V E R T I S E M E N T

A D V E R T I S E M E N T

Voters should research the fiscal impact to the General Fund when passing a ballot measure. The Psilocybin Program was established by

Ballot Measure 109 in 2020. The program was funded by a one-time General Fund of $4.1 million plus 10 positions to fund the second year of costs. This increase is in addition to first year funding of $2.2 million General Fund and 14 positions. That is a biennium budget going forward of over $10 million. Program services take effect January 1, 2023, at which time it will start collecting Other Fund revenues from licensing fees and tax revenue from the sale of psilocybin products. Just as cannabis has grown into a massive agency, psilocybin is headed toward the same outcome.

Likewise,

Ballot Measure 110 passed by voters in 2020 deals with the use of illegal drugs that received funding for 77 additional positions for the behavioral health program appropriating an additional $130.2 million. Some additional funding comes from Other Funds, which only means the cost is collected from the public in less transparent ways outside of taxing. Removing criminal penalties for low-level drug possession has increased the need for a behavioral health program.

Remember the lottery incentives the Governor offered to get people to get vaccinated? Apparently, she didn’t follow through on funding payments. The bill uses $12.4 million in federal Coronavirus Relief Funds unspent by the Health Systems Division in 2019-21 to pay for one-time expenses related to the agency’s response to the COVID-19 pandemic. These expenses include $3 million for vaccine incentives and lottery payments, which were announced in summer 2021; $9 million for incentives; largely hiring and retention bonuses, for the behavioral health workforce; and $0.4 million for health equity grants. These funds were transferred to OHA and are budgeted as Other Funds.

There is a lot to dig through so watch for part 2.

--Donna Bleiler| Post Date: 2022-03-11 10:21:02 | Last Update: 2022-03-11 10:44:03 |

Read More Articles

“Democrats continue to double down on failed housing policies that drive up the cost of housing while trying to run away from

responsibility,†said Senate Republican Leader Tim Knopp (R-Bend). “In the middle of all this economic uncertainty, it's unclear why

the Secretary is attacking the one tax benefit that is available to working-class Oregonians.

“Democrats continue to double down on failed housing policies that drive up the cost of housing while trying to run away from

responsibility,†said Senate Republican Leader Tim Knopp (R-Bend). “In the middle of all this economic uncertainty, it's unclear why

the Secretary is attacking the one tax benefit that is available to working-class Oregonians.

The second $15 million was deposited into the Medium and Heavy-Duty Electrification Fund, established in HB 4139 passed in 2022, sponsored by Representative Dan Rayfield (D-Corvallis), as a new grant program supporting medium and heavy-duty zero-emission vehicle charging and fueling infrastructure projects. This one-time funding is intended to support grants to public or private entities for capital improvements and technical assistance to support the installation of charging infrastructure for zero-emission medium and heavy-duty vehicles. Projects will be awarded through a competitive request with priority given to projects located in communities disproportionately impacted by diesel pollution or are connected to proposed or existing transportation corridor projects, and projects that demonstrate available matching funds.

The second $15 million was deposited into the Medium and Heavy-Duty Electrification Fund, established in HB 4139 passed in 2022, sponsored by Representative Dan Rayfield (D-Corvallis), as a new grant program supporting medium and heavy-duty zero-emission vehicle charging and fueling infrastructure projects. This one-time funding is intended to support grants to public or private entities for capital improvements and technical assistance to support the installation of charging infrastructure for zero-emission medium and heavy-duty vehicles. Projects will be awarded through a competitive request with priority given to projects located in communities disproportionately impacted by diesel pollution or are connected to proposed or existing transportation corridor projects, and projects that demonstrate available matching funds.

The Oregon Department of Geology and Mineral Industries has released two new Tsunami evacuation modeling reports covering Astoria, Cannon Beach, Arch Cape, and Falcon Cove in coastal Clatsop County. The reports are part of the Beat the Wave series of publications and complete the evacuation modeling for Clatsop County. Beat the Wave reports provide information about tsunami wave arrival times, evacuation routes, and minimum evacuation speeds that pedestrians must use to reach safety in the event of a Cascadia Subduction Zone earthquake.

The Oregon Department of Geology and Mineral Industries has released two new Tsunami evacuation modeling reports covering Astoria, Cannon Beach, Arch Cape, and Falcon Cove in coastal Clatsop County. The reports are part of the Beat the Wave series of publications and complete the evacuation modeling for Clatsop County. Beat the Wave reports provide information about tsunami wave arrival times, evacuation routes, and minimum evacuation speeds that pedestrians must use to reach safety in the event of a Cascadia Subduction Zone earthquake.

Senator Linthicum said, “Plain and simple: the CDC acted illegally in March of 2020, which has led to these current ‘medical’ mandates stemming from the original lynchpin of corrupted data for COVID death certificates. Our health and the health of our children is our responsibility, not the government’s, yet the CDC, through pure data manipulation, has promulgated government overreach through incredulous policies in unimaginable ways through this wrongful slight-of-hand, creating a falsified reality that has no place in a free society.â€

Senator Linthicum said, “Plain and simple: the CDC acted illegally in March of 2020, which has led to these current ‘medical’ mandates stemming from the original lynchpin of corrupted data for COVID death certificates. Our health and the health of our children is our responsibility, not the government’s, yet the CDC, through pure data manipulation, has promulgated government overreach through incredulous policies in unimaginable ways through this wrongful slight-of-hand, creating a falsified reality that has no place in a free society.â€