On this day, August 22, 2002, President George W. Bush proposed to end the government's "hands-off" policy in national forests and ease logging restrictions in fire-prone areas.

Also on this day, August 22, 2014, the State of Oregon filed a $200 million suit against Oracle Corp. and several executives over the company's role in creating the troubled website for the state's online health insurance exchange.

Also on this day, August 22, 2020, demonstrators faced off in Portland with the two sides -- one aligned with a "Back the Blue" rally and the other a Black Lives Matter counter-demonstration -- reportedly largely ignoring police warnings. Ultimately, Department of Homeland Security officers deemed the gatherings unlawful and moved through the plaza, forcing the crowd to disperse.

Post an Event

Post an Event

| Benton County Republicans’ Private Fundraising Event, “Bent-on Boots and Bling” with Trey Taylor |

| Friday, September 5, 2025 at 5:00 pm |

| Featuring Trey Taylor

Music Private Event

Friday, September 5, 2025 5:00-5:30 pm VIP Reception

5:30-8:00 pm Heavy Appetizers,

Auction, Concert

Red: $750 VIP Reception

Front Row Table Sponsor

White: $500 Table Sponsor

Blue: $50 per person

Limited Seating. Get Yours Now!!!

Support Local

Dress up: Bling, Cowboy, Patriotic Benton County Republican

FUNDRAISER

www.BentonGOP.org

Get your tickets today at:

https://www.bentongop.org/event-details/benton-county-republicans-fundraiser/form

About Trey:

Trey is the youngest African American Man in Country Music History. The Denver Post wrote

"It's impossible to miss his enthusiasm. With a fondness for cowboy boots, gaudy colors and dazzling jewelry, Trey Taylor could stand toe to toe with any of the Pop, Country or even Rap

contemporaries of his generation.“ |

| Trysting Tree Golf Club, 34028 NE Electric Rd., Corvallis |

Rep. Courtney Neron voted for the regressive tax

State Rep. Courtney Neron voted for a cell phone tax, which passed during the first Special Session at a time when Oregon’s people and economy might not appreciate the financial investment on behalf of the government, when they are themselves are soon required to make massive and historic budget cuts due to the recent shutdown of the economy. The tax will be applied to monthly service bills.

The proceeds of the tax are dedicated to building rural broadband infrastructure. Nonetheless, many Republican legislators from rural districts voted no, as they could not see the benefits outweighing the drawback of another tax.

Senate Republicans voted against

SB 1603, describing it as a cell phone tax disguised as a rural assistance bill. “The legislative process has not only been taken away from Oregonians, but now they must absorb a new tax when they are living in an economic shutdown,†said Senate Republican Leader Fred Girod (R-Stayton). “Democrats are spending money the state doesn’t have. This is a tax, and I think Oregon deserves better.†The Emergency Board recently allocated $20 million to broad band. “You know something is wrong with a bill when senators like me that represent rural Oregonians voted no,†said Senator Lynn Findley (R-Vale). “My constituents cannot afford another tax on their livelihoods, especially when the Emergency Board just allocated $20 million in funds to broadband without any plan on what projects the money will go to.â€

Critics have also noted that many Oregonians -- including many rural Oregonians -- use their cell phone as an internet connection and has the effect of taxing an existing internet connection in order to create another one. The irony of urban Democrats voting to tax their urban constituents to create a benefit for rural areas is also apparent. The tax is also seen by experts as regressive, placing a heavier burden on lower-income people who have to use a greater proportion of their income to pay the tax.

Governor Brown signed the bill into law on July 7.

--Ben Fisher| Post Date: 2020-07-10 19:10:16 | Last Update: 2020-08-03 20:12:22 |

Rep. Meek voted for the regressive tax

State Rep. Mark Meek voted for a cell phone tax, which passed during the first Special Session at a time when Oregon’s people and economy might not appreciate the financial investment on behalf of the government, when they are themselves are soon required to make massive and historic budget cuts due to the recent shutdown of the economy. The tax will be applied to monthly service bills.

The proceeds of the tax are dedicated to building rural broadband infrastructure. Nonetheless, many Republican legislators from rural districts voted no, as they could not see the benefits outweighing the drawback of another tax.

Senate Republicans voted against

SB 1603, describing it as a cell phone tax disguised as a rural assistance bill. “The legislative process has not only been taken away from Oregonians, but now they must absorb a new tax when they are living in an economic shutdown,†said Senate Republican Leader Fred Girod (R-Stayton). “Democrats are spending money the state doesn’t have. This is a tax, and I think Oregon deserves better.†The Emergency Board recently allocated $20 million to broad band. “You know something is wrong with a bill when senators like me that represent rural Oregonians voted no,†said Senator Lynn Findley (R-Vale). “My constituents cannot afford another tax on their livelihoods, especially when the Emergency Board just allocated $20 million in funds to broadband without any plan on what projects the money will go to.â€

Critics have also noted that many Oregonians -- including many rural Oregonians -- use their cell phone as an internet connection and has the effect of taxing an existing internet connection in order to create another one. The irony of urban Democrats voting to tax their urban constituents to create a benefit for rural areas is also apparent. The tax is seen by experts as regressive, placing a heavier burden on lower-income people who have to use a greater proportion of their income to pay the tax.

Governor Brown signed the bill into law on July 7.

--Staff Reports| Post Date: 2020-07-10 19:10:16 | |

Rep. Bynum voted for the regressive tax

State Rep. Janelle Bynum voted for a cell phone tax, which passed during the first Special Session at a time when Oregon’s people and economy might not appreciate the financial investment on behalf of the government, when they are themselves are soon required to make massive and historic budget cuts due to the recent shutdown of the economy. The tax will be applied to monthly service bills.

The proceeds of the tax are dedicated to building rural broadband infrastructure. Nonetheless, many Republican legislators from rural districts voted no, as they could not see the benefits outweighing the drawback of another tax.

Senate Republicans voted against

SB 1603, describing it as a cell phone tax disguised as a rural assistance bill. “The legislative process has not only been taken away from Oregonians, but now they must absorb a new tax when they are living in an economic shutdown,†said Senate Republican Leader Fred Girod (R-Stayton). “Democrats are spending money the state doesn’t have. This is a tax, and I think Oregon deserves better.†The Emergency Board recently allocated $20 million to broad band. “You know something is wrong with a bill when senators like me that represent rural Oregonians voted no,†said Senator Lynn Findley (R-Vale). “My constituents cannot afford another tax on their livelihoods, especially when the Emergency Board just allocated $20 million in funds to broadband without any plan on what projects the money will go to.â€

Critics have also noted that many Oregonians -- including many rural Oregonians -- use their cell phone as an internet connection and has the effect of taxing an existing internet connection in order to create another one. The irony of urban Democrats voting to tax their urban constituents to create a benefit for rural areas is also apparent. The tax is seen by experts as regressive, placing a heavier burden on lower-income people who have to use a greater proportion of their income to pay the tax.

Governor Brown signed the bill into law on July 7.

--Ben Fisher| Post Date: 2020-07-10 19:10:16 | |

Rep. Prusak voted for the regressive tax

State Rep. Rachel Prusak voted for a cell phone tax, which passed during the first Special Session at a time when Oregon’s people and economy might not appreciate the financial investment on behalf of the government, when they are themselves are soon required to make massive and historic budget cuts due to the recent shutdown of the economy. The tax will be applied to monthly service bills.

The proceeds of the tax are dedicated to building rural broadband infrastructure. Nonetheless, many Republican legislators from rural districts voted no, as they could not see the benefits outweighing the drawback of another tax.

Senate Republicans voted against

SB 1603, describing it as a cell phone tax disguised as a rural assistance bill. “The legislative process has not only been taken away from Oregonians, but now they must absorb a new tax when they are living in an economic shutdown,†said Senate Republican Leader Fred Girod (R-Stayton). “Democrats are spending money the state doesn’t have. This is a tax, and I think Oregon deserves better.†The Emergency Board recently allocated $20 million to broad band. “You know something is wrong with a bill when senators like me that represent rural Oregonians voted no,†said Senator Lynn Findley (R-Vale). “My constituents cannot afford another tax on their livelihoods, especially when the Emergency Board just allocated $20 million in funds to broadband without any plan on what projects the money will go to.â€

Critics have also noted that many Oregonians -- including many rural Oregonians -- use their cell phone as an internet connection and has the effect of taxing an existing internet connection in order to create another one. The irony of urban Democrats voting to tax their urban constituents to create a benefit for rural areas is also apparent. The tax is seen by experts as regressive, placing a heavier burden on lower-income people who have to use a greater proportion of their income to pay the tax.

Governor Brown signed the bill into law on July 7.

--Staff Reports| Post Date: 2020-07-10 19:10:16 | |

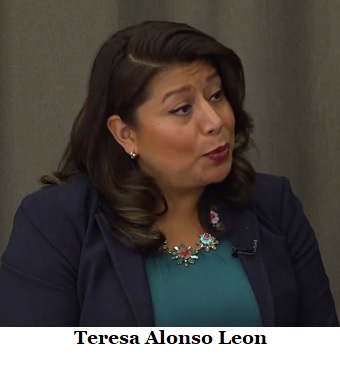

Rep. Alonso Leon voted for the regressive tax

State Rep. Teresa Alonso Leon (D-Woodburn) voted for a cell phone tax, which passed during the first Special Session at a time when Oregon’s people and economy might not appreciate the financial investment on behalf of the government, when they are themselves are soon required to make massive and historic budget cuts due to the recent shutdown of the economy. The tax will be applied to monthly service bills.

The proceeds of the tax are dedicated to building rural broadband infrastructure. Nonetheless, many Republican legislators from rural districts voted no, as they could not see the benefits outweighing the drawback of another tax.

Senate Republicans voted against

SB 1603, describing it as a cell phone tax disguised as a rural assistance bill. “The legislative process has not only been taken away from Oregonians, but now they must absorb a new tax when they are living in an economic shutdown,†said Senate Republican Leader Fred Girod (R-Stayton). “Democrats are spending money the state doesn’t have. This is a tax, and I think Oregon deserves better.†The Emergency Board recently allocated $20 million to broad band. “You know something is wrong with a bill when senators like me that represent rural Oregonians voted no,†said Senator Lynn Findley (R-Vale). “My constituents cannot afford another tax on their livelihoods, especially when the Emergency Board just allocated $20 million in funds to broadband without any plan on what projects the money will go to.â€

Critics have also noted that many Oregonians -- including many rural Oregonians -- use their cell phone as an internet connection and has the effect of taxing an existing internet connection in order to create another one. The tax is seen by experts as regressive, placing a heavier burden on lower-income people who have to use a greater proportion of their income to pay the tax.

Governor Brown signed the bill into law on July 7.

--Ben Fisher| Post Date: 2020-07-10 19:10:16 | Last Update: 2020-08-03 20:13:15 |

Rep. Marty Wilde voted for the regressive tax

State Rep. Marty Wilde voted for a cell phone tax, which passed during the first Special Session at a time when Oregon’s people and economy might not appreciate the financial investment on behalf of the government, when they are themselves are soon required to make massive and historic budget cuts due to the recent shutdown of the economy. The tax will be applied to monthly service bills.

The proceeds of the tax are dedicated to building rural broadband infrastructure. Nonetheless, many Republican legislators from rural districts voted no, as they could not see the benefits outweighing the drawback of another tax.

Senate Republicans voted against

SB 1603, describing it as a cell phone tax disguised as a rural assistance bill. “The legislative process has not only been taken away from Oregonians, but now they must absorb a new tax when they are living in an economic shutdown,†said Senate Republican Leader Fred Girod (R-Stayton). “Democrats are spending money the state doesn’t have. This is a tax, and I think Oregon deserves better.†The Emergency Board recently allocated $20 million to broad band. “You know something is wrong with a bill when senators like me that represent rural Oregonians voted no,†said Senator Lynn Findley (R-Vale). “My constituents cannot afford another tax on their livelihoods, especially when the Emergency Board just allocated $20 million in funds to broadband without any plan on what projects the money will go to.â€

Critics have also noted that many Oregonians -- including many rural Oregonians -- use their cell phone as an internet connection and has the effect of taxing an existing internet connection in order to create another one. The irony of urban Democrats voting to tax their urban constituents to create a benefit for rural areas is also apparent. The tax is seen by experts as regressive, placing a heavier burden on lower-income people who have to use a greater proportion of their income to pay the tax.

Governor Brown signed the bill into law on July 7.

--Ben Fisher| Post Date: 2020-07-10 19:10:16 | Last Update: 2020-08-03 21:58:15 |

Rep. David Gomberg voted for the regressive tax

State Rep. David Gomberg (D-Otis) voted for a cell phone tax, which passed during the first Special Session at a time when Oregon’s people and economy might not appreciate the financial investment on behalf of the government, when they are themselves are soon required to make massive and historic budget cuts due to the recent shutdown of the economy. The tax will be applied to monthly service bills.

The proceeds of the tax are dedicated to building rural broadband infrastructure. Nonetheless, many Republican legislators from rural districts voted no, as they could not see the benefits outweighing the drawback of another tax.

Senate Republicans voted against

SB 1603, describing it as a cell phone tax disguised as a rural assistance bill. “The legislative process has not only been taken away from Oregonians, but now they must absorb a new tax when they are living in an economic shutdown,†said Senate Republican Leader Fred Girod (R-Stayton). “Democrats are spending money the state doesn’t have. This is a tax, and I think Oregon deserves better.†The Emergency Board recently allocated $20 million to broad band. “You know something is wrong with a bill when senators like me that represent rural Oregonians voted no,†said Senator Lynn Findley (R-Vale). “My constituents cannot afford another tax on their livelihoods, especially when the Emergency Board just allocated $20 million in funds to broadband without any plan on what projects the money will go to.â€

Critics have also noted that many Oregonians -- including many rural Oregonians -- use their cell phone as an internet connection and has the effect of taxing an existing internet connection in order to create another one. The tax is seen by experts as regressive, placing a heavier burden on lower-income people who have to use a greater proportion of their income to pay the tax.

Governor Brown signed the bill into law on July 7.

--Ben Fisher| Post Date: 2020-07-10 19:10:16 | Last Update: 2020-08-03 20:14:54 |

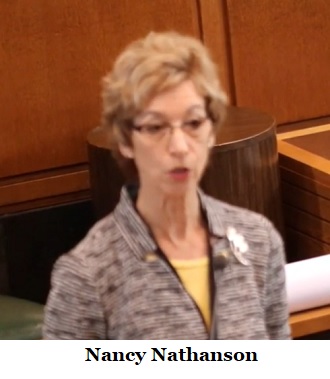

Rep. Nathanson voted for the regressive tax

State Rep. Nancy Nathanson voted for a cell phone tax, which passed during the first Special Session at a time when Oregon’s people and economy might not appreciate the financial investment on behalf of the government, when they are themselves are soon required to make massive and historic budget cuts due to the recent shutdown of the economy. The tax will be applied to monthly service bills.

The proceeds of the tax are dedicated to building rural broadband infrastructure. Nonetheless, many Republican legislators from rural districts voted no, as they could not see the benefits outweighing the drawback of another tax.

Senate Republicans voted against

SB 1603, describing it as a cell phone tax disguised as a rural assistance bill. “The legislative process has not only been taken away from Oregonians, but now they must absorb a new tax when they are living in an economic shutdown,†said Senate Republican Leader Fred Girod (R-Stayton). “Democrats are spending money the state doesn’t have. This is a tax, and I think Oregon deserves better.†The Emergency Board recently allocated $20 million to broad band. “You know something is wrong with a bill when senators like me that represent rural Oregonians voted no,†said Senator Lynn Findley (R-Vale). “My constituents cannot afford another tax on their livelihoods, especially when the Emergency Board just allocated $20 million in funds to broadband without any plan on what projects the money will go to.â€

Critics have also noted that many Oregonians -- including many rural Oregonians -- use their cell phone as an internet connection and has the effect of taxing an existing internet connection in order to create another one. The irony of urban Democrats voting to tax their urban constituents to create a benefit for rural areas is also apparent. The tax is seen by experts as regressive, placing a heavier burden on lower-income people who have to use a greater proportion of their income to pay the tax.

Governor Brown signed the bill into law on July 7.

--Ben Fisher| Post Date: 2020-07-10 19:10:16 | |

Rep. Gorsek voted for the regressive tax

State Rep. Chris Gorsek voted for a cell phone tax, which passed during the first Special Session at a time when Oregon’s people and economy might not appreciate the financial investment on behalf of the government, when they are themselves are soon required to make massive and historic budget cuts due to the recent shutdown of the economy. The tax will be applied to monthly service bills.

The proceeds of the tax are dedicated to building rural broadband infrastructure. Nonetheless, many Republican legislators from rural districts voted no, as they could not see the benefits outweighing the drawback of another tax.

Senate Republicans voted against

SB 1603, describing it as a cell phone tax disguised as a rural assistance bill. “The legislative process has not only been taken away from Oregonians, but now they must absorb a new tax when they are living in an economic shutdown,†said Senate Republican Leader Fred Girod (R-Stayton). “Democrats are spending money the state doesn’t have. This is a tax, and I think Oregon deserves better.†The Emergency Board recently allocated $20 million to broad band. “You know something is wrong with a bill when senators like me that represent rural Oregonians voted no,†said Senator Lynn Findley (R-Vale). “My constituents cannot afford another tax on their livelihoods, especially when the Emergency Board just allocated $20 million in funds to broadband without any plan on what projects the money will go to.â€

Critics have also noted that many Oregonians -- including many rural Oregonians -- use their cell phone as an internet connection and has the effect of taxing an existing internet connection in order to create another one. The tax is seen by experts as regressive, placing a heavier burden on lower-income people who have to use a greater proportion of their income to pay the tax.

Governor Brown signed the bill into law on July 7.

--Ben Fisher| Post Date: 2020-07-10 19:10:16 | |

Rep. Evans voted for the regressive tax

State Rep. Paul Evans voted for a cell phone tax, which passed during the first Special Session at a time when Oregon’s people and economy might not appreciate the financial investment on behalf of the government, when they are themselves are soon required to make massive and historic budget cuts due to the recent shutdown of the economy. The tax will be applied to monthly service bills.

The proceeds of the tax are dedicated to building rural broadband infrastructure. Nonetheless, many Republican legislators from rural districts voted no, as they could not see the benefits outweighing the drawback of another tax.

Senate Republicans voted against

SB 1603, describing it as a cell phone tax disguised as a rural assistance bill. “The legislative process has not only been taken away from Oregonians, but now they must absorb a new tax when they are living in an economic shutdown,†said Senate Republican Leader Fred Girod (R-Stayton). “Democrats are spending money the state doesn’t have. This is a tax, and I think Oregon deserves better.†The Emergency Board recently allocated $20 million to broad band. “You know something is wrong with a bill when senators like me that represent rural Oregonians voted no,†said Senator Lynn Findley (R-Vale). “My constituents cannot afford another tax on their livelihoods, especially when the Emergency Board just allocated $20 million in funds to broadband without any plan on what projects the money will go to.â€

Critics have also noted that many Oregonians -- including many rural Oregonians -- use their cell phone as an internet connection and has the effect of taxing an existing internet connection in order to create another one. The irony of urban Democrats voting to tax their urban constituents to create a benefit for rural areas is also apparent. The tax is seen by experts as regressive, placing a heavier burden on lower-income people who have to use a greater proportion of their income to pay the tax.

Governor Brown signed the bill into law on July 7.

--Ben Fisher| Post Date: 2020-07-10 19:10:16 | |

Rep. Brad Witt voted for the regressive tax

State Rep. Brad Witt (D-Clatskanie) voted for a cell phone tax, which passed during the first Special Session at a time when Oregon’s people and economy might not appreciate the financial investment on behalf of the government, when they are themselves are soon required to make massive and historic budget cuts due to the recent shutdown of the economy. The tax will be applied to monthly service bills.

The proceeds of the tax are dedicated to building rural broadband infrastructure. Nonetheless, many Republican legislators from rural districts voted no, as they could not see the benefits outweighing the drawback of another tax.

Senate Republicans voted against

SB 1603, describing it as a cell phone tax disguised as a rural assistance bill. “The legislative process has not only been taken away from Oregonians, but now they must absorb a new tax when they are living in an economic shutdown,†said Senate Republican Leader Fred Girod (R-Stayton). “Democrats are spending money the state doesn’t have. This is a tax, and I think Oregon deserves better.†The Emergency Board recently allocated $20 million to broad band. “You know something is wrong with a bill when senators like me that represent rural Oregonians voted no,†said Senator Lynn Findley (R-Vale). “My constituents cannot afford another tax on their livelihoods, especially when the Emergency Board just allocated $20 million in funds to broadband without any plan on what projects the money will go to.â€

Critics have also noted that many Oregonians -- including many rural Oregonians -- use their cell phone as an internet connection and has the effect of taxing an existing internet connection in order to create another one. The tax is seen by experts as regressive, placing a heavier burden on lower-income people who have to use a greater proportion of their income to pay the tax.

Governor Brown signed the bill into law on July 7.

--Ben Fisher| Post Date: 2020-07-10 19:10:16 | Last Update: 2020-08-03 20:13:40 |

Spoiler alert: They are as political as they come

In an ironic gaffe, new documents filed by Our Oregon in U.S. District Court assert the union-backed nonprofit seeks to protect Oregon election laws by breaking them.

The evidence comes by way of Our Oregon’s July 9 motion to intervene in an ongoing lawsuit against the Oregon Secretary of State,

People Not Politicians v. Clarno, which challenges the secretary’s signature-gathering requirements for ballot initiatives during COVID-19.

Our Oregon opposes the plaintiffs’ position that their petition should be granted additional time and a lower threshold of signatures due to the conditions brought on by the pandemic. The organization claims it is a “watchdog†of the process.

In the

motion, Our Oregon claims it “is opposed to (the petition)

and would be involved in organizing a campaign against it if it were to qualify for the Nov, 3, 2020 ballot.†(emphasis added).

Even worse, an accompanying

sworn declaration submitted by Our Oregon executive director Becca Uherbelau states that, “(A)llowing the Chief Petitioners to submit after the constitutional deadline (and at a lower threshold) would make it exponentially more difficult for Our Oregon, or anyone else, to organize an opposition campaign to IP 57.

It takes months to build and fund a coalition in opposition to a ballot measure.†(emphasis added).

What Our Oregon neglected to mention is that it’s not allowed to work on ballot measure campaigns without registering as a PAC — i.e, after a petition qualifies for the ballot — and it’s currently

under investigation by the Oregon Secretary of State and Attorney General for doing exactly that.

Freedom Foundation has

filed the new evidence with the Secretary of State to aid in her ongoing investigation.

“We have accused Our Oregon of a lot of things, and rightfully so,†said Freedom Foundation Oregon Director Jason Dudash. “But we’ve never accused them of being the sharpest tools in the shed. They’ve essentially admitted to what we’ve accused them of in documents before a federal court.â€

“It’s an ironic twist that they’re posing as defending the Secretary of State at the same time that the Secretary is investigating them for their serial election law violationsâ€.

--Staff Reports| Post Date: 2020-07-10 10:54:26 | Last Update: 2020-07-10 10:55:50 |

Read More Articles